The marijuana market battles for the control of the biggest market share in the Canadian adult use market are still raging on, with the country’s most populous province, Ontario, yet to announce any cannabis supply agreements with the warring licensed producers (LPs), but winners and losers are already emerging before the war is over, with seven provinces and one territory having announced supply agreements with selected LPs so far.

In its recent quarterly financial results earnings release on August 14, Canopy Growth (TSX:WEED)(NYSE:CGC) co-CEO Bruce Linton is quoted saying, “with an estimated 36% of the total supply committed to date to the provinces and territories, we have secured by far the deepest channel into the Canadian recreational cannabis market,” and it seems like the largest marijuana producer is in a clear lead.

But how big is the lead?

Canopy has clinched a deal with every province and territory that has announced contracts so far, yet its competitors have been awarded sporadic contracts, but the deal numbers could be very interesting.

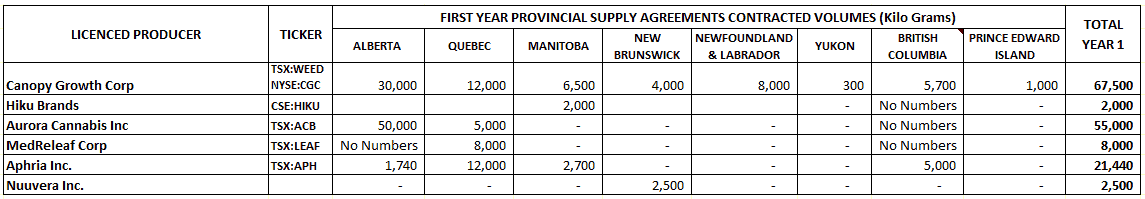

The following table highlights the deal volumes for selected LPs of interest.

As can be seen from the table above, Canopy has clinched up to 67,500 kilograms in provincial supply deals for the first year of recreational sales beginning October 17, and Aurora Cannabis (TSX:ACB), the closest rival, is sitting at 55,000 kilograms in reported volumes.

That said, the fact that Aurora did not release information on the British Columbia agreement makes our comparisons very tricky. However, with the available numbers, if we add the rising contender’s latest acquisition’s (MedReleaf) numbers to Aurora’s tally, its volumes will creep up 63,000 kilograms, well within Canopy’s range.

Worse still, MedReleaf did not disclose deal volumes in two provinces, namely the Alberta and British Columbia supply agreements, bringing further complication to comparisons efforts. Further, Canopy’s latest acquisition, Hiku Brands, did not release figures in its supply agreement with British Columbia. However, Hiku Brands’s revealed volume of 2,000 kilograms in the Manitoba supply deal increases Canopy’s tally to 69,500 kilograms — an impressive total indeed.

Could MedReleaf volumes cover Aurora’s lag?

It’s possible that MedReleaf’s unannounced volumes in two contracts could cover up the 6,500-kilogram gap between the two leading cannabis giants, especially considering that British Columbia tried to share the supply volumes between the 31 winning LPs and could easily lift Aurora figures by anything near or above 3,000 kilograms (in my opinion).

Therefore, it’s a bit of a challenge to tell how big Canopy’s lead can be in announced provincial deals so far.

Could Canopy widen the gap?

The most populous province, Ontario, is yet to announce supply agreements with any LP, but odds are highly in favour of Canopy. Canopy is based in Ontario and has a planned 1,870,000 square feet in productive capacity on five facilities in Ontario, thus making it a favourite to win a sizable supply contract.

Careful, though; MedReleaf is also based in Ontario, and Aurora is in line to get a significant deal there.

Foolish bottom line

A special mention is made of Hydropothecary, which won a five-year supply deal for 204,000 kilograms in Quebec, making the deal the largest so far in the market.

Although Canopy and Aurora are separated by a small margin in supply agreement volumes, the former has deals spread across all provinces so far, while Aurora only has supply agreements with three provinces.

Thanks to latest acquisition of MedReleaf, Aurora will add three more contracts to its portfolio, but Canopy’s portfolio is more widely distributed than that of its closest competitor and thus is of higher quality and of lower risk.

Investors should be careful, though; Aurora’s press release of about the Quebec deal stated that “supply quantities will be determined based on demand on a month-by-month basis, with a minimum of 5,000 for the first year, but no set maximum.”

Making an equity valuation thesis based on supply agreements could be a tricky endeavour right now.