Canada is rich in natural resources like palladium, gold, and silver. Some of the world’s most prominent mining and natural resource firms call the Toronto Stock Exchange (TSX) home. The global market for potash, uranium, and niobium would not be the same without the Canadian mining industry.

Up to 75% of the word’s natural resource mining firms choose to incorporate in Canada. Canada-based companies operate mines in North America, Latin America, and Africa, though not all the natural resource companies headquartered in Canada are run by Canadian nationals.

Whether it is attractive international trade deals favouring Canada or something more, Canada seems to be an ideal location to build an international mining company. Likewise, the TSX is the perfect exchange to buy stock in top natural resources and mining firms.

2 top mining stocks to buy in 2020

The two best mining and natural resource stocks to buy on the TSX are Largo Resources Ltd (TSX:LGO) and Labrador Iron Ore Royalty Corp (TSX:LIF). These two stocks are both undervalued with strong financials and high earnings growth.

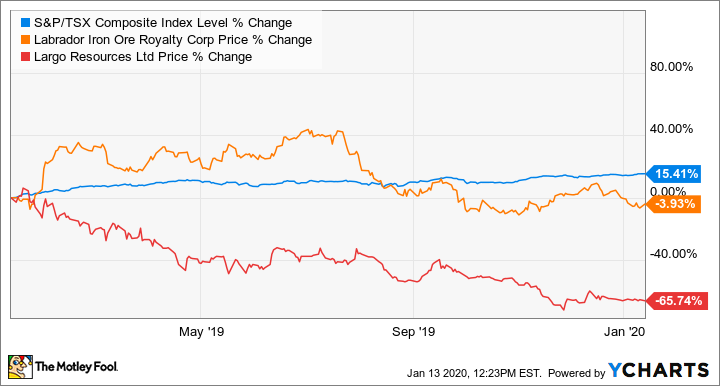

Labrador is probably the safer choice with more stable price performance on the TSX in the past 52 weeks, but Largo is the cheaper stock now that it has lost over 65% of its market value over the same time period.

Labrador Iron Ore underperforms the S&P/TSX Composite Index

Labrador is a top mining stock to buy in 2020 on the TSX. This company owns 15% of an iron mine near Labrador City, in Newfoundland & Labrador. Royalty companies finance expensive mining exploration and production projects. Although not without risk, royalty companies tend to be net creditors, meaning they carry less debt and have higher returns to equity than more highly leveraged companies.

At $23.85 per share and with a $2 billion market capitalization, Labrador is still within a reasonable price range for most investors in Canada. The trailing 12 months earnings per share (EPS) is $3.15 and the annual dividend is about $1 with a trailing yield of 4.33%.

The stock has been going through a bit of a rough patch related to price performance over the past decade. Still, the stock has been rebounding since 2016 and remains undervalued with a price-to-earnings (P/E) ratio of 7.58.

Largo Resources stock has a volatile history on the TSX

Largo operates a diversified portfolio of natural resources mining operations of vanadium, iron, tungsten, and molybdenum deposits in Brazil and Canada. Canadians can pick up a 100-share position for $99.

Largo has had its good years and bad years on the TSX. The stock price was more stable prior to 2015 compared to the last five years. Fortunately for shareholders, the price of its shares cannot fall much further than its current position, at $0.99 per share and a market capitalization of $526.59 million.

The stock price on Largo is close to its 52-week low of $0.81 per share. The company has paid off nearly $400 million in debt since September 2018. Today, the company is debt-free with a return on equity of 25.27%. Above-market average price performance accompanied the decrease in debt in 2018. Since then, the stock price has lost some of those gains but remains up 115.2% from its price of three years ago.