Top high-yield stocks come with more risk than GICs, but the return spread between high-quality Canadian dividend stocks and fixed-income today makes dividend stocks appealing for a TFSA or RRSP.

Why BCE is a top stock for dividends

BCE (TSX:BCE)(NYSE:BCE) trades near $56 per share at the time of writing and offers investors a solid 6% dividend yield. The stock has been an anchor holding for income investors for decades, and that should continue to be the case.

BCE is Canada’s largest communications company. It has a wide competitive moat and can raise prices when it needs extra cash. The world-class wireline and wireless network infrastructure showed its value in recent months, as million of Canadians worked from home.

The stock is down from $65 earlier this year. The drop is connected to BCE’s media group, which took a hit from all the pandemic lockdowns. Advertising revenue is down and the sports teams saw their seasons put on hold. The recent return to play occurred in empty arenas and stadiums.

It will take time, but the media operations will eventually get back to normal.

BCE’s stock tends to perform well when interest rates are stable or moving lower. The U.S. Federal Reserve and Bank of Canada will likely keep rates at record-low levels for the next few years.

Growth should be slow and steady to support average annual dividend increases in the range of 5%. The stock could easily drift back to the $65 mark by the end of 2022.

Why Pembina Pipeline stock is attractive today for dividend investors

Pembina Pipeline (TSX:PPL)(NYSE:PBA) has a 65-year track record of growing its presence in the Canadian and U.S. energy infrastructure sector.

The company’s attraction lies in its diversified assets all across the hydrocarbon value chain. Pembina operates gas and liquids pipelines to help producers get their product to market. In addition, Pembina has gas gathering and processing, logistics, and other gas liquids projects, including export terminals.

Pembina reported solid adjusted cash flow from operating activities in Q2 2020. Management took steps in the first half of the year to make sure Pembina has the liquidity to ride out the pandemic and the downturn in the energy sector. The dividend should be safe and offers a yield of close to 8% right now.

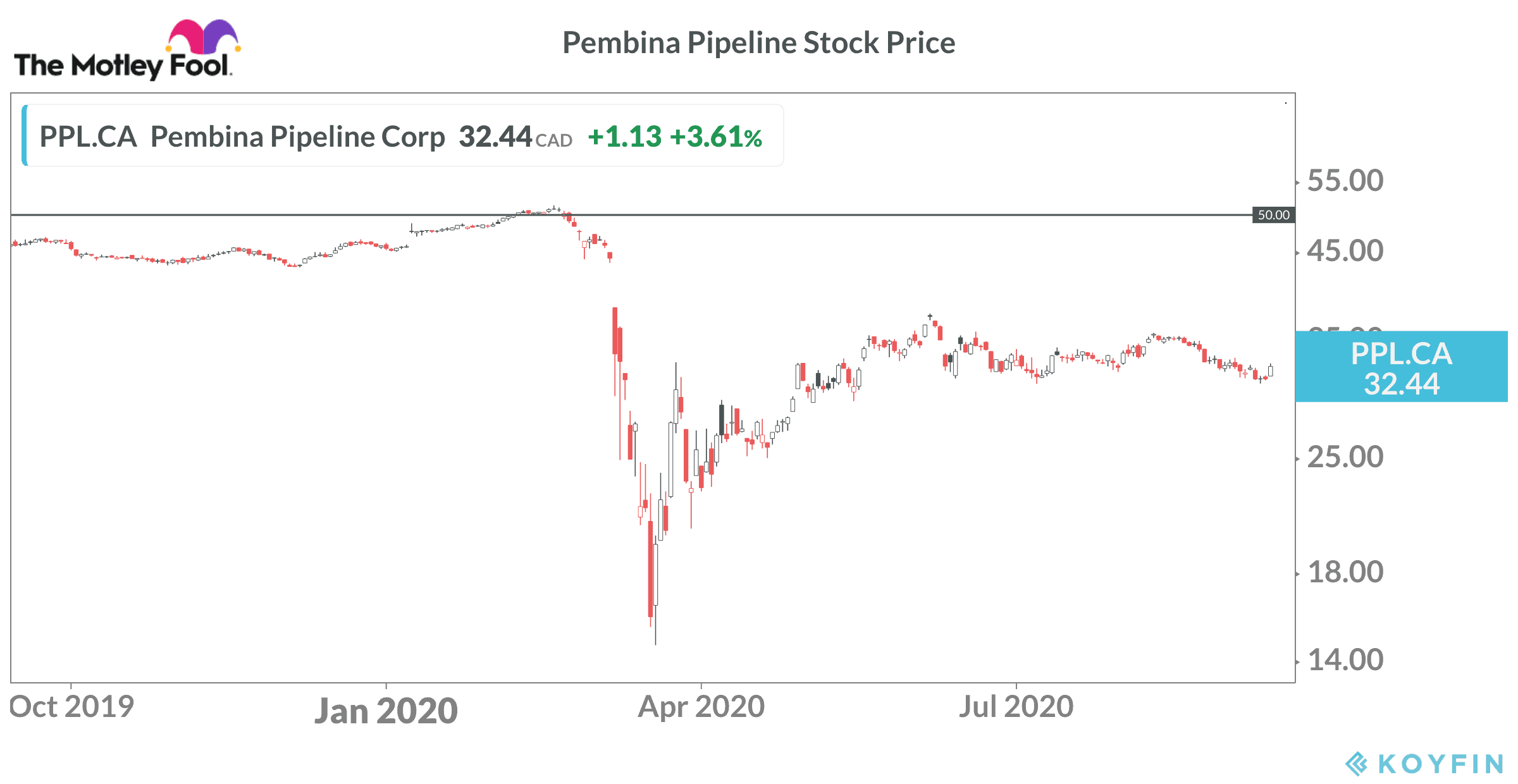

The stock trades around $32 compared to $53 in February, so there is significant upside potential when the energy sector stabilizes. The huge move in the share price also shows the volatility that can occur. As a result, investors have to be comfortable riding out the challenging times.

At this point, however, the downside should be limited.

Pembina has a market capitalization of about $18 billion. That makes it large enough to do opportunistic deals in the current environment. It is also small enough that the company might become a takeover target for one of the energy infrastructure giants.

The bottom line

BCE and Pembina pay above-average dividends that should be safe. The stocks appear oversold today and offer great yields with a shot at decent capital gains in the next five years.

Investors who prefer a more conservative pick that allows them to sleep well at night should probably make BCE the first choice.

If you can handle the added volatility, Pembina appears very attractive right now for both the yield and the upside potential in the share price.