The volatility storm is coming, and you need to be prepared to deal with the rough waters that lie ahead as captain the of your portfolio. It’s definitely a high-pressure situation if you’re a beginner investor who isn’t at all used to the volatility that was virtually non-existent in 2017.

Should you sell your stocks and jump to bonds? Are solid plays like REITs, telecoms, and utilities safe for hiding in? Is there a high degree of systematic risk that’ll bring everything down? Should you double down on cyclical plays to get the most out of a potential market bounce?

It’s overwhelming to manage your portfolio in times like these, especially if you’ve forgotten that the markets can head south in a hurry. As Motley Fool co-founder David Gardner once said, “Stock prices tend to fall faster than they rise, but they tend to go up more than they go down,” so it’s easy to forget what it’s like to experience rough waters after a prolonged period of calmness.

Indeed, 2018 is the choppiest and ugliest year that many new investors may have experienced. And while 2019 could have much worse things in store, it could also realistically be a big up year depending on the outcome of a handful of contingent events. Who knows? A surprise China-U.S. deal may be inked at a time of max pessimism!

Simply put, investors shouldn’t try to time the market. Instead, they should ensure their portfolios consist of robust cash-generative businesses that can weather the storm, so your portfolio will have the ability to rebound at the quickest rate while taking the least amount of damage.

Enter BMO Low Volatility Canadian Equity ETF (TSX:ZLB), a low-cost basket of robust low-beta stocks that was engineered to deal with turbulent times like these.

Brad Macintosh, my colleague here at the Motley Fool put it best: “ZLB is a good way to gain exposure to TSX stocks, as it cherry-picks stocks that have historically had lower volatility. ZLB fund managers can use the current choppy market to evaluate the holdings that they believe will continue to provide the low volatility that more cautious investors so desire.”

I think ZLB is a must-own at this juncture given the ETF’s fund managers are actively trying to deliver the best returns given the low-beta constraints. You’re getting a diversified mix of the crème de la crème in the TSX index for a mere 0.4% MER. That’s a steal, plain and simple.

Lower risk, lower reward … right?

Not with ZLB!

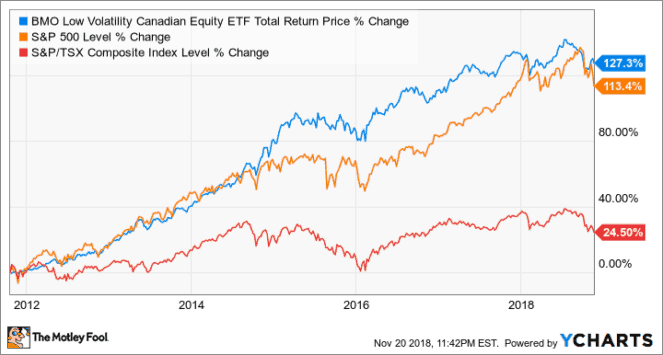

Since the ETF’s inception, ZLB has clocked in greater total returns than both the S&P 500 and the TSX Index, as shown in the chart above. So, not only are you taking on less volatility, but you’re also not compromising on the return front. And as the waters become rougher, one has to think that the outperformance exhibited by ZLB will become even more pronounced.

In the late stages of a bull market, downside protection is just as crucial as upside potential, and with ZLB, you’re getting a good mix of both. Is this smart ETF better than an index fund? It sure looks like it, and for the low fee, I’d encourage investors to give the name a look if they’re concerned about the rough waters we’ve experienced of late.

Foolish takeaway

While you can never make the volatility go away, you can dampen it with high-dividend-paying securities that have a low correlation to the broader markets. ZLB is a one-stop-shop investment that I believe all prudent investors should have in their portfolios if they intend to beat the markets sustainably over the long term without realizing excessive amounts of risk.

Stay hungry. Stay Foolish.