It’s been a tough investing year in 2018, with turmoil ravaging the global equities market as fears of a slowdown in world economic growth gripped the market, rumours of disturbing trade wars flooded the media while the flattening treasury bond yield curves in Canada and the United States switched on the bright red but inconclusive warning lights for a potential recession on the horizon.

Equities have been bashed — more so during the last few weeks of the year — bonds yields have softened, and gold has produced negative returns in United States dollars, but thanks to a weaker Canadian dollar, gold returns in the local currency unit have been a positive 5.4% this year.

One important asset class that’s proved resilient in 2018 is Canadian real estate investment trusts (REITs).

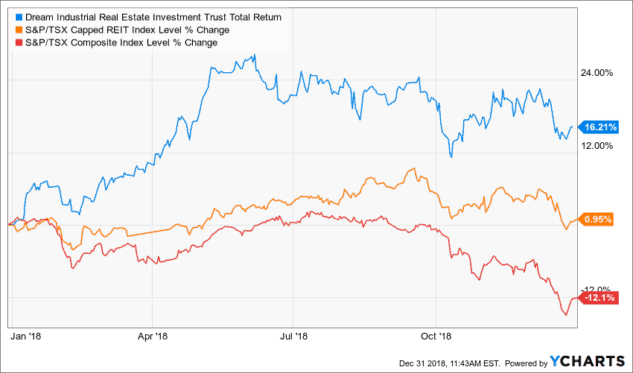

After generating a year-to-date price return of 0.95%, the S&P/TSX Capped REIT Index, a proxy for Canadian REIT returns, has by far outperformed the S&P/TSX Composite Index, the broader stock market returns benchmark for local equities, which sits at a double digit 12.1% loss for the year, with just a few hours remaining during the last trading day before the curtain closes on a painful 2018.

The income power in REITs

Real estate investment trusts do offer a very important alternative asset class to common stocks. Their rich portfolio cash flow generation affords them to offer great monthly income distributions at potentially lower total investment risks.

In fact, this asset class has provided income investors with welcome high yield alternatives during a long decade of near zero interest rates, and there could be some strong growth potential on invested capital too.

The underlying real estate property portfolios offer the potential for equity growth during periods of rising property prices, while new property development initiatives may generate organic portfolio equity growth and a growing cash flow generation capacity, just as new acquisitions usually do. During periods of market turmoil, the “hard real estate” assets do provide a critical valuation cushion to unitholders.

As shown above, one of the most outstanding offerings in this asset class has been Dream Industrial REIT (TSX:DIR.UN), which had a very promising start to 2018 and went on to produce phenomenal returns for the year.

The REIT was one of my favourites since April 2018. Its total debt ratio continued to decline during the year to 44.3% by September 30, down from 47.9% by December 31, 2017, a good achievement in a period of rising interest rates. Portfolio average in-place and committed occupancy level has remained strong and grew marginally to 96.8% during the third quarter as the trust recorded occupancy gains in its troubled Western Canada portfolio.

The sustained expansion drive into the United States has maintained strong pace and continues to boost net operating income while acquisitions in Canada will likely support cash flow growth. The trust saw an 8.2% growth in its net asset value per unit to $10.12 during the third quarter of 2018, largely a result of increasing property values in Ontario and Quebec.

Beware the risks

High debt levels, which are normal for the real estate sector, do pose significant interest rate risks to this asset class, and thus returns may not be so great during periods of rising interest rates. Further, although REITs enjoy stable cash flows from rental incomes, distribution cuts do happen, and it is necessary to closely monitor occupancy rates and the key pay-out ratios like the adjusted funds from operations (AFFO) pay-out rate.

If the year 2016 had any lessons for investors, it is that REITs may as well go down with the broader equities market too.

Investor takeaway

While past performance is no guarantee of future returns, there are significant diversification benefits to investing in real estate investment trusts resulting in dampened portfolio volatility. The income-producing potential from this asset class could provide outperforming returns during market downturns and the regular distributions may offer critical liquidity when it’s needed the most.

Investors should consider adding some REITs to their portfolios as they rebalance their portfolios in 2019.