For non-conservative folks, REIT investing is incredibly dull!

As a passive landlord, you have the opportunity to collect rent payments at the massive scale without the indigestion of dealing with tenants. As incredibly profitable as this may be for an income investor, there’s not much in the way of growth, and that’s because of how they’re structured. REITs are subject to the 90% rule, whereby trusts are required to distribute 90% of taxable earnings to its shareholders.

As you’d imagine, returning 90% of your profits in the form of a distribution isn’t great news for growth. Money that’s going back into the pockets of shareholders isn’t being reinvested to grow a trust’s FFO (funds from operations), and that’s why many young, aggressive investors may have taken a rain check when it comes to the REITs.

While you’d think that all REITs are built the same because the hefty distribution payout requirements, you’d be wrong. Some REITs are way hotter than others and can offer income investors a high distribution yield to go with an above-average magnitude of capital gains.

In the end, it’s all about supply and demand. And right now, Canadian e-commerce is taking off like a bat out of heck! As a result, the demand for warehouse/industrial real estate properties is picking up traction, and with no signs of slowing down, I think income investors would be wise to initiate a position in an industrial REIT today.

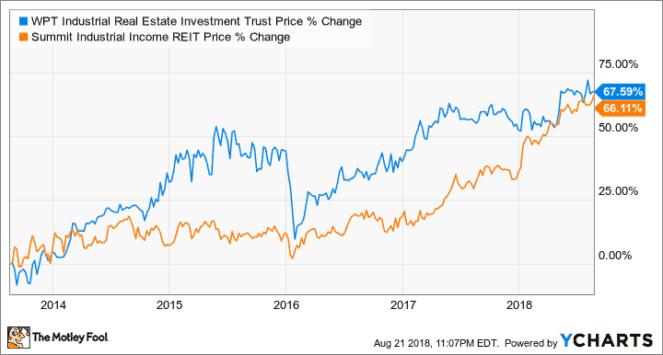

Consider adding names like Summit Industrial Income REIT (TSX:SMU.UN) or WPT Industrial Real Estate Investment (TSX:WIR.U), before a larger firm scoops them up such that they’re no longer available for Canadian investors to own, as in the case of Pure Industrial Real Estate Trust.

Summit and WPT have bountiful distribution yields of 5.75% and 5.5%, respectively, and both securities have been on an absolute tear, surging well over 65% over the last five years.

Summit has been busy on the acquisition front over the last few years, and looking ahead, the company is likely to continue to scoop up additional industrial properties to double down on the North American logistics boom that’s ripe to accelerate as retailers bolster their direct-to-consumer (DTC) e-commerce platforms.

If you’re looking for promising exposure to the U.S. industrial space, WPT may be the stock you’re looking for, as it’s got a robust portfolio of over 52 industrial properties across 15 U.S. states.

Foolish takeaway

You don’t need to be an aggressive growth investor to be able to profit off the e-commerce boom. Both Summit and WPT are stable REITs that provide income investors with a generous, steady distribution to go with ample capital gains, as the demand for industrial properties continues to spike.

I’d recommend buying both REITs, but if I had to choose one, I’d go with Summit because of its Canadian exposure. While the U.S. outlook for industrial properties is still impressive, I think the Canadian market looks positioned for explosive growth as Canada’s e-commerce scene isn’t quite as mature as it is for our neighbours to the south. This leads me to believe that the demand for logistics space will increase at a much quicker rate over the next few years as Canada looks to play catch up.

Stay hungry. Stay Foolish.