It’s common knowledge that one of the best long-term investments for Canadians has always been TSX bank stocks.

Over the long term, these companies are continuously growing their business, introducing new products, and capitalizing on organic growth as the population and economy continues to expand.

However, investors have been worried about higher risk levels during this pandemic. The economy is still suffering, and there are many unknowns with how things will turn out.

As the economy continues to evolve, and government stimulus programs begin to end, it’s unclear how consumers will be impacted. Furthermore, the uncertainty about a second wave of the pandemic also has investors on edge.

Therefore naturally, all the Big Five bank stocks are below where they started the year.

So which bank stock should you consider if you want to increase your exposure today?

TSX bank stocks today

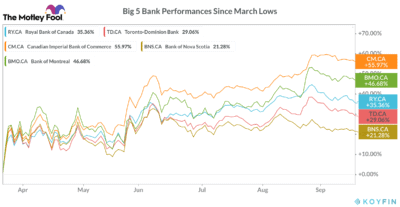

Each of the Big Five bank stocks are all down for the year after the market crash back in March. However, many have seen significant recoveries since the bottom.

As we can see from the chart, Bank of Nova Scotia is the worst performer with the Canadian Imperial Bank of Commerce being the best performer since the March lows.

It’s also clear how close the banks traded in the early stages. Then, as investors got a better idea of each bank’s strengths and weaknesses, the stocks started to split off each in their own direction.

So should BNS, the worst performer, be avoided, and is CM definitely the best bank stock to buy today?

Best bank stock to buy

You could look at the underperformance from BNS and assume it has value. You may not be wrong, but just because it has value doesn’t mean it offers investors the optimal choice. Scotiabank is actually in one of the most vulnerable positions of its peers, due to the large portion of the bank’s business operating in Latin America.

This exposure has been great in the past; however, during the pandemic, it’s likely those countries will suffer a bigger setback than we will in Canada.

Instead, considering the value of these bank stocks today, in my opinion, Bank of Montreal (TSX:BMO)(NYSE:BMO) is the most appealing bank stock today.

The company has proven to have solid capital conditions and is well positioned. It’s also managed its credit quality well, which is helping the company weather the storm.

Despite its resilient performance through the pandemic so far, the stock has been sold off considerably. Currently, the stock trades more than 20% below where it started the year.

Furthermore, when looking at its valuation, it’s clear just how cheap the stock has become. Its 10-year price to book average is roughly 1.6 times. Today Bank of Montreal trades for just 1.1 times its book value — not to mention, the bank stock pays an attractive 5.5% dividend making it one of the top dividend stocks in Canada.

At present, the eight analysts who have updated their target prices since BMO’s most recent earnings have an average price of $85.70. That represents a more than 10% increase from Wednesday’s closing price.

And when you consider that these price targets will likely only continue to rise as we progress through the pandemic, the stock could be much higher come 12 months from now.

Bottom line

There still remains some risk with Canadian bank stocks. However, these companies have proven time and time again to be both great at protecting and growing your hard-earned money.