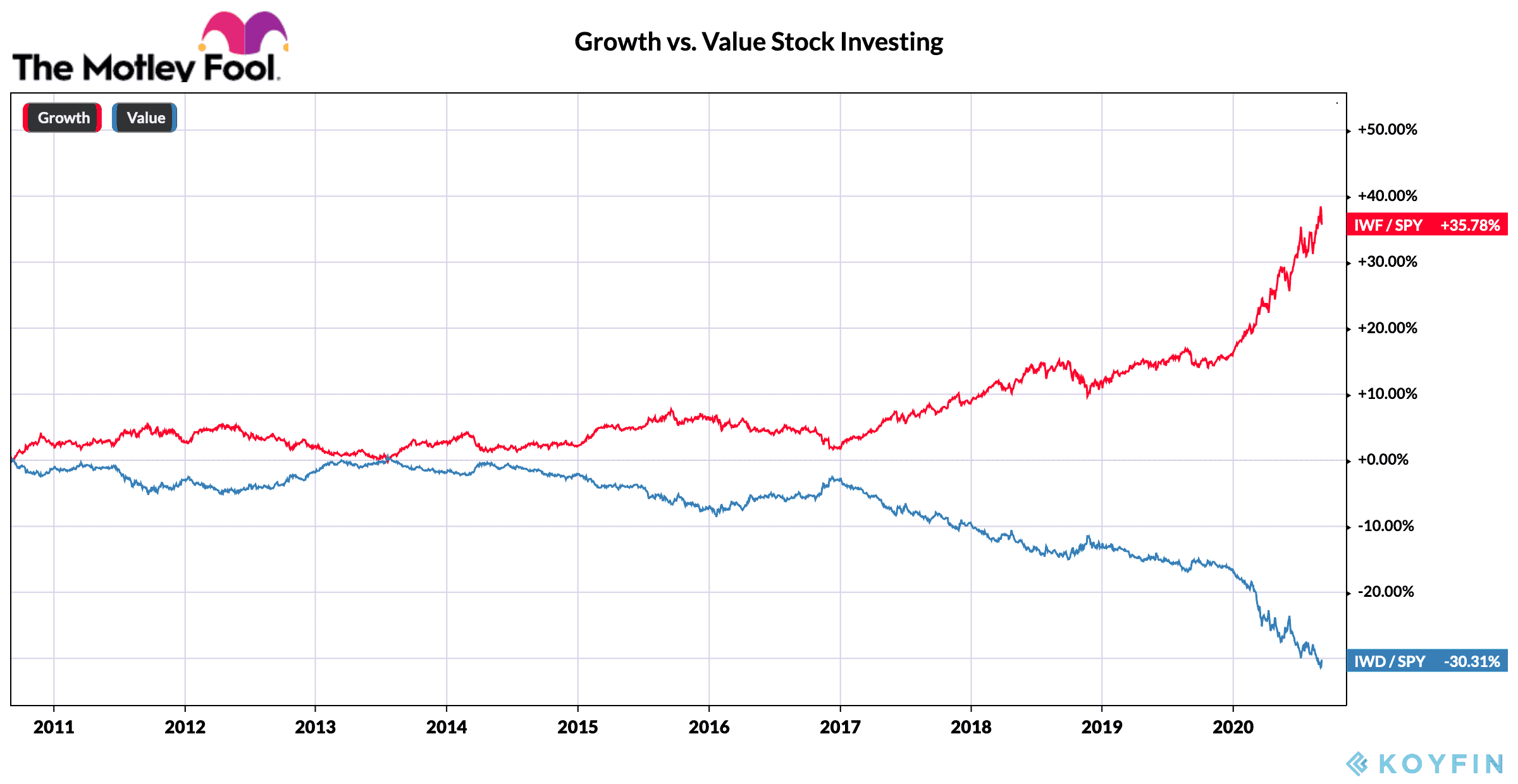

Growth and value stocks battle for your investing dollars all the time. The graph below shows the normalized performance between growth and value stock investing in the last 10 years. It clearly illustrates that growth stocks have been the winner as a group.

It seems that growth stocks, well, keep growing and climbing higher, while value stocks keep getting cheaper.

Will value stocks revert to the mean by rallying towards the 0% in the graph like it did in the past? My guess is that it will, but I don’t have a crystal ball to tell when that will happen.

Growth stocks can also revert to the mean, falling hard.

A notable observation is that both types of stock seem to hate sticking to the mean.

Are growth stocks a better buy for the next 10 years?

At the end of the day, whether to buy growth or value stocks depends on how you want to balance your stock portfolio and the future prospects of the individual stocks.

For example, some growth stocks are flying high from strong revenue growth but are trading at sky-high valuations. Then, there are other growth stocks that are increasing both revenues and earnings. OpenText is such a growth stock that’s reasonably valued.

I’d be concerned if I held an entire portfolio of growth stocks from the former group, which includes Shopify. At times, this group can experience huge selloffs of 30-50%. However, these are also exactly the type of stocks that can create serious wealth.

Look at how much Shopify stock has grown in merely three years!

Data by YCharts.

Some investors let their winners run. Others can’t stand having more than, say, 20% of their stock portfolio in one stock. In fact, fund managers definitely wouldn’t allow such a big allocation to one stock for risk management purposes.

Investors would allocate a small or large percentage of their stock portfolios to growth stocks, depending on their financial goals, investing styles, temperament, risk tolerance, and investment horizon. Each investor needs to decide what’s best for themselves.

Should you ignore value stocks?

As the first chart showed, value stocks have performed poorly against growth stocks since 2017. Should you then ignore value stocks altogether?

Again, it goes back to your financial goals and needs. Many value stocks also provide nice dividend income. If you need or prefer getting income as a part of your investing strategy, then it doesn’t make sense to ignore value stocks.

For example, I believe value stocks like the big Canadian bank, TD Bank, will deliver market-beating returns over the next five to 10 years while providing safe dividends. However, it would be impossible for it to beat the best growth stocks.

Many real estate investment trusts (REITs) with retail exposure are also value stocks that can deliver outsized returns and income over the next 10 years, as the COVID-19 pandemic problem resolves.

Check out H&R REIT for instance. It provides a safe dividend of close to 6.6% with a sustainable payout ratio of about 60% in today’s environment.

The Foolish takeaway

I believe investors can make tonnes of money with growth and value stock investing. What you invest in depends on your financial goals, investing style, risk tolerance, investment horizon, and preferred stock portfolio allocation. You’ll likely find that it’s a balancing act.

When you choose to invest in a growth or value stock, it comes down to studying each company closely to determine if it will be a winner within your investment time frame.