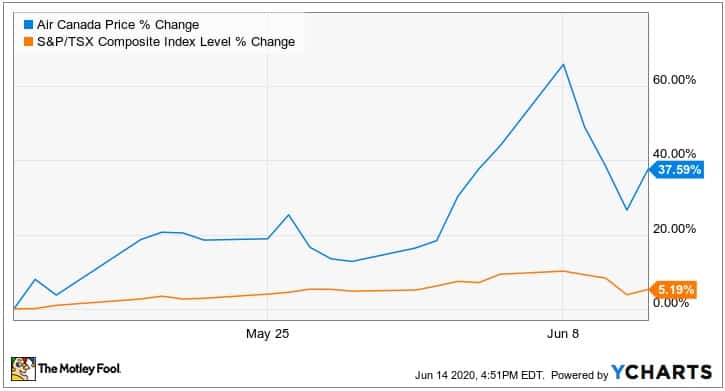

Airline stocks were some of the worst affected by the coronavirus pandemic and March 2020 stock market crash. Canada’s flag carrier Air Canada (TSX:AC) gained a remarkable 38% over the last month compared to the broader TSX remaining flat with the S&P/TSX Composite rising 5%.

Air Canada’s impressive bounce can be attributed to growing optimism over the economy, which triggered a solid market rally after the March 2020 stock market crash. There are fears, however, that the outlook is not as positive as the market believes.

Is the stock market’s optimism overdone?

A spike in coronavirus cases in the U.S. and Latin America is weighing on stocks. This could lead to further travel restrictions impacting airlines and tourism. The latest economic data also point to a rough road ahead for the foreseeable future, which would further impact travel demand. That has sparked fears that Air Canada’s latest rally is overdone and there is more downside ahead for Canada’s flag carrier.

Even after taking significant measures to mitigate the impact of the coronavirus pandemic and travel bans on its operations, Air Canada reported a larger first quarter 2020 loss. The airline announced a $1 billion net loss for the period despite revenue declining by only 16% year over year, which can be blamed primarily on a $711 million foreign exchange loss.

Even after the measures taken by Air Canada to blunt the financial impact of the coronavirus pandemic on its finances second quarter earnings will likely be worse. The pandemic only negatively affected first quarter’s final month, whereas it will have a profound impact on the economy and travel for the entire second quarter.

During the first quarter conference call, Air Canada’s chief financial officer stated that Air Canada was burning through around $20 million daily to cover fixed costs. When that’s considered along with Air Canada reducing second-quarter capacity by 85% to 90%, virtually wiping out most of its operating revenue, its operating loss will balloon out substantially.

An even greater fear is that the impact of the coronavirus on air travel will be far more severe than 9/11, the 2008 financial crisis, and the 2003 SARS epidemic. Air Canada expects it to take three years or possibly longer to recover from the pandemic. The coronavirus pandemic has been labelled by some industry insiders as the “darkest period ever” for commercial aviation.

How bad is the outlook for airlines?

Despite this particularly gloomy outlook, there are signs that Air Canada’s stock may be more positive than some pundits believe. The impact of the pandemic will be mitigated by Air Canada, sharply reducing costs by grounding most of its fleet, furloughing employees, cutting wages and reducing costs as well as capital spending.

Sharply lower fuel expense because of the oil price collapse will further cut operating costs for the foreseeable future.

The carrier also substantially boosted its liquidity, which saw Air Canada finish the first quarter with $6.1 billion of cash and short-term investors, 4% higher than at the end of 2019.

Canada’s flag carrier also recently closed a fully subscribed equity offering that generated gross proceeds of nearly $1.6 billion. That significantly boosted Air Canada’s cash buffer, liquidity and financial flexibility, markedly improving its ability to survive the current crisis.

Unlike its U.S. competitors, Air Canada has not received a government bailout. This provides an additional lever that can be used in an emergency to ensure Air Canada’s survival.

There are signs that air travel and tourism may recommence far sooner than anticipated. Many countries, notably in Europe, have begun reopening their borders. Others such as Colombia have flagged that tourism and international flights can recommence within the next three months.

While travel demand will remain low for some time, this bodes well for steadily increasing capacity and hence operating revenues.

Foolish takeaway

The latest developments coupled with Air Canada’s considerable liquidity and strong financial position explain why its stock spiked considerably over the last month.

While there are certainly significant headwinds ahead for the airline industry, Air Canada is one of the best positioned to emerge in solid-shape and return to growth. That makes Air Canada a top contrarian play for risk tolerant investors seeking outsized returns.