Right now is the perfect opportunity for investors looking to get rich. There are plenty of stocks that stand to make huge gains in the coming months, and even more if you have a long-term hold. But one of the best options is with a dividend stock — especially a solid stock like Brookfield Property Partners (TSX:BPY.UN)(NASDAQ:BPY), which has a sky-high dividend yield as of writing.

Within the real estate sector, there isn’t a more attractive dividend stock out there than Brookfield. If you’re making changes to your portfolio, this one alone could be the difference to bring you to riches in the next few months. But if you’re holding on long term, there is an even greater chance that Brookfield could bring you wealth.

Growth projects

When you’re looking at real estate, you want diversity. That diversity will make or break a company during a downturn such as the one we’re undergoing right now. If you’re mainly in retail, it’s going to hurt when customers can attend your properties. If you’re in hospitality, same problem. But if you’ve spanned a mass of properties, then you should come out relatively unscathed.

Such is the case for Brookfield. The company has properties in office, retail, industrial, hospitality, self-storage, and student housing. But the part I want to focus on for this dividend stock is its developing markets.

First off, you have to understand that although Brookfield Properties has been around since 2013, it is owned by Brookfield Asset Management. This company has been around since 1899! So, before you go thinking this is a new stock without much history, think again. It’s backed by a huge company with tons of cash on hand to make investments.

These investments include the developing markets I referred to. As soon as it was created, Brookfield Properties started buying. It’s bought a stake in Shanghai, a portfolio of office parks in India, office buildings in Brazil, 1.5 million square feet of office and retail space in Dubai, and an acquisition of high-rise office towers, a mall, and a hotel in South Korea.

While the pandemic has put a damper on further expansion, the company’s many assets have been able to handle any losses incurred. In fact, going forward, economists predict the company will rebound strongly. By 2022, earnings per share should increase a whopping 3,600% year over year once the world returns to normal.

Dividend growth

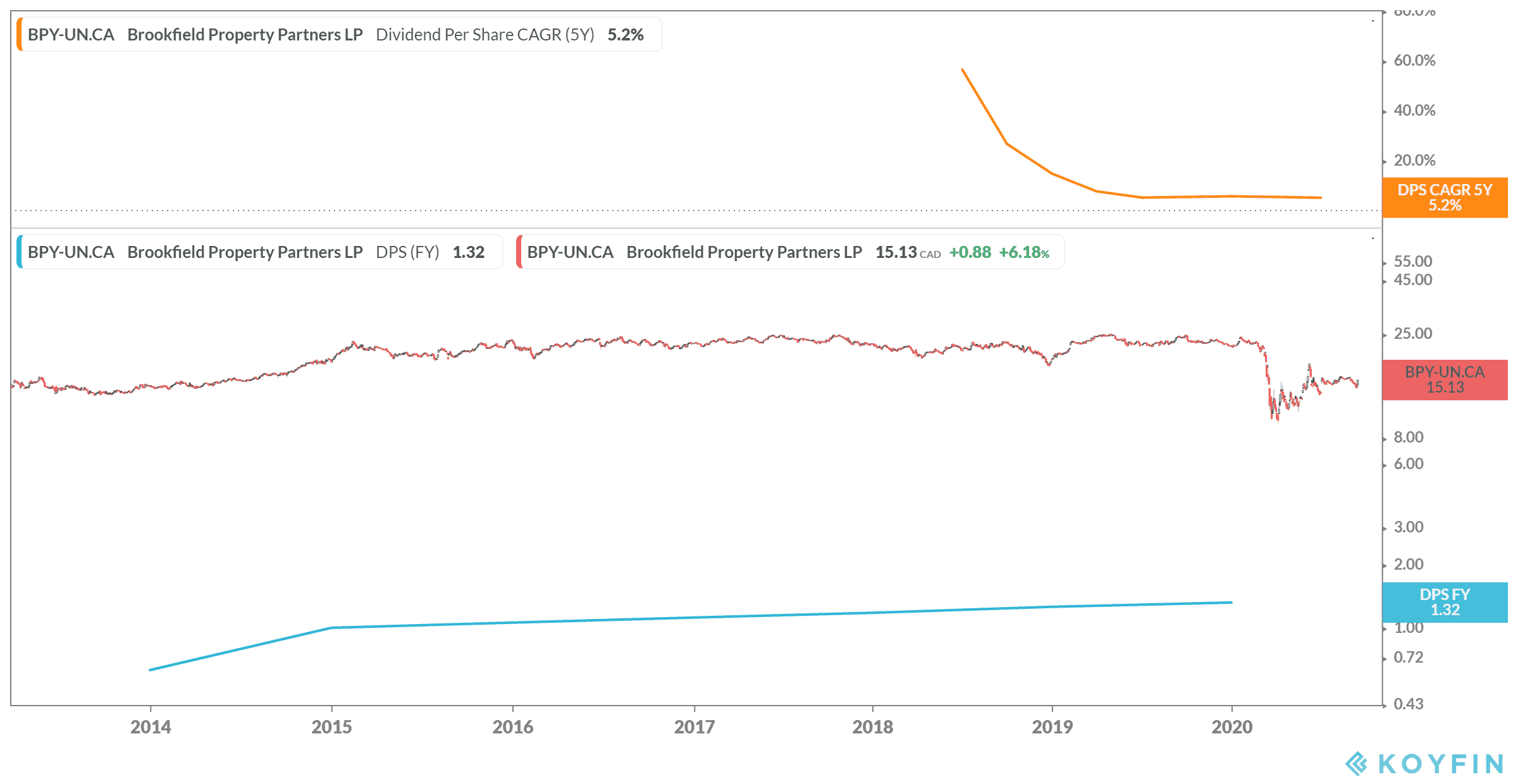

Although it’s only been around for six years, the company has already seen massive dividend growth. Since 2014, when dividends became available, there has been 32% growth to where dividends are now. That’s a compound annual growth rate (CAGR) of 5.2% for the last five years.

Again, given the diverse portfolio this company has, it looks like a perfectly safe investment for those looking to bring in income for the short and long term.

Get rich

As you can see from above, the one thing this stock is now working on for investors is its share price. It was relatively steady over the last several years until the crash back in March. Now, shares are at a level not seen since the beginning.

If you’re an investor looking for a stable stock that has plenty of assets to fall back on, then Brookfield Properties is the stock for you. The company has a wide range of properties to keep bringing in cash, and that should really speed up now that businesses are opening again. Simply to reach pre-crash levels, investors could be looking at a potential upside of 80% at writing!

That means using half your TFSA for investment today would bring in 2,317 shares rather than 1,287 and turn that $34,750 into $62,559 in just a few months. Meanwhile, you’ll receive an incredible 12.21% dividend yield right now! That’s annual income of $4,008.41!

If you reinvest those dividends for the long term, that’s how you get rich. In 25 years, that could turn your original investment into an incredible $1,106,075.85!