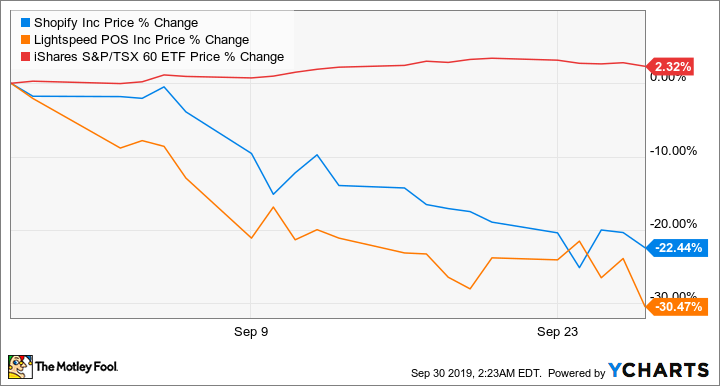

High growth stocks like Shopify (TSX:SHOP)(NYSE:SHOP) and Lightspeed POS (TSX:LSPD) have underperformed the market in the past month as investors took profit and rotated into value names.

However, the growth stocks are still up meaningfully and have substantially outperformed the market year to date. (Notably, Lightspeed only began trading on the Toronto Stock Exchange in March.)

SHOP data by YCharts. The price action of Shopify, Lightspeed, and the Canadian stock market in the past month.

SHOP data by YCharts. The price action of Shopify, Lightspeed, and the Canadian stock market year to date.

More important, there’s a long growth runway for Shopify and Lightspeed. If we don’t see a recession or market crash in 2020, the high growth stocks can propel your portfolio much higher next year.

Why I’m bullish on Shopify

Shopify has done a wonderful job in building a unique multi-channel e-commerce platform that has helped entrepreneurs and businesses to succeed.

In the last quarter, Shopify reported its gross merchandise volume (i.e., the total sales of merchandise sold through a platform) increasing by 51% to US$13.8 billion compared to the same period a year ago.

There’s no reason to believe that merchants on Shopify’s platform won’t succeed. Shopify has tirelessly focused on enhancing the platform to help merchants to build better customer relationships, fulfill orders faster, and limit operating costs using Shopify as a one-stop shop. In short, it helps merchants grow their businesses.

For example, this year, Shopify launched Shopify Chat and its United States fulfillment network. Shopify provides all the present (and future) tools and functionality that merchants need to compete for a small price every year.

In the last quarter, Shopify reported revenue of US$362 million (up 48% over the same period a year ago) and adjusted net income of US$15.8 million.

Why I’m bullish on Lightspeed

Lightspeed is a tech company that was founded, in 2005, one year after Shopify. Lightspeed somewhat resembles Shopify in that it aims to make entrepreneurs’ business lives easier by providing point of sale and payment processing services.

It’s also growing at a high speed like Shopify. In the past three years, its revenue growth was 36% per year. Lightspeed has a focus on restaurants and small- and medium-sized businesses. Its solutions are used at more than 51,000 customer locations across nearly 100 countries.

In the last quarter, the growth company reported gross transaction volume growth of more than 30% to US$4.6 billion compared to the same period a year ago, while its revenue increased 38% year over year to US$24.1 million. That’s high-quality revenue, as roughly 90% is recurring software and payments revenue.

By increasing product awareness, penetrating new markets, expanding its product offerings (e.g., Lightspeed Payments launched in January), and making strategic acquisitions, Lightspeed is set to grow.

Recently, Lightspeed acquired Switzerland-based iKentoo, which brings about 4,000 customer locations in new countries, such as Switzerland, France, and South Africa.

iKentoo offers platform breadth, capabilities, and upsell opportunities across EMEA, enabling Lightspeed to further accelerate the displacement of legacy point of sale providers around the world.

Foolish takeaway

If a market correction doesn’t happen in 2020, Shopify and Lightspeed can propel your portfolio much higher next year. Although these ultra high growth stocks can make you rich, investors should size their positions appropriately based on their risk tolerance, as these are also riskier stocks that come with greater volatility.