Apple‘s (NASDAQ: AAPL) focus on services is paying off. The company saw its largest monthly acceleration in App Store revenue since early 2015, according to data from Sensor Tower cited in a new note from Morgan Stanley analysts.

Consumers spent 28% more on apps in August this year than last year, accelerating from 18.9% year-over-year growth in July. That’s considerable growth for one of Apple’s oldest services. Apple’s total services revenue increased 15.9% through the first nine months of the fiscal year, and App Store revenue contributes more to the bottom line than most other sources of services revenue.

Margin notes

Apple’s services revenue includes App Store sales, iTunes downloads, Apple Music subscriptions, iCloud subscriptions, AppleCare subscriptions, ApplePay, and a few other sources of revenue. Those services have drastically different gross margin structures.

Apple Music, for example, has to pay high royalty rates to music publishers, pushing its gross margin close to 20%. iCloud subscriptions require Apple to use considerable compute power, for which it spends over $30 million per month. Overall, Apple’s services generated a gross margin of 63.6% through the first nine months of the fiscal year.

The App Store, notably, has a very high margin — about 90%. It’s important to note, however, that Apple recognizes App Store revenue on a net basis, after it sends app publishers their share. So, when you buy a $10 game in the App Store, that shows up as $3 in revenue on Apple’s income statement, and about $2.70 of that flows through as gross profit. Still, App Store sales are extremely lucrative for Apple.

What’s driving growth?

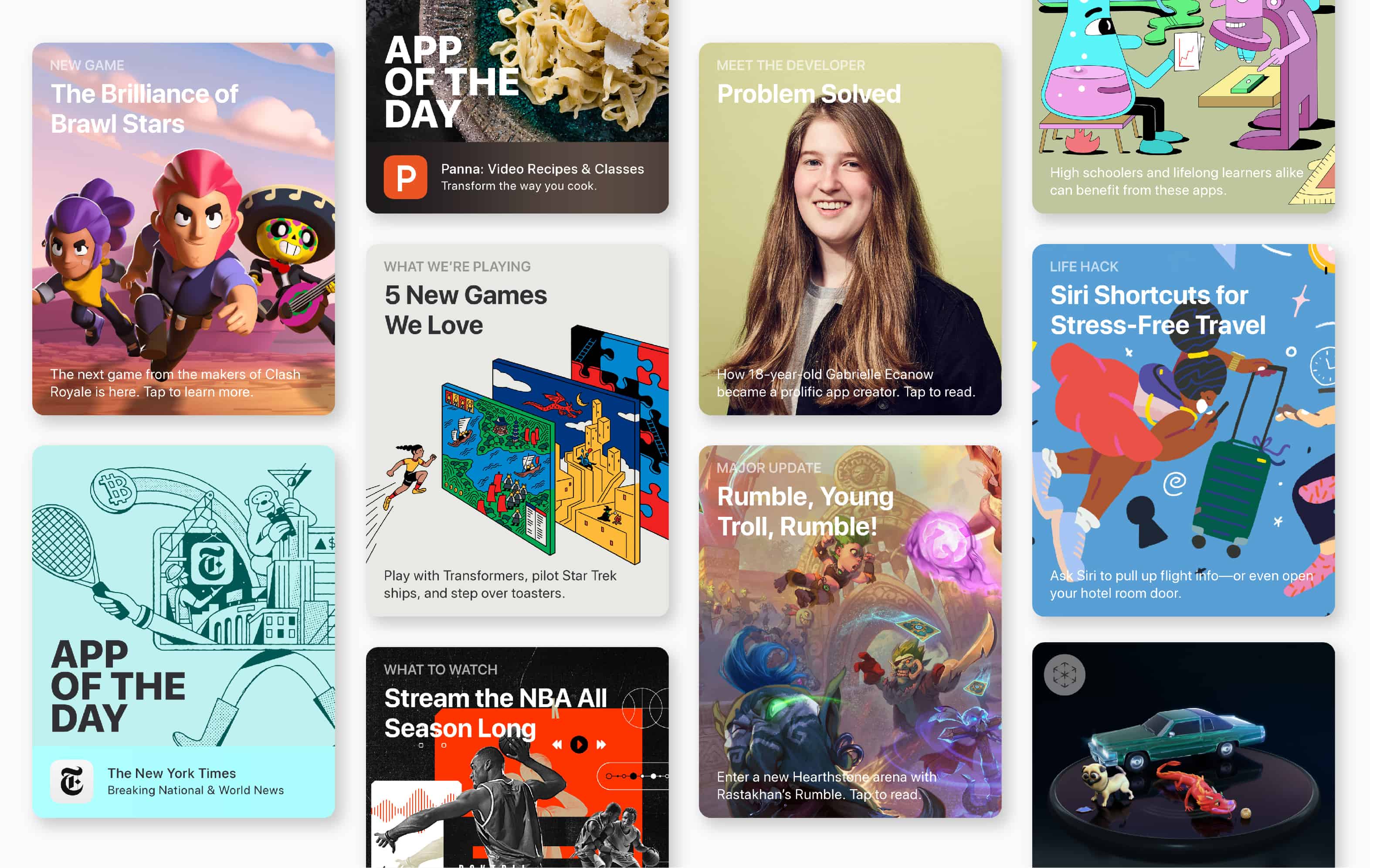

One of the biggest contributing factors to Apple’s App Store sales growth was the entertainment category, which grew in line with the rest of store sales in August. July sales growth for the category was just 8.9%, according to Sensor Tower, so entertainment apps can have a major impact on App Store sales growth.

Some big-name apps have been “bypassing the App Store billing platform,” Morgan Stanley analyst Katy Huberty points out. Notably, Spotify and Netflix don’t allow new subscribers through their apps. Users must navigate to the mobile web or sign up on a desktop or laptop computer.

On the other hand, some apps have stepped up in their place, including the top free app, Tik Tok. The short-form social video app offers in-app sales for virtual coins. It was selling about $5.5 million worth of those coins per month in February, according to Sensor Tower. That number has likely climbed higher as the app has gained popularity in 2019.

Going forward, Apple will likely benefit from the upcoming influx of premium streaming video services from Disney, AT&T‘s WarnerMedia, and others. As more stand-alone services come to the market, Apple benefits as an aggregator and distributor.

Ready to cannibalize itself

By far the biggest source of App Store revenue is gaming. Game downloads and in-app purchases accounted for roughly 69% of App Store sales in the first half of 2019.

But those sales might be about to see a reduction with the launch of Apple Arcade, a curated collection of exclusive games available for a monthly subscription price. Apple is reportedly spending $500 million on games for the service, so it should be a compelling offering. Worth noting: The games in Apple Arcade won’t be available in the App Store, but are still likely to steal sales away from other game apps since subscribers will have a buffet of premium options to choose from.

Apple Arcade is a necessary move for Apple, if not a major source of revenue growth. Competitors like Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) Google are launching their own game subscription services, including cloud gaming service Stadia. Google, notably, sees an even greater percentage of its app store sales come from games than does Apple. Therefore, it has an even greater incentive to lock consumers into a subscription service on its platforms.

If Apple doesn’t steal sales away from the App Store, someone else will. That said, Apple Arcade could be compelling enough to increase the average game spending per user, raising overall service sales for Apple.

The App Store’s small-but-mighty revenue growth acceleration is an important development for Apple investors as Apple continues to shift its focus to services. The strength in entertainment apps is especially noteworthy, but investors should expect App Store sales growth to see a considerable hit following the launch of Apple Arcade.