BlackBerry Ltd. (TSX:BB)(NYSE:BB) stock is trading in majorly undervalued territory. Despite the fact that there are many good reasons to buy this stock.

The amount of growth that we can expect from this technology leader is significant. Secular, long-lasting trends will drive this growth. Trends such as the increasing digitization of the economy. And trends such as increased automation of cars. Machine-to-machine interconnectivity is the future.

Here are the three reasons that undervalued BlackBerry stock is a big opportunity today.

BlackBerry stock is undervalued on many valuation metrics

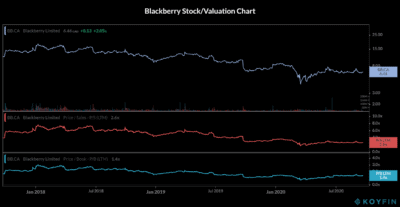

BlackBerry stock is deeply undervalued. It is trading just above book value, at 2.7 times sales, and at only 1.4 times book value. The chart below shows BlackBerry’s stock price over the last three years (in the upper portion). The graph also shows BlackBerry’s price to sales multiple in the center. And finally, it shows BlackBerry’s price to book multiple in the lower part of the chart.

To drive this point home, let’s consider BlackBerry’s business. It is a business that has potential for long-term, significant growth. Read on as I review the significant growth that’s in BlackBerry’s future. This will illustrate the fact that BlackBerry stock is, in fact, a deeply undervalued stock.

BlackBerry’s cybersecurity business is in high demand

BlackBerry will benefit greatly from where the world is heading. In this pandemic, the digitization of every facet of life has been accelerating at light-speed. And with this comes the need for security. Leading industry organizations consistently recognize BlackBerry as a leader in cybersecurity.

BlackBerry’s unified endpoint management (UEM) and unified endpoint security (UES) systems make up its cybersecurity assets. These systems have recently received growing acceptance worldwide. They have met the worldwide security standard, recognized by 31 countries. They have also achieved NATO restricted level certification. These are huge strides forward for BlackBerry in the growing cybersecurity market.

The cybersecurity business is on the cusp on significant growth. BlackBerry is positioning itself to be part of this growth. In the company’s latest earnings release, CEO John Chen had a very interesting quote. BlackBerry is seeing “good demand for BlackBerry’s security, business continuity, and productivity solutions.” This is a function of “an increasingly remote working environment”. It is only a matter of time until Blackberry stock begins to reflect this.

Research suggests that the global cybersecurity market will grow steadily. ResearchAndMarkets expects is to grow from $149 billion in 2019 to $210 billion in 2023. In the short-term, the coronavirus pandemic has negatively impacted near-term growth. But the longer-term secular growth trend remains intact.

BlackBerry stock: thanks to BlackBerry, cars are becoming more and more connected

Autonomous cars may be at least a decade away. But cars are quickly becoming equipped with BlackBerry’s technology. BlackBerry QNX is at the forefront of transforming automobiles. Many of the connected systems today incorporate BlackBerry’s technology. And autonomous vehicles tomorrow will surely include BlackBerry’s technology.

BlackBerry’s software has been used in cars for a while now. For example, in infotainment systems, acoustics, and dashboard functions. This history has allowed BlackBerry to learn and grow. Thus, the company has expanded the software’s expertise. It now includes more advanced technologies such as Advanced Driver Assistance Systems. These systems enhance driver performance. They automate functions, give warnings and intervene when necessary.

The coronavirus pandemic shutdowns decimated the auto industry. But the future for connected cars remains bright. The global market size is widely expected to increase threefold in the next five years. In 2020, the market was valued at more than $60 billion. By 2025, it is expected to be more than $180 billion.

Foolish bottom line

BlackBerry stock price is on the cusp of breaking out. Cybersecurity and connected cars will grow significantly over the long-term. These are secular trends that are accelerating. BlackBerry is proving to be a leader in both of these industries. Its undervalued state right now does not do it justice. It doesn’t reflect any of the significant growth coming to BlackBerry’s businesses.