As the markets continue tumbling, income investors are going to get a generational opportunity to bolster their income streams. By dollar-cost averaging, you can not only lower (or average down) the cost basis of your invested principal, but you can also average up the dividend yield based on this same principal.

So, with that in mind, it’s not a mystery that the assets I’m about to bring your attention to are highly productive assets like dividend-paying equities and distribution-paying REITs. Gold, while a great insurance policy for select portfolios, is a non-productive asset, as Warren Buffett has noted many times in the past. Sure, a bit of gold will do you good when the world ends, but regarding the value it’ll create over time, you’re getting zilch.

As an income investor, you should be more concerned about your income stream rather than the fluctuations in the price of the security itself. Thus, for those income investors looking to set themselves up with a “big boost” in income, crashes are the perfect time to put any excess cash to work.

When the markets crash, securities that fall in price typically experience a proportional magnitude of increase to their yields. Assuming the underlying business behind the security has operations stable enough to sustain its payout through tough times, the yield will swell, and for those who buy, the dividend is typically “enhanced” relative to the depressed entry point of a buyer.

Simply put, if you buy the dip in a quality income-paying security on a crash, you’re getting a bigger yield, perhaps even a massive yield that’ll be offered by Mr. Market for a limited time only.

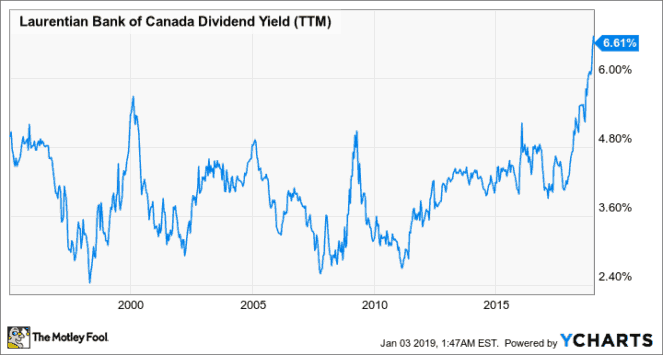

Look at Laurentian Bank (TSX:LB), a regional bank that’s been bruised so badly such that the dividend yield is hovering around the highest levels it’s ever been. As you can see from the chart below, the TTM dividend yield is now higher than where it was during the Financial Crisis after the stock’s latest 36% peak-to-trough fall.

Foolish takeaway

At the time of writing, Laurentian sports a 6.71% yield, a tad lower than where it was when I encouraged investors to buy the stock on the dip when the yield hit the 7% mark. Although regional banks aren’t my cup of tea when there are geographically diversified banks out there, the current valuation of Laurentian shares has me enticed.

It’s just too cheap!

Sure, you’re not getting the best bank out there, but at just 7.58 times trailing earnings, something has got to give, as the stock is far too cheap, especially for those seeking enhanced, reliable cash flows.

Stay hungry. Stay Foolish.