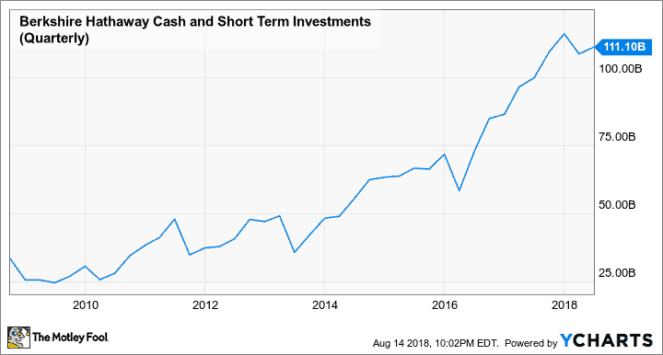

If you’re a disciple of Warren Buffett, then you’ve probably been paying close attention to the moves he and his firm Berkshire Hathaway have been making. Apart from taking a big bite out of Apple stock, Buffett’s most remarkable action of late has been doing nothing at all with a majority of his firm’s cash pile, which continues to swell in size.

Buffett is a contrarian value investor, and although his strategy has changed over the decades — most notable is his changed stance on airline and tech stocks — his original approach to stock selection is still very much intact.

He’s an incredibly patient investor, and if he can’t spot opportunities, he’ll sit on his mountain of cash and wait for one. As he’s emphasized in the past, the stock market is a “no-called-strikes game.” If there are no perfect pitches, he’s not going to take a swing, and neither should you.

There’s zero shame in hoarding cash

Sure, the sub-1% return from leaving your money in a savings account is undesirable, especially as the markets continue roaring higher. But you’ve got to realize that sooner or later, the tides will turn. The bull is going to die, and the bear will come out of hibernation. Once that happens, you’re going to want a sizable cash position to take advantage of the tremendous opportunity of buying stocks at severely marked-down prices.

Cash will be king once the next economic downturn hits, and if you don’t have any dry powder on the sidelines, you’re going to miss out on large returns, as the market cycle resets and stocks bounce back, while the economy moves back into expansion mode.

If Buffett has ample cash sitting on the sidelines, and he’s not using the proceeds to buy stocks, then that should be treated as a sign that stocks, in aggregate, may be a bit on the expensive side.

Everybody needs a market crash game plan, and if you don’t have one, you’re going to miss out on a generational opportunity once the markets finally implode. Nobody knows when the crash will happen, but it will inevitably happen, and once it does, stocks will be at fire-sale prices. If you’ve got cash, you’ll be able to capitalize off the opportunity, but if you were already fully invested before having the carpet pulled from underneath you, then it’ll be you that’ll end up on the sidelines, as Buffett and his disciples put their money to work.

Defensive stocks aren’t enough

I’ve encouraged investors to adopt an “all-weather” strategy by mixing defensive stocks with their cyclical names. While defensive stocks like Fortis (TSX:FTS)(NYSE:FTS) are great to have when the markets get hit, it’s still not a suitable alternative to cash. So, for the ultimate all-weather strategy, investors should include defensive stocks and a cash (and short-term bond) position, so they won’t need to do any selling of equities once the next crash hits.

Fortis, while a great “bomb shelter” stock, will still decline come the next economic downturn. So, it shouldn’t be treated as a means to raise cash come the next crash.

Foolish takeaway

While the magnitude of Berkshire’s cash position shouldn’t be looked at as an indicator for when the markets are going to crash, it should definitely be treated as a wake-up call for investors who’ve gone all-in on stocks with little to no disposable cash on the sidelines.

As it stands today, the markets are hovering near all-time highs, and the bull market is about to hit its 10th birthday, as the U.S. trade war plays out in the background. Buffett is going to turn 88 years old later this month, and while you would think he’d be in a rush to put his money to work before his age catches up with him, you’d be wrong.

He’s got all the patience in the world, and if you’re merely half his age or less, it’s you who has all the time in the world, but the real question is, are you going to be patient?

Stay hungry. Stay Foolish.