The Canadian financial sector constituted nearly 32% of the S&P/TSX Composite Index at the end of May this year, and any investor who considers the index as a portfolio performance benchmark would be wise to pay attention to a sector that commands nearly a third of the main index.

The sheer index domination by the Big Five chartered banks means one can’t avoid banking names completely, even during times of perceived industry weakness, but can only underweight the industry in a portfolio to maintain some diversification benefits.

That said, banking stocks have been strong contributors of positive returns to local indices. While the TSX has gained just over 42% over the past 10 years, the Big Five banks have soared; some have generated more than 200% in total returns during the past decade.

Selecting the best ticker among the big names could have generated outperforming returns, and one of the best, up over 260% in 10 years, has been the Toronto-Dominion Bank (TSX:TD)(NYSE:TD). Does it continue to be the best name to own today?

Where’s Toronto-Dominion Bank’s advantage?

It has been in the DNA of TD Bank stock to produce outperforming returns that trumped those of most peers over the long term. The financial institution has been very efficient in deploying its business strategy locally, and forays into international jurisdictions have been highly rewarding, too.

Slow Canadian housing mortgage business growth and the increasing likelihood of sector-wide defaults due to unsustainably high household debt levels in the short term could indeed put a dent in most lending portfolios, but like a few of its peers, management has found a new diversifying growth frontier in the United States.

There appears to be an improvement in the bank’s lending portfolios lately when considering 26% decline in provisions for credit losses quarter over quarter to $636 million during the second quarter to April this year. Surprisingly, TD managed has to report positive growth in its Canadian residential mortgage portfolio in five consecutive quarters.

I like the financial sector giant’s mid to high single-digit growth in adjusted net income achieved thus far, and there’s reason to believe the institution could maintain a stellar income growth momentum given the latest 23% year-on-year growth in U.S. segment net income during the recently reported quarter (15% on an adjusted basis), especially if the U.S. economy continues to grow at anywhere near the 3.1% reported for the first quarter recently.

Last quarter’s return on equity at 17% was just 50 basis points below that of leading Royal Bank of Canada (TSX:RY)(NYSE:RY), and the 6.7% year-over-year growth in adjusted net income was too close to RBC’s 7%, but total investment returns on TD have matched or marginally trumped those on the bigger competitor.

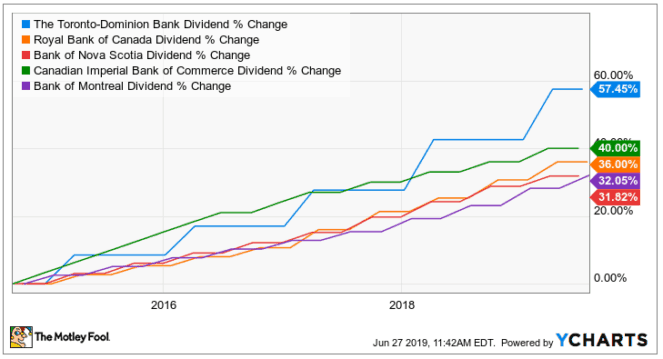

Most noteworthy, Toronto-Dominion Bank should be a favourite for dividend-growth investors. The stock grew its quarterly payout religiously and faster than peers over the past five years, and it will likely continue to do so if the 7-10% adjusted earnings-per-share medium-term growth rate is achieved.

TD’s quarterly dividend is 57% higher than it was five years ago, and the current yield is a juicy 3.88%. The yield is marginally lower than RBC’s 3.98% currently, but investors who scoop shares today could see their income yields rise faster year over year if management continues increasing the dividend as fast as it did historically.

For this quality equity offering, shares will almost always trade at a premium. There’s a 11.11 times forward P/E ratio on the ticker currently, which is below five-year historical averages, and shares are slightly cheaper than RBC common shares, which trade at a 11.47 times forward P/E multiple.

Foolish bottom line

Toronto-Dominion Bank has dominated the Big Five in total returns for most of the time, and although Royal Bank of Canada has been a great contender lately, the former could offer the best dividend growth to a portfolio and could be a good candidate for new money.