When it comes to market cap, Royal Bank of Canada (TSX:RY)(NYSE:RY) remains the undisputed king of Canadian banking. And while a majority of investors may continue to treat the name as their preferred choice in the Canadian banking scene, I think investors would be far better off if they focused on where Canada’s banks are headed rather than relying on shallow metrics like market cap to determine which Canadian bank is the “best” bet.

As the Great One, Wayne Gretzky, used to say, “Skate to where the puck is going, not where it has been.”

In the case of Canadian banks, you’d be doing the latter with Royal Bank. And while skating to where the puck has been may still reap significant rewards, you’re probably not going to be happy with the results on a comparative basis.

So, where is the puck going next in the Canadian banking scene?

Over the next two to three years, investors should watch the Canadian banking throne closely, because I think it’s just a matter of time before Royal Bank surrenders its top spot to Toronto-Dominion Bank (TSX:TD)(NYSE:TD) — the bank that I believe has far superior growth prospects and risk-management practices.

There’s a new king in town!

Don’t get me wrong. Royal Bank is still an excellent business that investors will do very well with over the long haul, but at these levels, it’s not the best bank for your buck — not by a long shot.

Not only does TD Bank have deeper roots in the more desirable U.S. banking scene (around 35% of revenues derived from the U.S.), but it’s got an extremely conservative risk-management process that’s firmly ingrained in TD Bank’s corporate governance. So, not only are you getting superior growth (from U.S. banking), but you’re also getting an applaud-worthy amount of stability with TD Bank’s proactive risk-management policies that’ll allow TD Bank to be best equipped to respond and rebound come the next inevitable economic crisis.

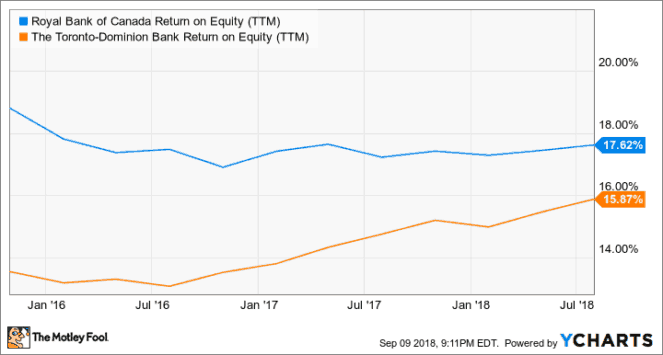

Royal Bank, however, has the second-highest exposure to Canada’s frothy and potentially vulnerable housing market. Moreover, Royal Bank’s lesser exposure to the U.S. market isn’t great news for forward-looking growth when compared side by side to TD Bank. Although Royal Bank is determined to continue its expansion into the U.S. market moving forward, it’ll still be playing catch-up with TD Bank, and given the premium price tags attached to potential U.S. tuck-ins, Royal Bank’s incredible ROE numbers could be heading on a downtrend, potentially to a level lower than that of TD Bank.

Foolish takeaway

TD Bank looks like offer the most in the way of capital gains and dividend hikes over the next five years or so. Royal Bank had a great run and will continue to improve upon its operations. At this point, it looks as though nothing will stop TD Bank from surpassing it in market cap at some point over the near future. For the time being, Royal Bank is keeping the throne warm.

Stay hungry. Stay Foolish.