Renewable power is the energy source of now and tomorrow. What better way is there to get exposure to that sector than through Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP)? Brookfield Renewable offers a big dividend yield, for starters. Moreover, management plans to increase the dividend per share by at least 5% every year.

With the stock down about 10% in a year, it’s a good time to buy some as an income investment.

BEP.UN data by YCharts. The one-year price action of TSX:BEP.UN.

Business overview

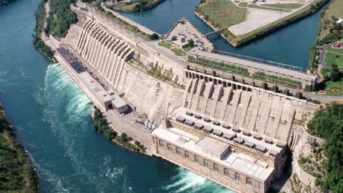

Brookfield Renewable owns and operates one of the world’s largest renewable power portfolios available to retail investors. The $42 billion asset portfolio is globally diversified with 877 power-generating facilities in North America (about 60% of cash flow), South America (35%), and Europe and Asia (5%).

The portfolio has 17,400 MW of capacity diversified across 25 markets in 15 countries. About 76% of the generation is hydroelectric, 20% is wind powered, and 4% is solar powered.

Brookfield Renewable aims to acquire renewable power assets at value prices, and it has also developed its own. Additionally, it has operational expertise to improve its acquired assets and optimize its cash flow generation.

Dividend and dividend growth

Brookfield Renewable is a Bermuda-based limited partnership that is treated as a partnership for Canadian tax purposes. It offers a cash distribution that’s like a dividend but can consist of investment income, such as interest, dividends, and return of capital, which are taxed differently from dividends.

Foreign income and interests are taxed at your marginal tax rate. Return of capital reduces the cost basis and is ultimately taxed like capital gains. If you hold TSX:BEP.UN units in a TFSA or RRSP account, you can essentially view the cash distribution as dividends, as you’ll get the full cash distribution. You only have to worry about how the cash distribution is taxed if you hold the units in a non-registered account.

At about $37.60 per unit as of writing, Brookfield Renewable offers a juicy cash distribution yield of roughly 6.9%. It has increased its cash distribution per unit for nine consecutive years with a three-year dividend-growth rate of 5.7%. Going forward, management aims to increase the cash distribution per unit by 5-9% per year.

Ample liquidity for investing

In the last reported quarter at the end of October, management said that it expects to sell about US$1 billion of assets at strong valuations to raise net proceeds of US$850 million. This will result in Brookfield Renewable having available liquidity of more than US$2.3 billion, giving it lots of resources to invest in quality assets for higher returns.

Investor takeaway

Brookfield Renewable is a decent income investment. It offers a yield of 6.9%. And it’s about to increase its cash distribution by at least 5% this quarter, which means the forward yield is even more appetizing.