Small-cap companies with high growth usually come with high risks. But on the other hand, large-cap blue-chips tend to be slow and stodgy without a lot of upside.

In other words, you get what you pay for.

However, mid-cap companies — market caps of $2 billion-$10 billion — can often offer a sweet “best-of-both worlds” combo: high growth plays that also have a lower risk profile.

A good example is Ritchie Bros. Auctioneers Inc. (TSX:RBA)(NYSE:RBA). The auctioneer delivers double-digit growth, a sound dividend, and big upside to boot. In fact, the stock soared 8.1% on Friday after its Q2 results.

Is it worth bidding up? Let’s find out.

Going, going, gone?

Here are some of the Q2 details: diluted EPS flew 27% to $0.42 as revenue increased 22% to $308.5 million. Meanwhile, gross transaction value (GTV) — a key metric in the auction business — rose 14% to $1.4 billion.

To be sure, revenue was up partially due to its purchase of equipment company IronPlanet last year, but it was mainly driven by improvement in both live and online auction performance. Moreover, Ritchie saw higher-value equipment in both segments.

So, growth at Ritchie is good. But here’s why even conservative investors should take a look: Ritchie’s operating cash flow was also strong, clocking in at $107.9 million.

With that cash, Ritchie paid down $27.3 million of long-term debt during the quarter — $56.6 million has been paid down over the first six months of 2018. And it also upped its quarterly cash dividend 6% to $0.18 per share.

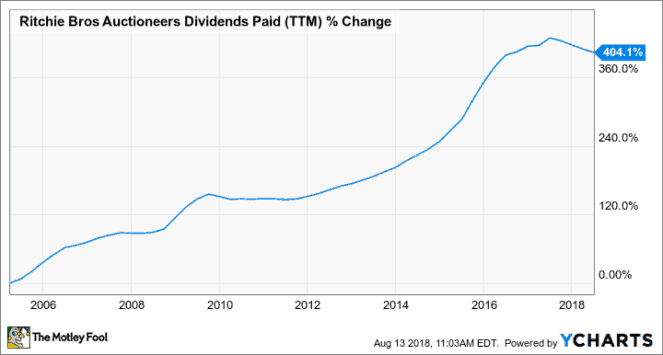

Now, Ritchie’s dividend growth isn’t always the smoothest, which shouldn’t concern long-term investors. Over the past two decades, Ritchie’s payments have increased at a very impressive rate:

“We were pleased with our earnings growth and our strong operating cash flows in the quarter,” said CEO Ravi Saligram. “As we enter the second half, we are encouraged to see our sales teams gaining traction on leveraging our multi-channel solutions and offering the appropriate channel that best meets individual customer needs.”

Given the company’s top-line trajectory, stable cash flows, and firming balance sheet, it’s easy to share in Saligram’s (and Mr. Market’s) enthusiasm. Costs remain an issue — they jumped 19%. But since the increase is tied mainly to the IronPlanet purchase, I wouldn’t be too concerned — yet.

The Foolish bottom line

There you have it, Fools: Ritchie Bros. is a mid-cap company that makes sense for the average investor.

It delivers double-digit revenue growth, all while boasting a stock that yields 2% and a beta of only 0.6 (it’s about 40% less volatile than the overall market).

Of course, after Friday’s big pop, Ritchie now has a forward P/E of 30. So while nibbling is fine, I’d wait for some of the enthusiasm to die down before taking a bigger bite.