There are many Canadian companies with long-term histories of outperforming the S&P/TSX Composite Index. As the historical top gainers are proven winners on the exchange, these top stocks should be in every Canadian’s retirement portfolio.

When you aren’t sure which stocks to buy, you know you can trust established, reputable companies that rarely ever lose any price momentum. Constellation Software (TSX:CSU) has been on a 10-year uptrend on the Toronto Stock Exchange.

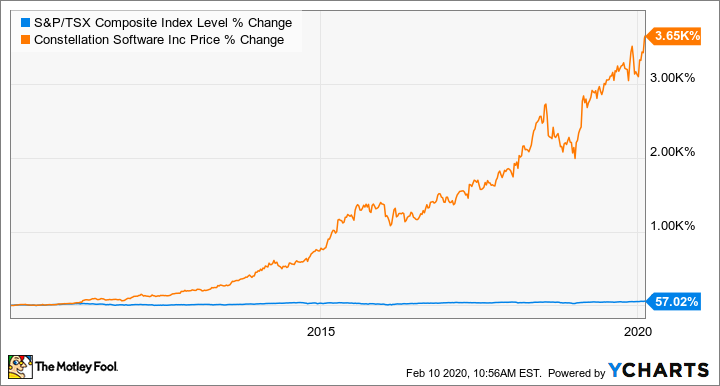

Since 2010, the stock price has climbed 3,650% versus the index level percent change of 57.02%. The good news is that you haven’t missed out on making money on this diversified technology stock.

Buy stocks on long-term uptrends

It’s never too late to buy stocks on long-term uptrends like Constellation Software. Stocks like this might undergo small, temporary dips much like the one Constellation Software experienced in 2018. Nevertheless, these companies will almost always bounce back.

There’s a reason why Constellation Software has been on such a long uptrend. This technology stock reports a return on equity (ROE) of 63.42%!

Return on equity is the net income of a company divided by total shareholder equity. A high return on equity indicates that investors can feel confident that their investment will pay returns later on.

If you are wondering which types of stocks in which to invest, find established companies with long-term uptrends and a high ROE. That way you won’t need to worry about losing your life savings in stocks like Constellation Software.

Buy stocks with strong EPS growth

In the past year alone, the stock has returned 49% on the TSX. By comparison, the S&P/TSX Composite Index has increased by just 13.23%.

Canadians who want to earn alpha-level returns (above market average returns) in the stock market in 2020 should find stocks that consistently outperform the market such as Constellation Software.

Constellation Software is a technology company with high earnings growth. In 2018, Constellation Software brought in $17.90 in earnings per share (EPS), 71% higher than 2017’s reported EPS of $10.47. In 2016, Constellation Software reported $9.76.

Smart investors look for dependable growth in earnings. So before you invest in new, hot stocks with outsized share price increases compared to the EPS growth, you should re-evaluate your options. Overpriced stocks with hard-to-justify price momentum are too risky for the average investor.

Stick with proven earners before taking on risk

Before taking on risk in your Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), make sure you have reliable stocks like Constellation Software in your portfolio.

There’s nothing wrong with making speculative bets in the market to add some potentially profitable risk to your stock market portfolio. Before you make those bets, however, you need to ensure that you have exhausted your less risky investment options with similar expected returns.

Constellation Software has a five-year beta of about 0.7, less than the market average of approximately 1.0. If you use the beta as a risk measure, you can determine how well you’re optimizing your portfolio returns with respect to market risk.

Self-investing isn’t difficult. You just need to learn how to avoid unnecessary speculation and instead earn easy, painless money in the stock market.