Glu Mobile (NASDAQ: GLUU) investors finally had something to cheer about in September. Shares of the mobile gaming specialist showed some signs of life after Roth Capital analyst Darren Aftahi upgraded the stock to buy. This came as a big sigh of relief to Glu investors, who have seen the stock fall nearly 40% so far in 2019.

So what led Aftahi to upgrade Glu and slap a $7 price target on the stock, which indicates a 40% upside from current levels? Let’s find out.

Glu’s games seem to be gaining traction

Glu Mobile stock was pummeled in August after the company substantially slashed its full-year bookings guidance. This shocked investors, who were probably expecting Glu to increase its bookings guidance after the launch of two new games during the second quarter — WWE Universe and Diner DASH Adventures.

But the company’s announcement that WWE Universe was performing below expectations spooked the market, forcing Glu to shift its spending on the other title. However, Roth Capital believes that Glu is finally managing to get its act together.

Aftahi says that his bookings model for the third quarter shows that Glu’s bookings could arrive above the guidance range originally issued by the company. The company expects third-quarter bookings to fall between $110 million and $112 million. Aftahi’s model indicates that Glu can deliver $117 million in bookings during the quarter.

If that’s true, then it means Glu Mobile’s games have finally regained their mojo. Glu Mobile’s third-quarter results are expected to be released in early November, so investors will have to wait for some time to see if Aftahi’s model is on point or not.

But the good part is that savvy investors looking to invest in a mobile gaming stock now have a window of opportunity, as the analyst upgrade indicates that Glu could be a growth stock.

Why now may be a good time to buy

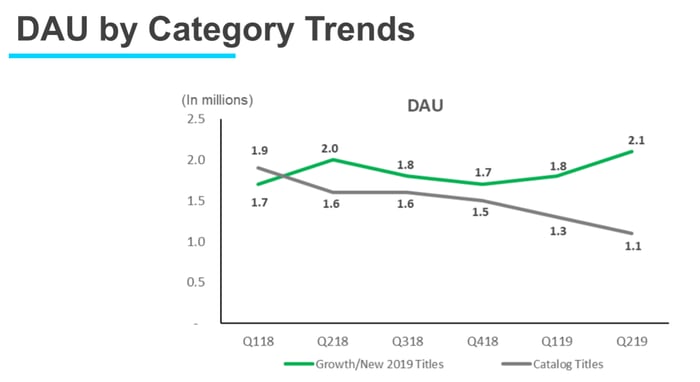

An important metric to note is that 83% of Glu’s total bookings in the second quarter came from games that it classifies under the “growth” category. The good news: More users are now getting attracted to this category; the daily active user (DAU) base of Glu’s growth games has been rising at a nice clip, as shown in the chart below.

Image Source: Glu Mobile.

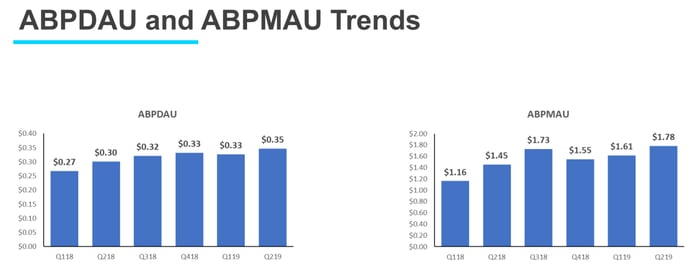

What’s more, not only are Glu’s new titles attracting more users into the company’s fold, they are also driving bookings growth. This is evident from the fact that the company’s average bookings per daily active user (ABPDAU) and its average bookings per monthly active user (ABPMAU) increased substantially on a year-over-year basis last quarter.

Image Source: Glu Mobile.

Since Glu is on track to bring more new titles to the market, there’s a good chance that these metrics will keep trending upward. So don’t be surprised to see Glu Mobile stage a nice recovery in fiscal 2020 thanks to new game launches that include Disney Sorcerer’s Arena and the next installment in the Deer Hunter franchise.

This is why now could be a good time to go long on Glu stock, as it trades at a forward price-to-earnings (P/E) ratio of around 15. This is less than half of the company’s five-year average forward P/E ratio of nearly 33.

Glu has a nice pipeline of games that will hit the market in the coming months, and it has been better at engaging its users. The company could very well hit those ambitious earnings targets, which is why investors should consider stocking up on Glu shares given its current valuation.