You might be wondering how the Canada Revenue Agency (CRA) could possibly tax a Tax-Free Savings Account (TFSA) in the first place. After all, not getting taxed is what a TFSA is about, isn’t it? But unfortunately, there are a few ways that a TFSA can still be subject to taxation — especially if you’re using it for TFSA income.

One of the most common mistakes investors can make is investing in TFSA income that comes from another country. Unless your investments are all Canadian, you would be subject to taxes from the CRA. Or let’s say you’re one of the lucky few who managed to pump their TFSA past the $250,000 mark. This amount seems to be the red flag where the CRA swoops in and decides to start taxing the TFSA as a business. Right now, however, this is a very grey area.

But the most common mistake investors make is simply using their TFSA as storage space. This isn’t a regular savings account, despite the name. TFSA income can be made only if you’re making investments. While it might be a less-risky option, it’s also just unfortunate. There is a lot of money to be made, even in conservative stocks.

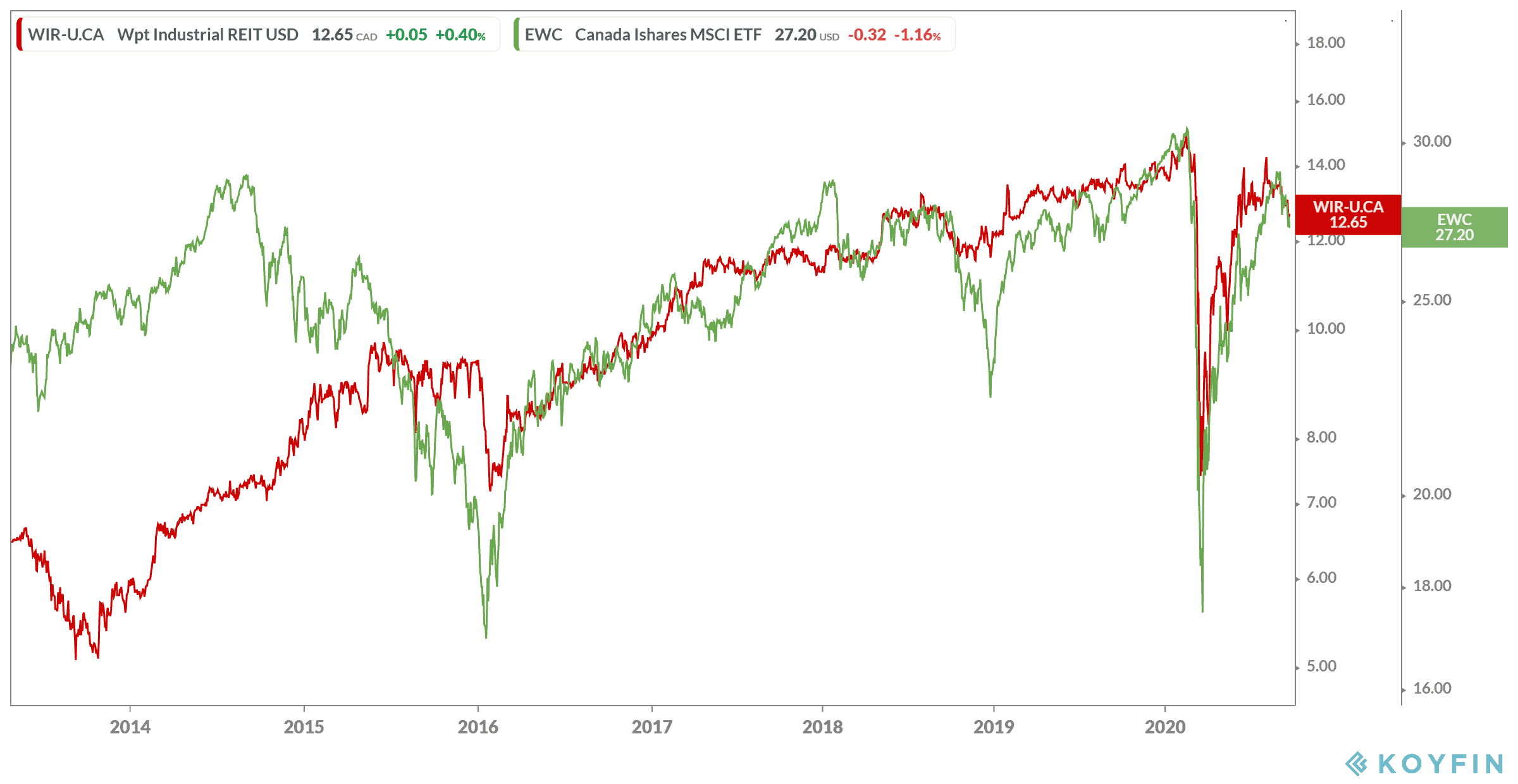

How high are these costs? Let’s look at a solid real estate investment trust (REIT) like WPT Industrial REIT (TSX:WIR.U) for a prime example.

WPT Industrial is a relatively new REIT that just so happens to be in the booming area of e-commerce. The company owns 102 light industrial properties across the United States, where e-commerce companies can store and ship out products. As of writing, the company sports a solid 6.02% dividend yield, paid out monthly, and a $1.4 billion market cap.

Partner up on property

If that number isn’t high enough, you can simply double it by investing with your partner, if you have one. The pair of you could put half of your TFSA income investment towards WPT Industrial. Suddenly, the numbers get substantially higher. The pair of you would bring in $4,225.60 per year, or $352 per month!

Now comes the hard part: don’t spend it. Well, of course you can, but I wouldn’t. Instead, reinvest in this super stock. E-commerce was already set to boom over the next decade. However, the pandemic and work-from-home economy set it into hyperdrive. So, expect WPT Industrial to soar over the next few years as e-commerce expands and continue outperforming the market.

If the company merely continues as it has, you can look forward to much of the same. In the last five years, the company had a return of 40%. On average, it has a compound annual growth rate (CAGR) of almost 7%. Yet today, returns are down about 7.5% as of writing. So, buying now could be the smartest thing you do for some massive TFSA income.