Great stocks are often led by wonderful underlying businesses. One of my favourite dividend stocks is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP), and I’ll use it as an example of a wonderful business that also happens to be a great stock.

BIP has a relatively young trading history of less than 12 years. However, it is a spin-off of Brookfield Asset Management (BAM). So, it has been in operation for a long time.

BIP simply outperforms

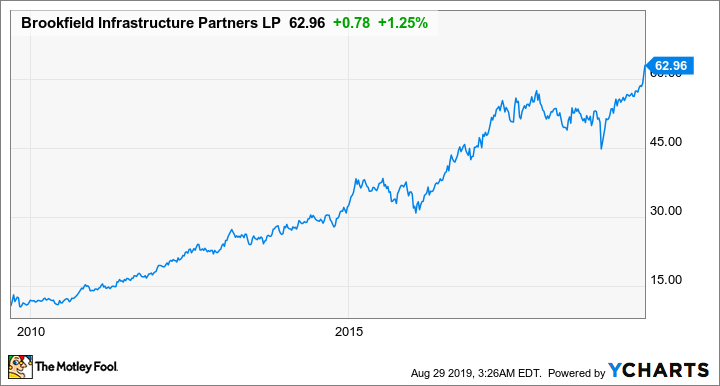

BIP stock has delivered the highest long-term returns among BAM’s four spin-offs. Heck, it even beat its general manager and partner’s, returns since it was spun off.

Since 2008, BIP stock has delivered annualized returns of 13.7% on the NYSE and since 2009, BIP stock has delivered annualized returns of 21% on the TSX. Of course, the 21% rate of return was helped by the economy coming out of a recession and the recovery of the stock from a market crash at the time.

Worried about an expensive stock?

After BIP stock has run up, analysts will often say that there’s little room for the stock to go higher. In the short term that may be true.

When I was a new investor, I often sold stocks when I thought they were fully valued. On one hand, doing so can be a great way to boost returns. On the other hand, you may end up using the proceeds to pick up a worse stock/business.

So, focus on buying at good valuations in great businesses and the selling part can be the least of your worries.

How often do you get the chance to buy a wonderful business at a bargain?

If we look at BIP’s 10-year price chart, you’ll notice that it had two meaningful corrections and bottomed in January 2016 and December 2018, respectively. That’s not a lot of opportunities to buy the wonderful business at a bargain.

BIP.UN data by YCharts.

If I sold out of the stock after big runs, I may have to wait for a long time before I can buy it back (and likely at a much higher price).

You can’t go wrong holding winners

I have more than doubled my money (from price appreciation and dividends received) from my oldest shares that were bought fewer than four years ago.

There’s no doubt that the stock will experience corrections in the future. However, since it’s a wonderful business and a core holding of mine, I decided not to sell a single share.

Conclusion: Should you sell a great stock for big gains?

It may surprise you that I have a mixed answer for this. For BIP, I plan to hold it and add to it when it’s attractively priced because it’s a wonderful business, a stable utility that has little cyclicality, and it pays a nice growing dividend.

In general, it depends on a lot of factors in terms of whether to sell a great stock for big gains. For example, many North American industrial companies haven’t been doing so well lately as they’re subject to greater cyclicality. So, I wouldn’t hesitate to sell these stocks for big gains when the fruits are ripe for the picking.