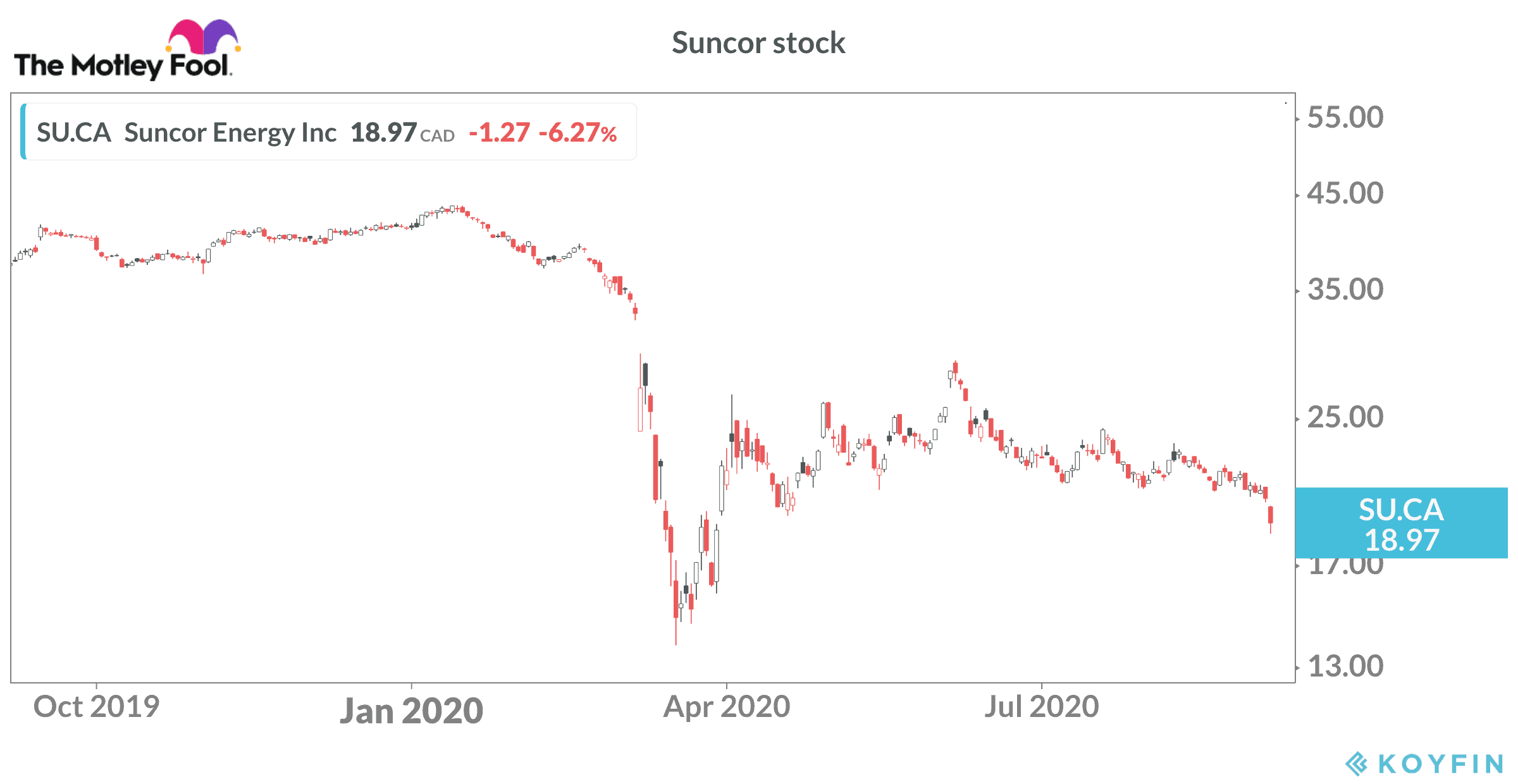

Suncor Energy (TSX:SU)(NYSE:SU) now trades below $20 per share for the first time since March. The stock started the year above $40, so investors with a contrarian style are wondering if there might be a 100% return on the horizon.

Oil market’s impact on Suncor stock

It has been a volatile year in the oil industry. WTI oil traded as high as US$64 per barrel at the beginning of 2020 shortly after the United States killed one of Iran’s top military people. The arrival of the pandemic then sent oil demand into a tailspin.

Traders bailed out amid fears the industry could run out of storage capacity. At one point in April, WTI futures actually went negative. Since then, oil has gradually moved higher, topping US$43 in late August.

In recent days, however, oil has sold off again. At the time of writing, WTI is down more than 8% on the day and trading just above US$36 per barrel.

What’s going on?

Saudi Arabia announced a priced cut over the weekend according to a report from Bloomberg. The OPEC leader reduced the price it will charge clients for October oil sales.

Back in April, OPEC and a handful of other key producing nations agreed to cut supply by roughly 10 million barrels per day to bring the market closer to a balanced position.

Suncor is Canada’s largest integrated energy company. It is best known for its vast oil sands production and reserves but also operates four large refineries that produce fuel. The marketing division then sells the fuel through the Petro-Canada retail locations.

With global economies reopening, the market originally anticipated steady demand growth for fuel. Now, it appears traders are not as confident in the recovery. COVID-19 cases are surging again in many developed markets, increasing the risk of additional lockdowns and extended travel restrictions.

Suncor production outlook

Suncor just updated its operational guidance for 2020. The market apparently doesn’t like the news. Suncor’s share price dropped as much as 8%, as investors digest the news.

Suncor had a fire at one of its sites in August. The resulting shutdown and measured restart will hit production numbers for Q3 and Q4. In addition, Suncor has decided to move up maintenance work at another key site, taking advantage of the weak market conditions to compete work originally planned fo 2022.

Full-year total production guidance is now set for 680,000-710,000 barrels of oil equivalent per day (boe/d). In July, when Suncor reported its Q2 2020 results, the company anticipated 2020 production of 740,000-780,000 boe/d.

Should you buy Suncor stock now?

The downstream operations, which include the refineries and gas stations, should benefit from the reopening of the economy. A quick look at all the new traffic around town in the past couple of months suggests people are buying gas. Air Canada and other airlines are slowly increasing capacity, but the recovery in the jet fuel market could take three to four years.

Ongoing volatility should be expected, and oil producers have an uncertain future over the long haul. Electric vehicles will eventually replace combustion engines. As such, you might not want to hold Suncor stock for decades.

That said, contrarian investors might want to take a medium-term position in Suncor at the current price. Once the global economic recovery kicks into overdrive, oil demand should rebound, and there is a chance we could see tight supplies in the next five to seven years.

Suncor cut its dividend at the start of the pandemic. The current payout should be safe offers a 4.4% yield, so you get paid well to wait for the rebound.