You might be worried about the recent stock market pullback and wonder what you should do with your stocks. It’s possible to prepare your portfolio for a market crash.

The fall has always been a time of volatility for stocks, especially in 2008 as the global financial crisis unfolded. Stocks started to fall over the summer, but it was after Labour Day that the stock market hit bottom.

Fall 2020 could be the most difficult period to anticipate in years for investors. The combination of a dramatic summer boom for stocks, especially tech stocks, and the risk of a second wave of COVID-19 make it harder for the market to rally higher. The economy is still recovering from the first round of the pandemic and a new lockdown would be a huge setback.

Here are some ways to prepare your portfolio for a market crash.

Increase your cash allocation if you are retired

Take some profits off the table from stocks that have skyrocketed and use the proceeds to expand the cash portion of your retirement portfolio. This is especially relevant for seniors who wait until the end of the year to make their mandatory annual withdrawal from a registered retirement income fund (RRIF). You wouldn’t want to be forced to sell stocks that have lost value after a market crash. You have a reasonable level of cash if you can fund two to three years of RRIF withdrawals with it.

Shift to a more conservative investment approach

One way to reduce the risk level of your portfolio is to start investing money in a more diversified and conservative portfolio. An easy way to do this is to buy a balanced exchange-traded fund with an appropriate mix of stocks and bonds. There are conservative, balanced, and growth versions of these ETFs, all with variable asset mixes and low fees.

Keep a portion of your investments account in cash to buy during a market crash

As we saw in April and May, the stock market can bounce back in no time after hitting bottom. So forget about trying to time the next stock market low. Instead, pour cash into your investment account now and use it to strategically buy during the market’s worse days. Cash balances in brokerage accounts don’t pay interest, but you must have cash on hand to be ready to buy when the market rebounds.

Create a stocks shopping list for the next market crash

Create a watch list of stocks that you are ready and willing to buy when the price gets low enough or the dividend yield gets high enough. Know what you want to buy before the market crash begins.

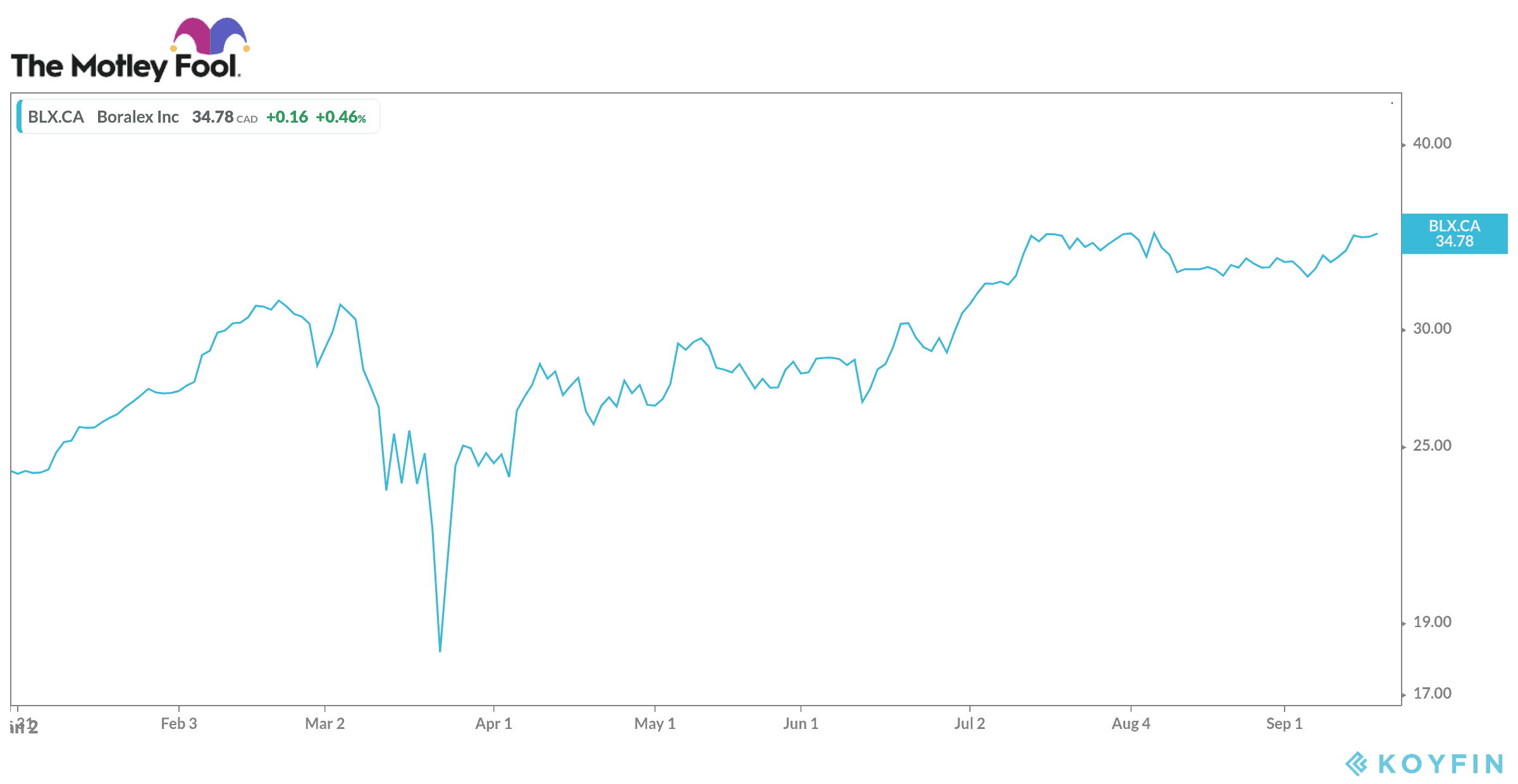

A great stock that you may want to add to your list is Boralex (TSX:BLX).

Boralex develops and operates renewable energy production facilities (wind, hydroelectric, thermal, and solar) in Canada, France, and the northeastern United States. The majority of the company’s production comes from wind energy.

This stock has defensive attributes, has a solid growth profile, and provides reliable income. With a beta of 0.7, it is less volatile than the market, so it should fall less during a market crash. It was also the best performing stock in the S&P/TSX Utilities Composite Index this year. Year-to-date, the share price is up nearly 45%.

The company has a conservative payout ratio, which suggests that its quarterly dividend is sustainable with room for growth. The current dividend yield is 2%. The company recently completed a public offering, which could lead to future growth opportunities – a potential short-term catalyst for the stock.

If you buy Boralex in your TFSA, you won’t have to pay taxes on its share price appreciation and the dividends you receive.