September has seen huge selling activity in the stock market. The TSX Composite Index fell 4.3%, driven by significant dips in tech stocks. The iShares S&P/TSX Capped Information Technology Index ETF fell by 8.7%. On September 9, the market rose after three days of correction, but Lightspeed POS (TSX:LSPD) fell another 4%, pulling the stock down 15.5% from its all-time high. Should you buy this stock at $40.8?

The stock price momentum

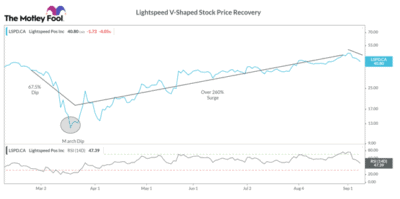

Before I answer this question, you should look at the stock’s momentum this year. It fell by 67.5% in the March sell-off and then made a full V-shaped recovery by growing more than 260% between April and August. The stock continued to surge and made a peak at $48.3 on September 1 before the market correction began. Lightspeed stock’s 15% decline had nothing to do with the company’s fundamentals or growth potential.

I will dive a little into the stock’s technicals. Lightspeed stock became overbought because of its August rally. Its Relative Strength Index (RSI) crossed the overbought mark of 70 in late August. When a stock is overbought, either the high price becomes the new normal or the stock price sees some correction. The last four days of selling activity saw investors cashing out on their profits, putting the stock back to normal trading activity (RSI of 47).

Even after the 15% decline, the stock is still trading above its 50-day moving average, which shows that it is still in the growth spree. At this point, the stock could fall for another day or two (until it is oversold with an RSI of 30-35) before it returns to growth. It is difficult to time the lowest price in a dip. But it is a win if you can buy the stock near its dip.

Once the stock returns to growth, it could rise by 8% to its normal trading price of $44 or even surge 18% to its all-time high. As Lightspeed is in its early stages of a growth stock, there is a possibility that it could make a new high.

The bull case for Lightspeed

I became bullish on Lightspeed after its remarkable turnaround during the pandemic. Its strategic changes in its omnichannel platform made it a stock that would thrive in the post-pandemic economy. The stock dipped 67.5% in the March sell-off as its point-of-sale (POS) solutions were targeted at physical stores. Its business model helped retailers and restaurants manage multiple retail locations on one platform.

This model would have not survived in the pandemic-driven lockdowns where many retail outlets were closed. The physical store footfall diverted to the online store. Lightspeed saw growing momentum in e-commerce volumes. Hence, it tweaked its platform to converge online and physical stores in a better way.

Like Shopify, Lightspeed introduced features such as e-commerce stores, curbside pick-up, shipments, online payments, and online appointment booking. These features helped retailers integrate their inventory, payments, purchases, and marketing of both physical and online stores on a single platform. This saw an uptick of its platform among retailers. By June end, it increased its customer locations to 77,000 from 75,500 in April, despite the huge churn rate.

Lightspeed has also introduced eCom for Restaurant. Its new Bon Appetit theme enables customers to reserve table and order food online, and help restaurants manage orders and deliver food. Lightspeed is seeing a recovery in the restaurant segment.

The COVID-19 pandemic has permanently altered the hospitality and retail industry. Lightspeed’s platform is preparing its customers for the post-pandemic world.

Valuing Lightspeed stock

Lightspeed is increasing its revenue at a CAGR of over 50%. The company still depends largely on new customer acquisitions for its revenue growth from subscriptions. However, a surge in transactions is significantly increasing its gross transaction volume. The new features are increasing its commission earned per transaction.

The recent dip in Lightspeed stock has reduced its price to 15.8 times its next 12 months sales per share. This is an attractive valuation for a stock that is growing its revenue by 50%. If you haven’t yet exhausted your Tax-Free Savings Accounts (TFSA) limit, buy Lightspeed stock with that amount now.