It’s not necessary to take big risks to build big wealth. In fact, buying stable companies that consistently pay dividends has proven to be the most reliable way to riches.

It takes patience. It takes discipline. And it can be very boring. But if you focus on companies that prioritize steady dividend payments, your retirement dreams can come sooner than you think.

Well, telecom giant Telus (TSX:T)(NYSE:TU) is one of those companies. It just declared another dividend and currently yields a scrumptious 4.5%.

Let’s take a look.

Steady dividends

Here are the dividend details: last week, Telus declared a quarterly dividend of $0.525 per share. It will be paid on October 1 to shareholders of record on September 10.

In my opinion, it’s worth picking up — particularly if you’re an income-oriented investor.

First, Telus’s business is doing well. In Q2, revenue increased 5.3% to $3.5 billion. New customer additions grew 29% to 135,000. Furthermore, Telus’s total wireless subscriber base increased 3.5% to nine million. Management even said that it saw its “best combined retention levels on record.”

So, in the ongoing cutthroat wireless battle with the likes of BCE and Rogers, Telus is holding its own.

But here’s the best part for dividend investors: the company’s free cash flow spiked 27% to $329 million. That’s completely in line with the trend we’ve been seeing. In fact, Telus’s free cash flow is up an incredibly strong 62% year to date.

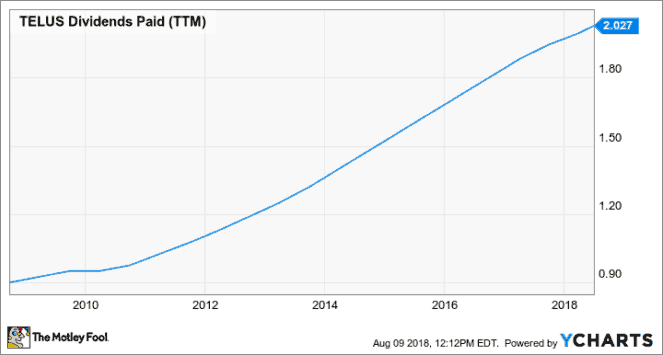

That’s no coincidence, Fools. Management has been laser-focused on free cash flow for the specific goal of rewarding shareholders with fat dividends — more specifically, fat and growing dividends.

“[W]e’re continuing to build on our track record of providing investors with the industry’s best multiyear dividend growth program, targeting annual dividend growth between 7% and 10% through the end of 2019,” said CEO Darren Entwistle. “Importantly, the ongoing consistency in our results enables us to achieve this dividend growth objective while simultaneously making significant growth-oriented investments on the capital front to ensure sustainable growth at the profit level for years to come.”

Given Telus’s current free cash flow generation and long track record of shareholder-friendly payments, I’d bet on that dividend growth to continue.

Moreover, with management’s long-term dividend-payout ratio in the 65-75% range, it’s a rather comforting bet, too.

The Foolish bottom line

There you have it, Fools: Telus is a conservative play that looks perfect for retirees.

The dividend is fat. It’s growing. It’s backed by strengthening free cash flow. And currently, it yields a juicy 4.5%. When you consider how ho-hum Mr. Market has been on the stock since its Q2 release last week, now might be even be the perfect time to pounce.

It’s not without risks (no company is). But as far as income plays go, Telus makes a tonne of sense.

Fool on.