The tech stocks are under pressure this month amid the concerns over their high valuations and shift in investors’ focus toward value stocks. Meanwhile, the pandemic has fastened the digitization process. More people are choosing to work, learn, and shop from their homes amid health concerns. This favorable shift towards digitization has created a strong demand for products and services of tech companies, which could sustain for years to come.

So, I believe long-term investors should utilize the recent correction to accumulate these tech stocks for higher returns.

Lightspeed

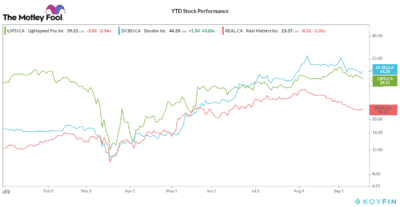

Lightspeed POS (TSX:LSPD) has been a turnaround story of this year. Amid the pandemic, all non-essential businesses were closed. So, the company, which delivered point-of-sale services to physical stores, witnessed its stock price decline by over 70% during March.

However, the company shifted its business model to focus on delivering omnichannel solutions to aid small- and medium-scale businesses to take their shops online. This shift helped the company to increase its customer base despite a higher churn rate. Its revenue also increased by over 50% in its recently completed first quarter to $36.2 million, with over 90% of it coming from recurring sources.

Meanwhile, the company’s omnichannel solutions, which has augmented the physical stores with online and digital strategies, has created a long-term tailwind. This month, the company has also raised over US$330 million from an IPO in the United States. The company plans to strengthen its balance sheet and fund its growth strategies from the proceeds. Thus, given its strong growth prospects, I believe the company could deliver impressive returns over the next three to five years.

Docebo

Second on my list is Docebo (TSX:DCBO), which currently trades over 24% lower from its 52-week high. Despite the recent pullback, the company has returned over 160% for this year.

The outbreak of COVID-19 has increased the utilization rate of its platforms, driving its revenues. For the recently completed second quarter, its revenue grew by over 46.5% on a year-over-year basis, with its recurring revenue contributing over 92%. Further, its customer base and average contract value grew by over 20%, which is encouraging.

Meanwhile, the company was doing well even before the pandemic. In the last three years, its annual recurring revenue grew at a CAGR of 69%, while its contract value expanded by 2.7 times. Currently, North America is its primary market, contributing 79% of its revenue.

The learning management solutions market could reach US$14.6 billion by 2023. The company therefore has a significant opportunity for expansion. Given its strong growth prospects, Docebo’s stock price could easily double over the next three to five years.

Real Matters

The low interest-rate environment has caused a surge in refinancing activities, benefiting Real Matters (TSX:REAL), which services mortgage lenders and insurance companies. In its recent quarter, its net revenue increased by over 52%, while its adjusted EBITDA grew by over 100%. Its nationwide presence and healthy relationship with field executives provide the company with a competitive edge over its peers.

In the first three-quarters of this fiscal, it has added 11 new clients in each of the title and appraisal divisions. With the surge in refinancing activities, many lenders are facing scalability and performance issues with their existing vendors. So, Real Matters, with its competitive edge, is well positioned to acquire new clients and expand its market share.

The company’s management projects its total addressable market to be at US$13 billion. So, with analysts expecting the company’s fiscal 2020 revenue to come in at US$425.7 million, it has significant scope for expansion.

The recent fall in its stock price has dragged Real Matters’s valuation levels into an attractive territory. Currently, the company trades at a forward EV-to-sales multiple of 2.7. Given its impressive growth prospects and attractive valuation, I am bullish on the stock.