Canadian banks face a number of challenges connected to the COVID-19 pandemic. This has investors wondering which of Canada’s top banks deserve to be on their buy lists today.

Let’s take a look at Royal Bank of Canada (TSX:RY)(NYSE:RY) and Toronto Dominion Bank (TSX:TD)(NYSE:TD) to see if one stock is the best pick for your TFSA or RRSP portfolio.

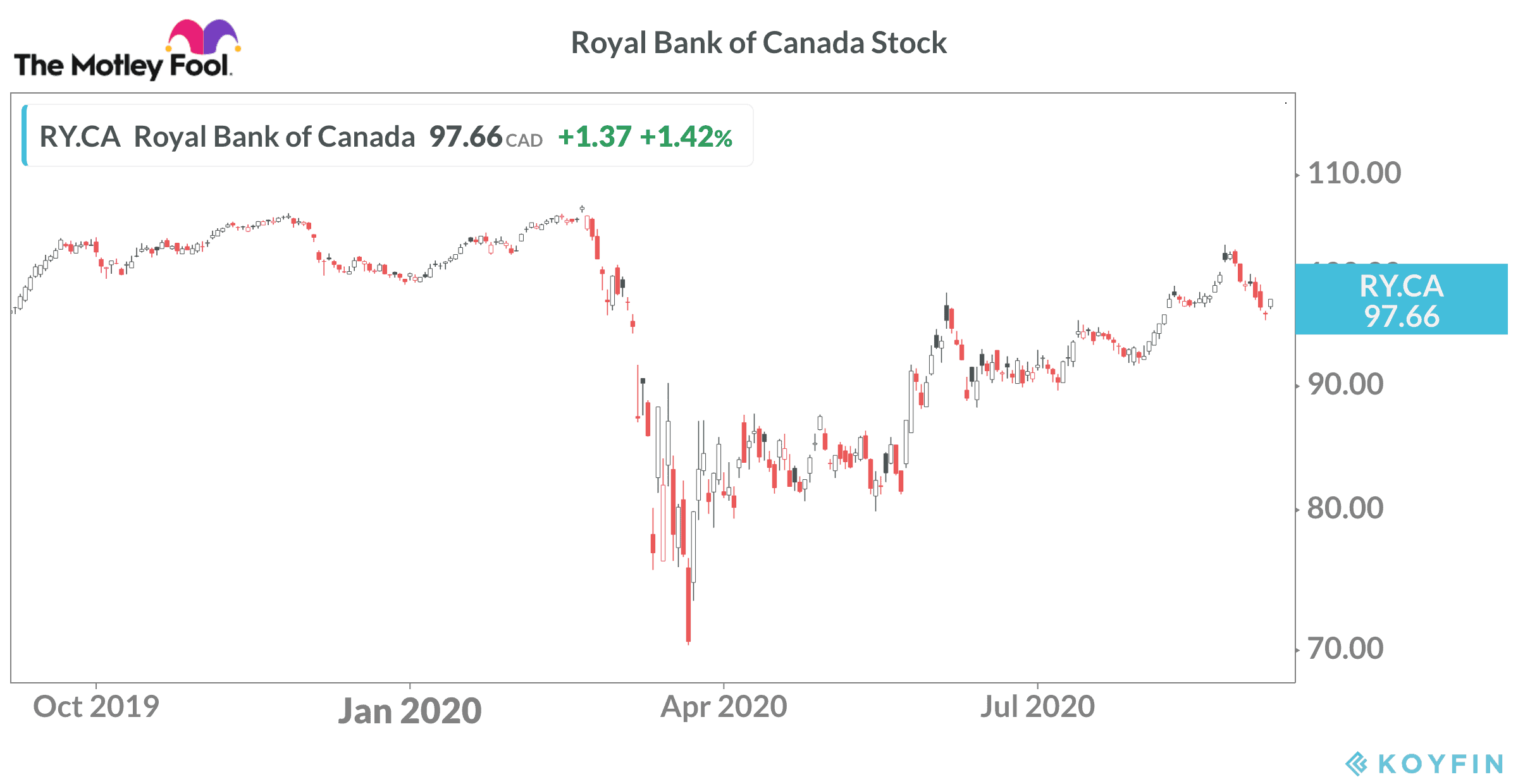

Royal Bank of Canada stock

Royal Bank is Canada’s largest financial institution based on market capitalization. In fact, Royal Bank sits in the list of the top 15 banks on the planet when measured by this metric. It is so large, the bank is deemed too big to fail.

Fortunately, Royal Bank is in good shape, and investors shouldn’t have to worry about the financial giant going bust.

Royal Bank’s profitability is the envy of most global banks. The company’s return on equity (ROE) for fiscal 2019 topped 17%. Even with all the provisions for credit losses (PCL) connected to the pandemic, Royal Bank still managed to generate $3.2 billion in net income for the three months ended July 31. ROE for the quarter came in at 15.7%.

Earnings gains in the capital markets and insurance groups helped mitigate hits in the personal and commercial banking and wealth management divisions due to higher PCL compared to last year.

Royal Bank’s CET1 ratio sits at 12%, meaning the bank is well capitalized to ride out the downturn.

The stock trades at 11.9 times expected earnings over the next 12 months. At the current stock price near $97, investors can pick up a 4.4% dividend yield. Royal Bank’s stock enjoyed a nice rally off the March low and now sits just 11% below the 12-month high.

