The CRA sent out GST/HST credit payments on July 3. For single individuals, the quarterly payment was $112.75. For married or common law couples, the quarterly payment was $148. Additionally, you can receive $38.75 for each child under the age of 19. Of course, the GST/HST credit is subject to eligibility criteria, which means that not everybody will receive this quarterly payment.

Furthermore, there is no way to predict what amount these payments will be in future years. Therefore, you might want to consider these three dividend stocks to create your own quarterly pay cheque. This will allow you to forget about the GST/HST credit and achieve predictable and growing quarterly income.

Toronto-Dominion Bank

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of the Big Five Canadian banks and has the largest exposure to the U.S. market. TD has built up a considerable retail presence in the eastern United States and now has more branches in the United States than in Canada. However, the majority of its earnings still come from its Canadian operations.

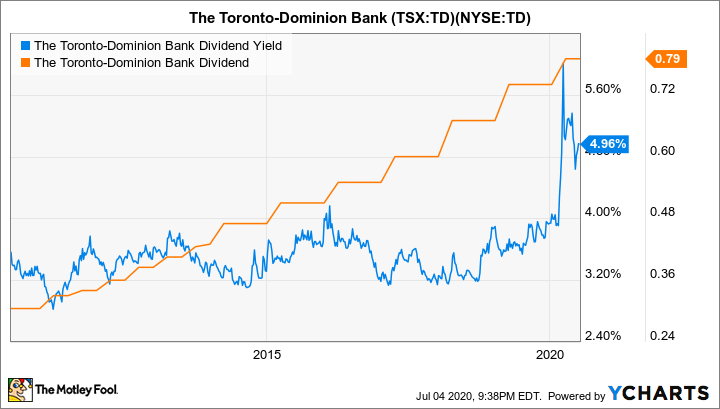

TD is one of my favourite dividend stocks because of its generous blend of high starting yield and a high dividend growth rate. TD currently yields around 5%. Prior to March, TD’s starting yield rarely broke above 4%. Therefore, locking in a 5% starting yield on TD is an attractive proposition.

The annual dividend growth rate has consistently been in the high single digits for the past decade, which means that quarterly dividend payments from TD are likely to increase in future. However, it’s unclear at this point whether TD’s dividend growth rate will remain this high in a post-pandemic world.

TD Dividend Yield data by YCharts

Telus

TELUS Corporation (TSX:T)(NYSE:TU) is one of the big three telecom companies in Canada. Telus also owns Koodo, which it operates as an independent brand, albeit uses the same network infrastructure. In addition to providing mobile, internet, TV, and phone connectivity to consumers and businesses, Telus also provides call centre solutions for business clients.

Furthermore, apart from telecom, Telus also owns Telus Health, which is primarily focused on providing IT solutions to the health care sector.

The quarterly dividend is currently $0.29125. Long-term followers of the stock may think this represents a dividend cut, since Telus was paying over $0.50 per share less than a year ago. However, Telus recently completed a 2:1 stock split. This explains the new dividend amount, which is good for an approximately 5% starting yield.

Telus has historically increased its dividend twice per year. Like TD, its annual dividend growth rate has also been in the high single digits for the past decade. There is less uncertainty about Telus’s ability to continue to raise its dividend at the current pace, as its business is far more insulated from the effects of the pandemic than is TD.

T Dividend Yield data by YCharts

Fortis

Fortis Inc. (TSX:FTS)(NYSE:FTS) is one of the leading electric and gas utility companies in Canada. Fortis also operates in the U.S. and the Caribbean, giving it a broad geographic presence. Fortis’s starting yield is around 3.5%.

Fortis is the only one of the three stocks that I’m focusing on that is not trading at the upper end of its dividend yield range over the past 10 years, as it’s a stable, reliable company with a solid dividend history. Fortis’s share price has therefore held up better than that of TD or Telus.

The starting yield therefore remains in the middle of Fortis’s dividend yield range over the past 10 years. Nonetheless, the starting yield is attractive.

Fortis has one of the longest dividend growth streaks in Canada, having raised its dividend for 46 consecutive years. Fortis has been able to maintain this dividend growth history with mid-single digit annual dividend growth for the past 10 years.

FTS Dividend Yield data by YCharts

Takeaway

| TD | T | FTS | |

| Quarterly Dividend | $0.79 | $0.29125 | $0.4775 |

| Number of Shares Purchased | 50 | 130 | 80 |

| Cost Per Share (as of July 3 close) |

$60.65 | $22.80 | $52.46 |

| Position Cost | $3,032.50 | $2,964.00 | $4,196.80 |

| Total Quarterly Dividend | $39.50 | $37.86 | $38.20 |

With just over $10,000 you can purchase 50 shares of TD, 130 shares of Telus, and 80 shares of Fortis. This three-stock portfolio will currently generate $115.56 of quarterly income. This roughly matches the current amount of the GST/HST credit for single individuals.

As the dividends from these companies grow, you should find yourself with quarterly paycheques that begin to make the GST/HST credit pale in comparison.