Shareholders in Canada reacted positively to Constellation Brands Inc. (NYSE:STZ) earnings on Wednesday, despite reporting equity losses from market investments in Canopy Growth Inc (TSX:WEED)(NYSE:CGC) stock.

The stock price rose by $6.70 per share to $190.29, or 3.70% after the earnings call on Wednesday. Profit and sales exceed analyst estimates last quarter and the company raised its earnings forecast for the year.

Analyst estimates of earnings-per-share (EPS) last quarter averaged an approximate $1.85. Constellation reported an actual EPS of $2.14 per share (including Canopy Growth equity losses), $0.29 more than the average of the analyst estimates. Greater-than-expected earnings for the quarter translated into higher EPS expectations for the year at $9.45 to $9.55 per share.

Day traders and speculators tend to overreact to positive (and negative) earnings surprises. If you want to buy shares in Constellation Brands, try waiting until after the excitement from the earnings surprise wears down. You’ll thank yourself later when you buy the stock for less than what it is trading for today.

35% loss in Canopy Growth stock price drags down EPS

On Wednesday, January 8, Constellation Brands reported third-quarter fiscal year 2020 results. Constellation Brands owned 38% of Canopy Growth as of August 2018, making the company the biggest loser out of all Canopy Growth’s shareholders. Luckily for Constellation Brands’ shareholders, the equity investment dragged down the EPS by just $0.25 per share.

For the year, Constellation Brands expects to report a total EPS loss of $0.64 per share. Constellation Brands lost $71.1 million on a comparable basis between July 1 and September 30 in 2019. A comparable basis means that the company excluded items that reduced the analytical value of the data.

On a reported basis, Constellation Brands announced a profit of $46.2 million in equity earnings and other Canopy Growth related activities. Reported basis figures are amounts announced in compliance with generally accepted accounting principles (GAAP). GAAP principals in Canada aim to promote consistency in financial reporting and auditing.

These are top stocks to buy in 2020

Canadian investors can’t go wrong with either Canopy Growth stock or Constellation Brands next year. Granted, Canopy Growth is the more affordable option for investors with less available cash at a stock price of $26.19 on the TSX.

Stock market investors willing to pay a little extra for the safety and confidence in an established enterprise might want to choose Constellation Brands.

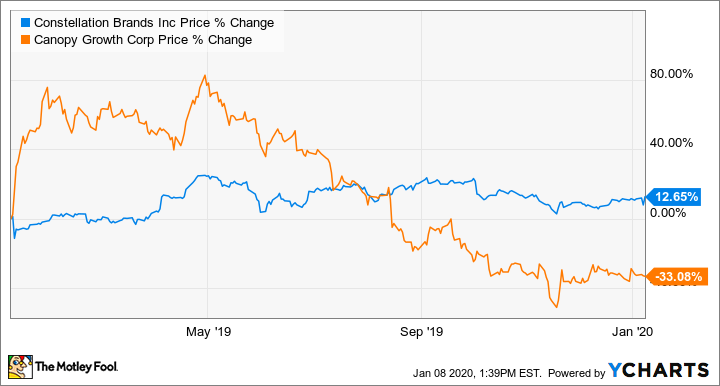

The benefit of Constellation Brands stock is in its dividend and stable price history. In the past year, the stock price on Constellation Brands increased by 12.65% compared to the Canopy Growth’s 33% decline in stock market value. Shareholders in Constellation also cashed in a trailing annual dividend yield of 1.62%.

The downside of Constellation Brands is that shareholders must pay a nice US$190.29 per share at the time of writing. Not all investors have that kind of cash to purchase stock in one company.

Moreover, Canadian investors who buy Constellation Brands for the dividend on the NYSE may have extra concerns come tax time with the Canadian Revenue Agency.

Either way you go, as long as you take a long-term view of the investment, you’re sure to walk away happy when you retire.