There has been a lot of press focused on gold with this economic downturn. While gold certainly has its merits, the other metal many are forgetting to discuss is silver. Silver stocks continue to outperform the market and have also given gold a run for its money.

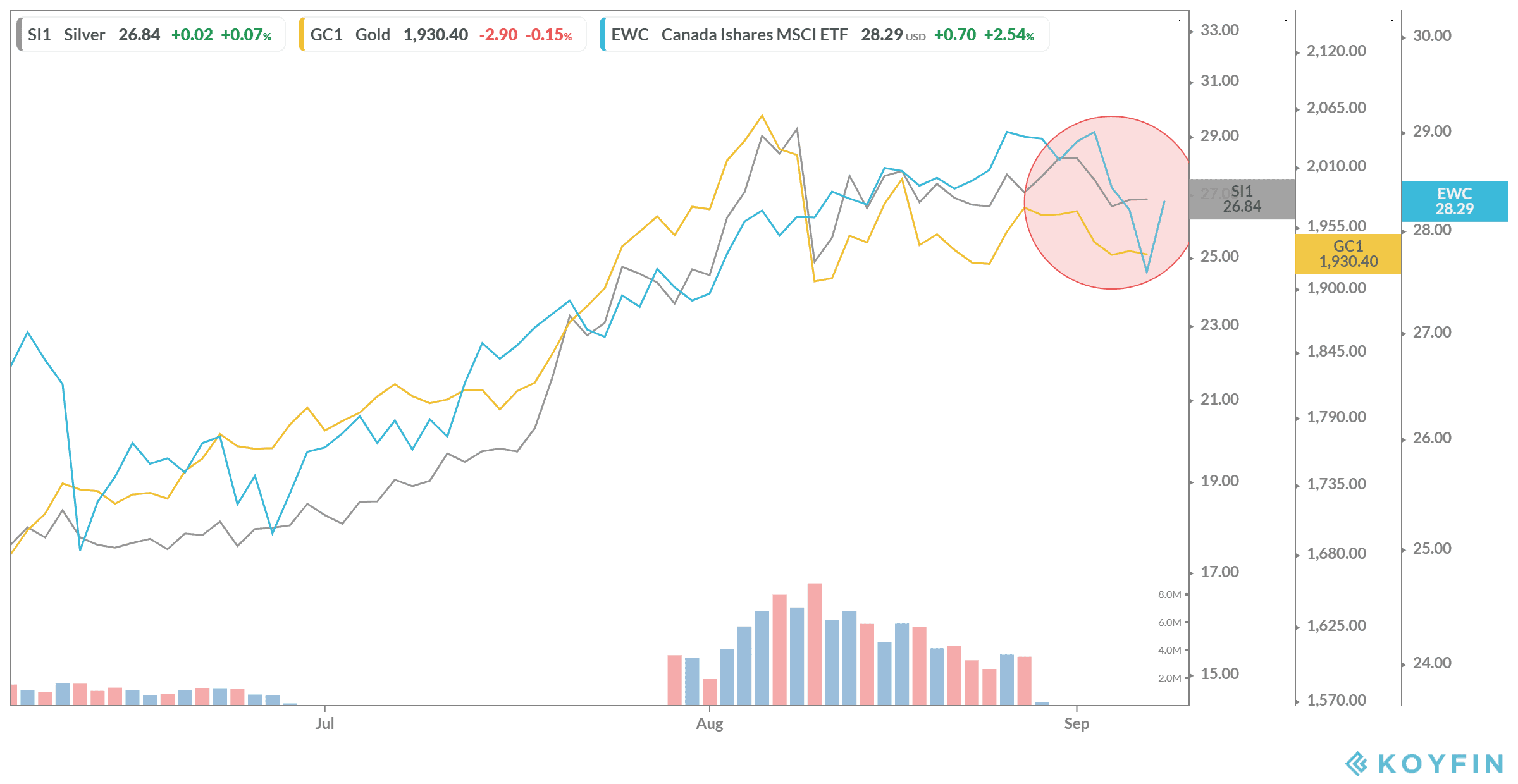

As you’ll see below, during the last three months, silver caught right up to the Canadian market performance and to gold as well. But in the last little while, silver outpaced both. In fact, during the most recent downturn, silver outperformed both gold and the Canadian market. In fact, since the crash, silver has rebounded by almost 125%, while gold is only up 33%. Looking at a year return, gold gave investors 27% as of writing, while silver is at a whopping 48%.

The reason? Silver isn’t just used for products; it’s used for a wide range of industries. The stock provides investors with an incredibly safe place to hold their cash until the market cools down. The best news is that many of these companies offer fairly cheap stock prices, especially compared to gold and streaming companies.

So, if you’re thinking of getting into silver, what companies should you look into? Luckily, I’ve got two that should fit just right into any portfolio.

Pan American Silver

If you’re looking for a great return, it doesn’t get much better than Pan American Silver (TSX:PAAS)(NASDAQ:PAAS). The company is at a 99% return in the last year, with a five-year CAGR of 40% as of writing and a P/E ratio of 20.9 times for the next year.

The company is certainly one of the world’s biggest silver producers, with mines mainly in Canada and Latin America. While this makes it one of the pricier picks, it’s still less than a lot of gold streaming companies. As of writing, shares still sit at about $46.

The company continues to beat analyst expectations, and with its next earnings report in the next two months, it could be a great time to get in before the company announces even more great results. This stock alone could be the perfect defence against the next stock market crash.

Silvercorp Metals

If you’re really looking to make a killing without spending a lot, then Silvercorp Metals (TSX:SVM)(NYSE:SVM) is your best bet. The company trades at heights not since in the last decade, after making a large fall during the market crash. The company has a one year return of 94% as of writing, with a five-year CAGR of 64% and a P/E ratio of 30.1 times for the next year.

While it may not be the world’s largest producer, it is China’s largest producer of silver. While it’s true that trade tensions could affect this stock, the company doesn’t seem worried. Before the crash, Silvercorp even went so far as to buy back shares in mid-March when prices were at the weakest point.

As the company continues to drill and explore, it’s highly likely that investors will see great things from this company. Again, with earnings in the next two months, its a great time to buy up this stock before it soars.