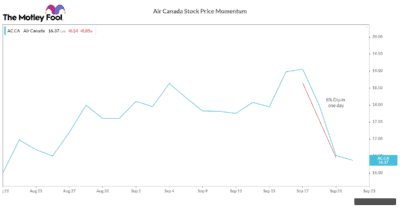

It took Air Canada (TSX:AC) stock almost a month to rise 12% to $19 — and just one day to wipe out these gains. Yesterday, AC stock fell 8% to $16.5, resulting in a 2.7% decline month-to-date. As I stated in my previous articles, the AC stock rally is not sustainable as it is not backed by fundamentals, but hope. These hopes are being crushed by the Justin Trudeau government, which has extended international travel restriction to September 30.

The International Air Transport Association (IATA) has also asked the Canadian government to reconsider its travel restrictions. Even if the travel restrictions are eased, the 14-day quarantine requirement may not be removed.

Behind the Air Canada stock rally

AC is making many efforts to adapt to the new normal of air travel, which drove the stock last month. But in the end, it is the outcome that matters. And so far, the outcome is the highest level of refund complaints and cancellation of hundreds of flights.

According to flight data firm Cirium, Air Canada and Westjet have cancelled at least 439 flights thus far in September, as business travel demand did not return as the airlines expected.

McGill University’s Global Aviation Leadership program head John Gradek noted that airlines were expecting some international travel, especially business travel, to return this fall as the government eases travel restrictions. Hence, they started scheduling more flights across different routes. But the extended travel restrictions disrupted their plan and left the flights half-booked.

AC is already burning $17 million in cash daily and can’t afford to make losses on flights. Hence, it is consolidating flights and cancelling flights that failed to secure sufficient bookings. It is also not refunding the money of cancelled flights to passengers. Hence, people are reluctant to book flights with AC as they fear losing money at a time when the employment market is low.

What is Air Canada doing to attract passengers?

AC has opened voluntary COVID-19 testing booths at the Toronto airport. It has also introduced complimentary COVID-19 emergency medical and quarantine insurance for new bookings made in Canada from September 17 until October 31. With these efforts, it is trying to make consumers feel confident about air travel.

AC is also launching loyalty programs and flying pass to encourage consumers to fly more. It has introduced a new Infinite Canada Flight Pass for up to three months, giving customers the flexibility to book, change, and cancel domestic air travel tickets without penalty.

All the above initiatives are good, but they won’t materialize until the travel restrictions are eased. Even if the restrictions are eased, it remains to see how effective they are. Are people returning to international travel?

The recent cancellation of hundreds of flights shows the uncertainty around the air travel demand and its consequences on the airline operations.

COVID-19 impact on Air Canada’s operations

The six-month travel restrictions have grounded AC planes. The company has been operating at less than 20% capacity and burning cash to maintain its remaining 80% capacity. AC knows that air travel will not return to the pre-pandemic level anytime soon, which means its huge capacity of 174 aircraft has now become a liability than an asset as they are not generating revenue.

Hence, AC is reducing its fleet size by a third and has already halved its workforce. Such a sharp reduction in capacity shows the magnitude of the impact on AC. The first half has been the worst for AC. It reported a loss of $2.8 billion. With the third quarter spent in travel restrictions, this loss could widen to $4 billion by the end of the year.

Moreover, AC is taking new debt to survive the weak demand. Its $9.1 billion liquidity can keep it going for at least two years and even three years if it successfully cuts cost. By then if air travel recovers materially, it can avoid bankruptcy and manage its financial requirement. But it will take the airline another three to five years to show some profits.

Investor corner

Air Canada stock will start growing significantly after it returns to profits. Until then, it will keep hovering between $14 and $22, which represents a 50% upside and downside potential.