Telemedicine is hot and will stay strong for years. Evidence from a four-month pandemic in North America, when telemedicine was forced upon us, suggests that most patients find it as good, if not better, than in-person visits. Going to the doctor takes time and logistical preparation and incurs additional expenses. A half-hour date can turn into a much longer ordeal. CloudMD Software & Services (TSXV:DOC) is ideally positioned to grow rapidly in the field of telemedicine and potentially be acquired. CloudMD stock has a market cap of $233.5 million.

The telehealth company is revolutionizing the delivery of healthcare by giving patients quick and easy access to all aspects of their care via phone, tablet, laptop, or desktop.

Cloud MD offers SAAS (software as a service)-based health technology solutions to medical clinics across Canada and has developed proprietary technology that delivers quality health care through the combination of connected primary care clinics, telemedicine, and artificial intelligence (AI).

The company currently provides services to 376 clinics in eight provinces, over 3,000 licensed practitioners, and nearly 3 million patients.

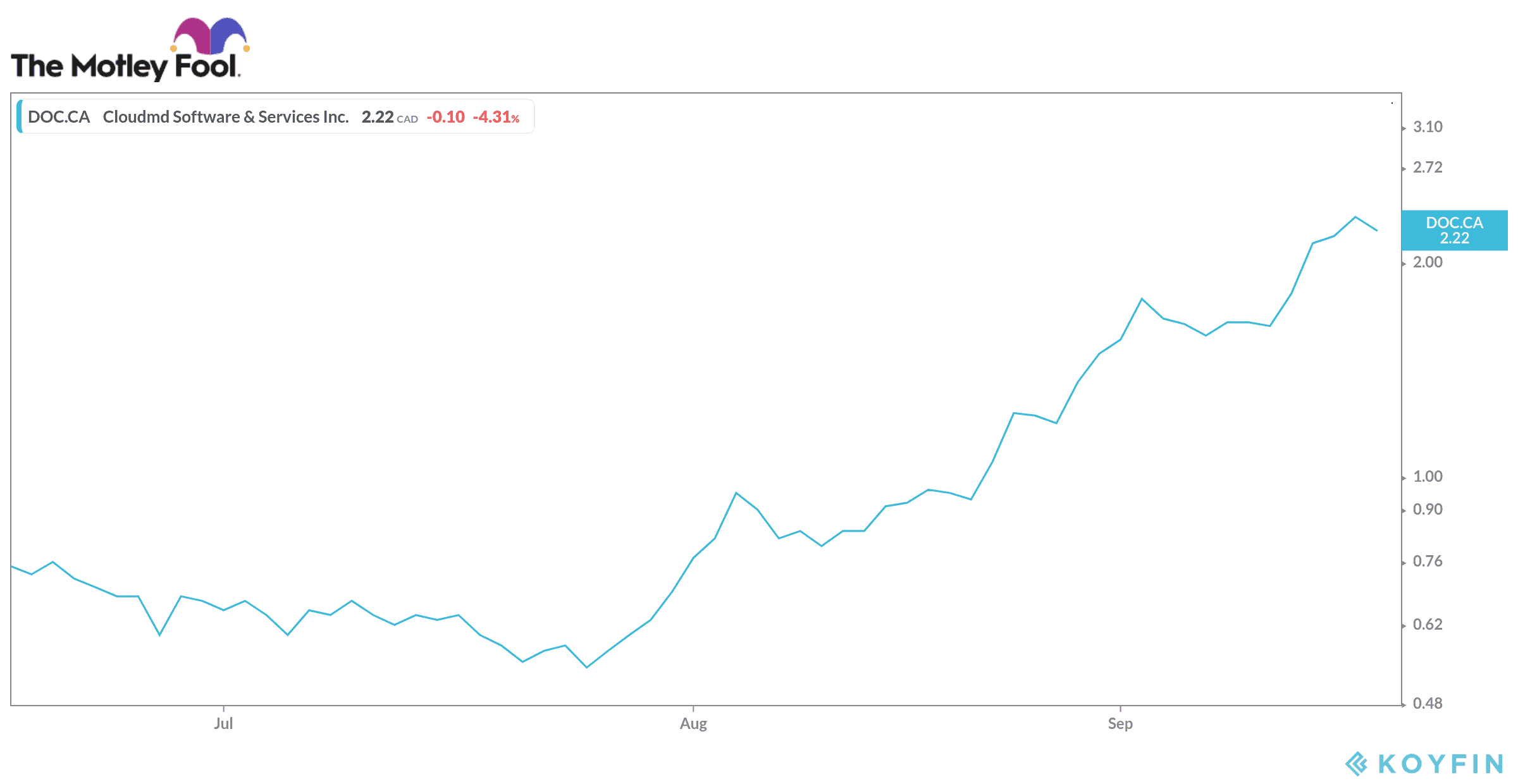

CloudMD stock has profited from the pandemic

The SaaS-based healthcare technology company has been able to capitalize on the current pandemic crisis, with more and more patients turning to online consultations. CloudMD stock has soared more than 200% since its debut at TSXV in June of this year. Shares have increased by 130% in one month. The current price/book ratio (P/B) is 10.28.

CloudMD aims to tap the untapped $10 trillion virtual care market and focuses on an easily scalable vertical growth strategy with low overhead. It has also recently entered the U.S. markets.

The solutions offered by CloudMD include Telemedicine Platform, Medical Clinics, Cloud Practice which offers cloud-based Electronic Medical Records (EMRs), and pharmacy services.

CloudMD has the potential to be a stable, high margin, and fast-growing company with sustainable revenues.

CloudMD reported 163% year-over-year revenue growth in the second quarter. Its total revenue was $2,789,987, compared to $1,061,569 in Q2 2019. Growth was driven by telehealth and acquisitions.

Net loss and comprehensive loss was $2,768,117 in the second quarter, resulting in a net loss of $0.03 per share (basic and diluted).

In fiscal 2021, CloudMD is expected to increase its revenue by 124.4% to $37 million while earnings per share are estimated to grow at a rate of 100% to hit $0.00.

CloudMD is expanding in the U.S. market

CloudMD entered into a binding agreement in August to acquire 100% of a U.S.-based medical clinic serving patients with chronic illnesses. This acquisition is part of CloudMD’s broader strategy to enter the U.S. market with its full line of telehealth products.

This acquisition is an important and strategic part of CloudMD’s cross-border expansion plan in the United States. One of CloudMD’s primary goals with this acquisition is to begin providing a one-stop-shop for longitudinal care for chronic and complex patients in the U.S. These patients often suffer from multiple concurrent illnesses such as diabetes, hypertension, vascular and heart disease.

The opportunity for expansion with this acquisition is significant, as in the United States alone, 90% of the $3.5 trillion spent annually on healthcare is for chronic pain and mental health issues. CloudMD’s integrated telehealth technology will be used in clinical practice to ensure patient-centered continuity of care.