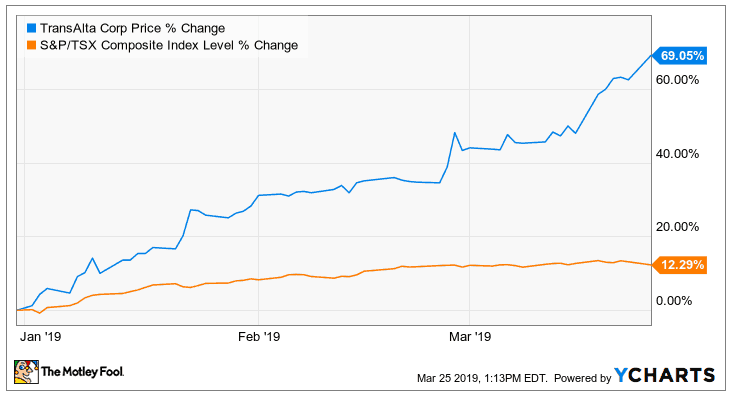

There’s a strong price growth momentum on TransAlta (TSX:TA)(NYSE:TAC) stock as it continued to set new 52-week highs during the past week and news on Monday propelled the valuation further by over 4%. Investors have seen their positions grow by nearly 70% since the beginning of this year. Could this be the time to buy into this energy producer as it undergoes a fundamental transformation?

A strong resurrection story

The company’s share price is on a strong recovery path after hitting agonizing multi-year lows in January 2016 when the stock traded below $4, as the market strongly condemned dirty coal power-generation plants.

The Canadian energy producer owns and operates a fleet of electricity-generating assets that are spread over Canada, the United States, and Australia. It is now one of the country’s largest producers of wind and hydroelectric power. Its ongoing strategic transitioning of its asset portfolio from being predominantly composed of coal-powered plants to clean energy production is gaining momentum.

Coal-powered plants contributed 22% to corporate cash flow last year, down from 30% in 2017, as the company accelerates conversions to gas. The conversion program is expected to be fully implemented by 2025 and will extend the fleet lifespan by about 75 more years.

The ongoing asset transformation may see the company generating improved cash flows, as it becomes a competitive low-cost power provider to Alberta, and this may strongly support the sequential growth in free cash flow witnessed over the past three years.

Strong institutional investor interest

Institutional investors’ re-ignited interest in the company is making headlines. When the smart money rallies a stock, you’d better get more interested.

Activist institutional investors Mangrove Partners, Bluescape Energy Partners, and Cove Key Bluescape Holdings have determined to directly influence corporate strategy at the company through their combined shareholding, which exceeds 10%, and management agreed to engage them on March 15.

Brookfield Renewable Partners and its institutional investor partners couldn’t be left behind. As announced on Monday, it is investing $750 million in the company to help it transition to clean energy; shares rallied nearly 5% on the news. The deal could result in Brookfield increasing its stake to 9% in the company and will include a share buyback program.

Interestingly, the activist investor group announced on Tuesday that they are increasing their board nominations, as they didn’t have enough time to evaluate the Brookfield deal and believe a better offer may be available.

Can the momentum be sustained?

The company’s transformation strategy appears very simple and it is highly likely to succeed. Conversions to gas are already halfway through, and its hydro assets are intact and will likely generate better cash flows as contracts are renegotiated next year.

Most noteworthy, the company’s commitment to grow TransAlta Renewables almost guarantees a strong cash flow stream from the high yield clean energy play, where it has a 61% controlling stake.

Canadian assets’ improved earnings and cash flow generation is visible. The company harvested increased cash flows from Australian operations last year, while its hydro segment is growing earnings and cash flow on the back of stronger energy pricing and high demand for ancillary services.

High debt was a significant problem three years ago, but the company accelerated its debt repayments in 2018 and expects to continue deleveraging its balance sheet over the next three years.

The equity investment risk on the stock is significantly decreasing and investors are falling in love with the transformed company once again. The share price could continue going up as valuation multiples grow.

Foolish bottom line

There is a strong long-term investment case on TransAlta today, and the emerging institutional investor interest may propel the valuation further.

Although bottom-line losses increased over the past two years, cash flow generation has picked up and the company may be expected to turn earnings positive soon.

Most importantly, the power generator is likely to return to its high-yield dividend-payer status once the transformation is complete and cash flow generation becomes much more stable in the near future.

This company’s shares could be a nice addition to a long-term retirement portfolio right now.