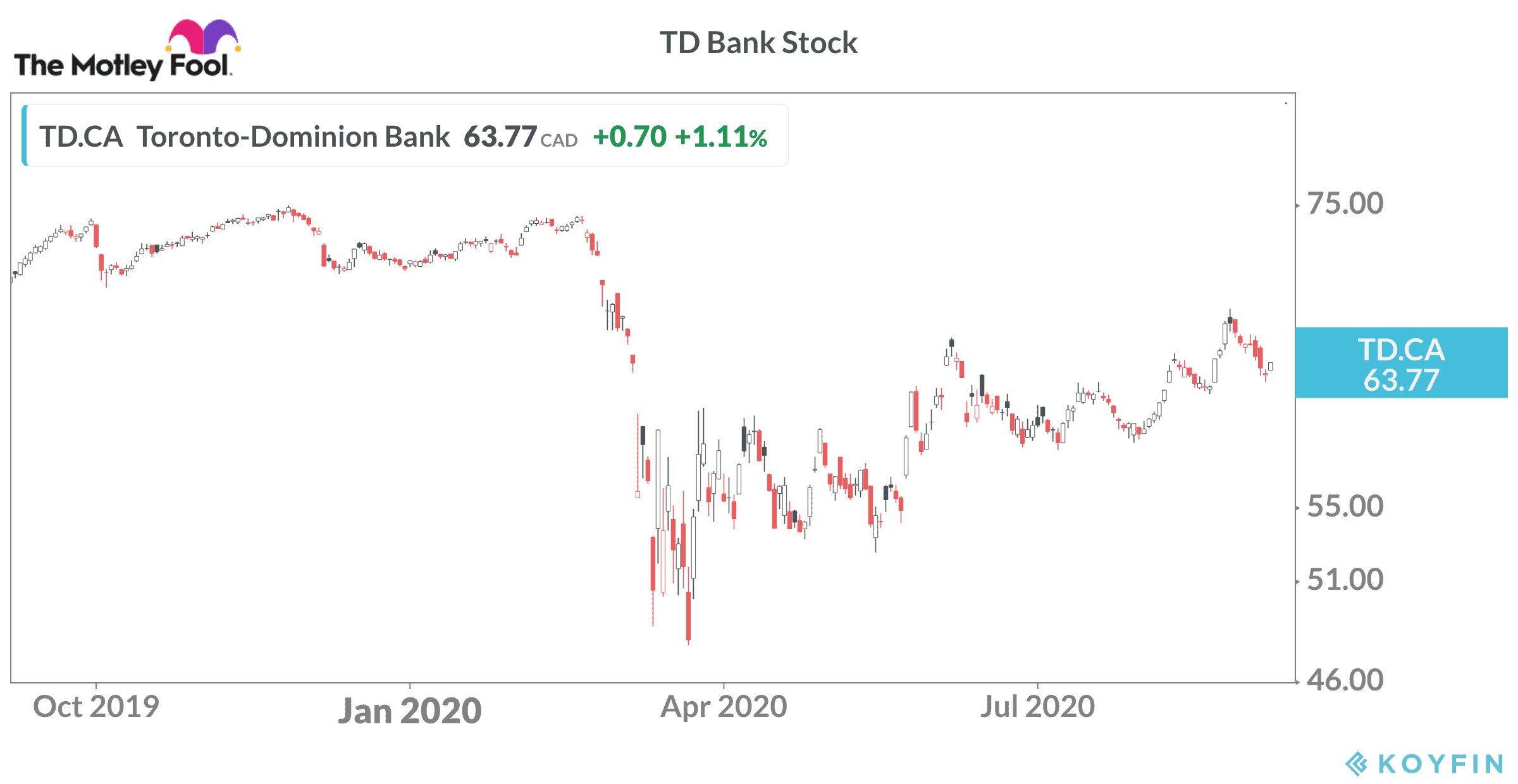

TD Bank stock

TD is Canada’s second-largest bank. Analysts often say TD carries lower risk due to its heavy focus on retail banking activities. The capital markets operations, for example, tend to have less of an impact on earnings that we see at Royal Bank.

The pandemic, however, is hitting personal and commercial banking results at all the top Canadian banks. TD is well known for its Canadian business, but it is also a major player in the United States.

TD’s large retail banking operations in the United States makes the stock attractive for investors who want decent exposure to the U.S. economy through a Canadian stock.

In the near term, the American group likely adds risk due to the size of the COVID-19 outbreak in the country. Most of TD’s American operations are located along the east coast from Maine down to Florida. New York took a big COVID hit early on but has managed the outbreak well. Florida is a different story.

TD reported $2.3 billion in adjusted net earnings for fiscal Q3 2020. That’s down from $3.3 billion in the same quarter last year and reflects the large increase in PCL. TD set aside $2.2 billion in the quarter to cover loans that might default. Royal Bank set aside $675 million.

The wealth management and wholesale banking groups had strong quarters. The personal and consumer banking operations in Canada and the U.S. continue to face pandemic headwinds.

TD’s CET1 ratio is 12.5%, so the bank remains well capitalized.

The stock trades at 11.5 times anticipated earnings for the next year. The slight discount to Royal Bank might be connected to the uncertainty on how the U.S. operations will fare in the coming months.

The stock provides a 5% dividend yield and trades 18% below its 12-month high.

Should you buy Royal Bank or TD stock today?

Royal Bank and TD are both top stocks to add to a TFSA or RRSP portfolio.

If you only buy one, however, I would probably go with TD today. The stock might carry more near-term risk, but TD offers a better dividend yield right now and the share price could outperform Royal Bank over the next 12 months.