Algonquin Power & Utilities (TSX:AQN)(NYSE:AQN) and Fortis (TSX:FTS)(NYSE:FTS) are two of my favourite retiree-friendly stocks that simply don’t get the respect they rightfully deserve from the general public.

Algonquin and Fortis offer compelling upfront yields of 5% and 4%, respectively. While these yields may seem standard and unremarkable for a retiree, they don’t tell the whole story. Based off these numbers, you wouldn’t know just how much of a positive impact they’ll have for your income stream over the course of many years.

While buying a no-growth REIT may seem like your best course of action when entering retirement. Retirees ought to consider the fact that REITs have their hands tied when it comes to growth. REITs are required to pay out 90% of their taxable income, so every dollar that goes in your pocket today isn’t going towards providing you with a consistent series of stable raises over time. A dollar today is worth heck of a lot more in +10 years from now in the hands of a competent management team that knows how to create value for shareholders.

In the case of Algonquin and Fortis, you’re not only getting downside protection, but you’re also getting nearly guaranteed raises on a consistent basis, even if a couple of recessions were to be thrown into the mix.

Both firms are highly regulated cash cows, leaving very little room for error, meaning investors can sleep comfortably at night knowing that their generous, growing income stream will be there for them in spite of rising economic uncertainties or geopolitical issues.

Moreover, Fortis has made a promise to deliver a 5% raise over the next few years, and given its sexy growth profile that would put the average low-growth utility to shame; I find it very likely that the dividend aristocrat’s streak of dividend raises will continue moving forward until the world ends.

While Algonquin has seemed more aggressive when it comes to returning cash into the pockets of its shareholders, it’s also important to remember that the possibility of contingent cash outflows is so ridiculously low given the predictable nature of its business. Consequently, management can afford to “spoil” its shareholders with generous dividend payments without having to worry about scraping it back down the road. Like Fortis, Algonquin’s rock-solid cash flow stream is so predictable such that unforeseen liquidity issues are pretty much out of the question.

Speaking of liquid, Algonquin is one of the few ways that Canadian investors can expose themselves to the mouth-watering business of water utilities, which are the epitome of stability. I challenge you to find a business that’s more stable and more robust than a water utility!

Foolish takeaway

Look beyond the upfront yields and consider dividend growth when constructing your post-retirement income stream.

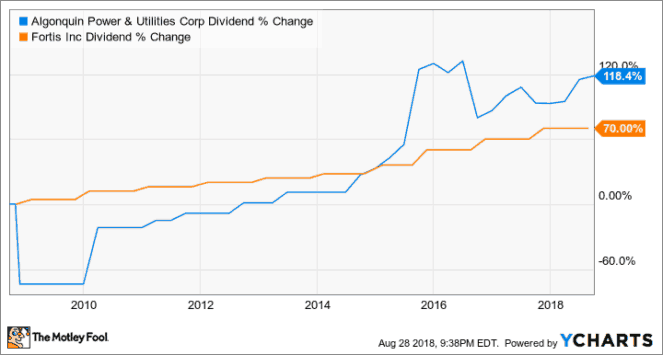

Fortis and Algonquin have grown their dividends by 70% and 118.4%, respectively, over the past decade. Picture yourself getting a 7-12% raise every year in retirement. You’d be hard-pressed to obtain raises that generous or consistent, even if you were still in the workforce!

As such, just because you’re in retirement doesn’t mean you need to watch your nest egg wither away as it provides you with the income stream you rightfully deserve. Just weigh your options, select the finest of stocks, and please don’t just chase upfront yield with a neglect for the longer-term picture!

Stay hungry. Stay Foolish.