When it comes to stability, high upfront yields, and consistent dividend growth, it’s hard to do better than Canada’s Big Five banks, the perfect balance of all the sought-after attributes.

Think of the big banks as an essential nutrient to a diversified portfolio if you will. For a risk-averse investor who’s looking to the most favourable risk/reward trade-off, the big banks are a must. They’ve got a rock solid foundation that’s a must for any optimal portfolio.

It’s not a mystery as to why many professional money managers include the big banks as one of their fund’s largest holdings. It’s because sometimes boring is beautiful. And while I’m sure you could obtain superior results on a year-over-year basis, you’d find that with a longer-term horizon (10+ years) that the banks are a safe way to put the S&P/TSX Composite Index to shame while giving the S&P 500 Composite Index a good run for its money.

Without further ado, here are my favourite bank stocks at today’s levels:

Toronto-Dominion Bank (TSX:TD)(NYSE:TD)

If there’s one bank to rule them all, it’s TD Bank, the perennial overachiever that’s poised to become Canada’s largest publicly traded company at some point over the next few years.

TD Bank CEO Bharat Masrani has done an applause-worthy job of turning TD Bank into a force to be reckoned with. Masrani and company have stuck with the dull, old-fashioned strategy of risk aversion, rather than taking chances on potentially riskier, short-sighted growth opportunities.

TD Bank has one of the most conservative lending practices in the Canadian banking scene, and although lower risk lending implies a smaller reward, TD Bank has compensated for this by investing in extremely forward-looking initiatives that may not have the potential to pay off in many years down the road, thereby depressing the bank’s RoE in the process.

The result?

A bank with a low risk, high reward profile.

TD Bank has one of the most attractive retail revenue streams out there, and it’s subject to less volatility than its peers, who lack the same abilities to manage risk at the corporate governance level. This stabler, premium revenue stream means that TD Bank is among one of the best prepared to deal with high levels of systematic risk.

On the growth side, TD Bank is reaping the rewards from the U.S. investments it’s made in the past. Today, TD Bank is Canada’s most American bank, and as the red-hot U.S. economy continues to roar, it’s going to be hard for the other Big Five players to keep up.

Simply put, TD Bank continually grows trees, so that it may collect the fruit in the future. The firm’s U.S. business is paying huge dividends today, and as TD Bank looks towards the next 10+ years, the bank continues to open up its wallet when it comes to financial technology. It may not have a big RoE today, but it’ll yield abundant amounts of fruit in several years from now.

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM)

Unlike TD Bank, CIBC isn’t the most risk-averse bank out there. Many pundits would argue that CIBC is the most exposed to risk given its high exposure to the frothy Canadian housing market.

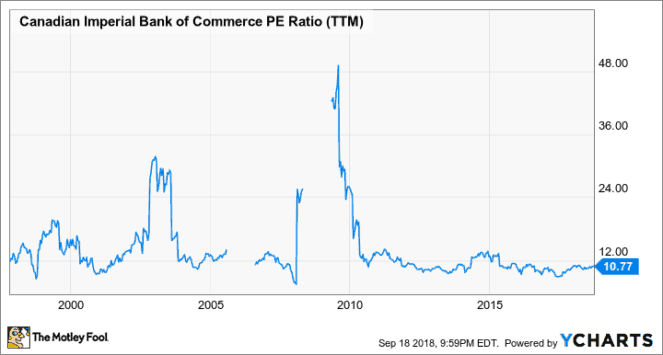

It’s this “sub-par” risk management thesis and the ill-preparedness for the 2008 financial disaster that’s caused investors to lose trust in a name that I believe is overly punished and undervalued given the underlying fundamentals of the business.

Investors love to hate CIBC because it was the biggest loser in the last recession and will, by most estimates, be a huge loser come the next downturn.

This time is different, however. Before the Great Recession, CIBC traded more in line with its peers with a P/E ratio that fluctuated around 12. Today, a single-digit P/E isn’t out of the ordinary for CIBC.

Today the stock trades at a 9.7 forward P/E, which is ridiculously cheap when you consider that CIBC is a better bank than it was before 2008.

You’re getting a better bank for a better price, and as CIBC continues its U.S. expedition, it’s not too far-fetched to think that CIBC can compete with its bigger brothers.

Foolish takeaway

It doesn’t matter if you’re a millennial who’s getting started with investing or a retiree who’s looking for a reliable income-payer, the big banks are one of the few securities that are suitable for any portfolio!

Stay hungry. Stay Foolish.