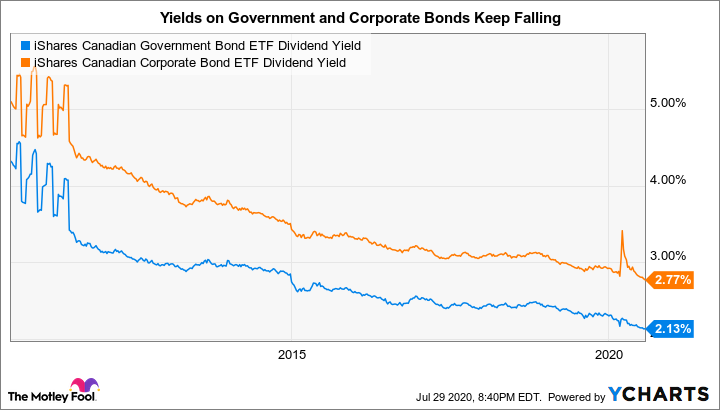

The past decade has been brutal for savers. As governments around the world continued to provide accommodative monetary and fiscal policy, savers and pensioners were hit especially hard.

As borrowing costs dropped to stimulate the economy, the yields on safe investments, such as government bonds, also dropped dramatically. It is still difficult to come across safe, predictable, and stable income investments that will allow you to grow savings at a respectable rate. However, these two bank stocks might be a good place to start.

XGB Dividend Yield data by YCharts

Royal Bank of Canada

Royal Bank of Canada (TSX:RY)(NYSE:RY) (“RBC”) is Canada’s largest bank and currently pays a quarterly dividend of $1.08 per share. RBC has not missed a quarterly dividend payment since the bank started paying dividends. However, RBC has frozen the dividend in the past. Most recently, RBC froze the dividend between 2008 and 2010 following the financial crisis.

While this may be troubling for pure dividend-growth investors, this is not necessarily problematic from an income perspective. The bank continued to pay shareholders and those who purchased shares in 2008 were rewarded with one of the highest starting yields that RBC shares have offered since 2000. After this brief hiatus, RBC raised the dividend again in 2011.

This makes RBC suitable for retirees, or soon to be retirees, because RBC has been through turbulent times in the past and has continued to send dividends to shareholders. Those who require bond-like income that will hold up well against inflation are likely to find that RBC stock is a good fit because of the high starting yield and the high-single-digit dividend growth rate that the stock offers.

Toronto-Dominion Bank

The Toronto-Dominion Bank (TSX:TD)(NYSE:TD) (“TD”) is the Canadian bank with the largest presence south of the border. The bank actually has more retail locations in the United States than in Canada. However, the bulk of TD’s loan exposure is still to Canadian clients.

TD has a large exposure to Canadian real estate. Just over 25% of TD’s loan portfolio is to borrowers in the real estate sector. This segment of the economy has held up surprisingly well in 2020. Residential real estate prices in major cities have recovered to pre-pandemic levels, and sales volumes are increasing as well.

TD pays a quarterly dividend of $0.79 per share. TD has traditionally been the Big Five bank that has had the highest dividend growth rate over the past decade. The dividend growth rate has averaged around 10% per year since 2010.

While it is too soon to quantify how the pandemic may impact TD’s dividend trajectory, the bank is well positioned to continue paying and increasing the dividend.

Takeaway

XGB Dividend Yield data by YCharts

The falling yields on safer investments have forced income investors into riskier assets. Common stocks are, by definition, riskier than bonds. However, investors should be confident in the ability of RBC and TD to pay and grow dividends given the stellar history of the two banks.

In a world desperate for safe high-yield investments, it may not get much better than RBC and TD.