The Tax-Free Savings Account (TFSA) is one of the greatest investment tools at the disposal of Canadians to date. Since its creation in 2009, the TFSA has increased its contribution room so that today, investors have $69,500 available. Invested wisely, you could make some serious cash long term.

Not only that, but there are ways to turn that TFSA into an income-producing powerhouse. Of course, it isn’t easy. Finding the stocks that provide both stable growth and dividends is tricky, or else everyone would do it. Many companies that offer ultra-high yields are risky. For others, the yields are simply too low to take into consideration.

But, of course, the middle ground does exist. There are a few income stocks that could certainly bring in solid cash, while still offering growth. For your consideration, I would recommend Northwest Healthcare Properties REIT (TSX:NWH.UN).

Top among income stocks

When it comes to income stocks, Northwest has a lot for investors to admire. All of it adds up to predictable cash flows that and strong growth potential for today’s investor.

The company has a portfolio of high-quality international healthcare real estate. The diversified portfolio includes 189 income-producing properties located in Canada, Brazil, Europe, Australia, and New Zealand. It’s not just long-term care but includes office buildings, clinics, and hospitals. What this means is, investors can look forward to long-term leases and stable occupancies. A hospital doesn’t just close, after all.

Of course, the growth potential is expansion! The company could also create more clinics, and in more states, provinces, and even countries. But even so, the main business provides plenty of cash flow to keep dividends healthy.

In fact, the company has remained strong, even amid a pandemic. Revenue grew 10.8% year over year during the most recent quarter. The EBITDA margin also grew to 70.6%. The company also has leveraged free cash flow of $110 million and assets of almost $4 billion.

Worth the wait

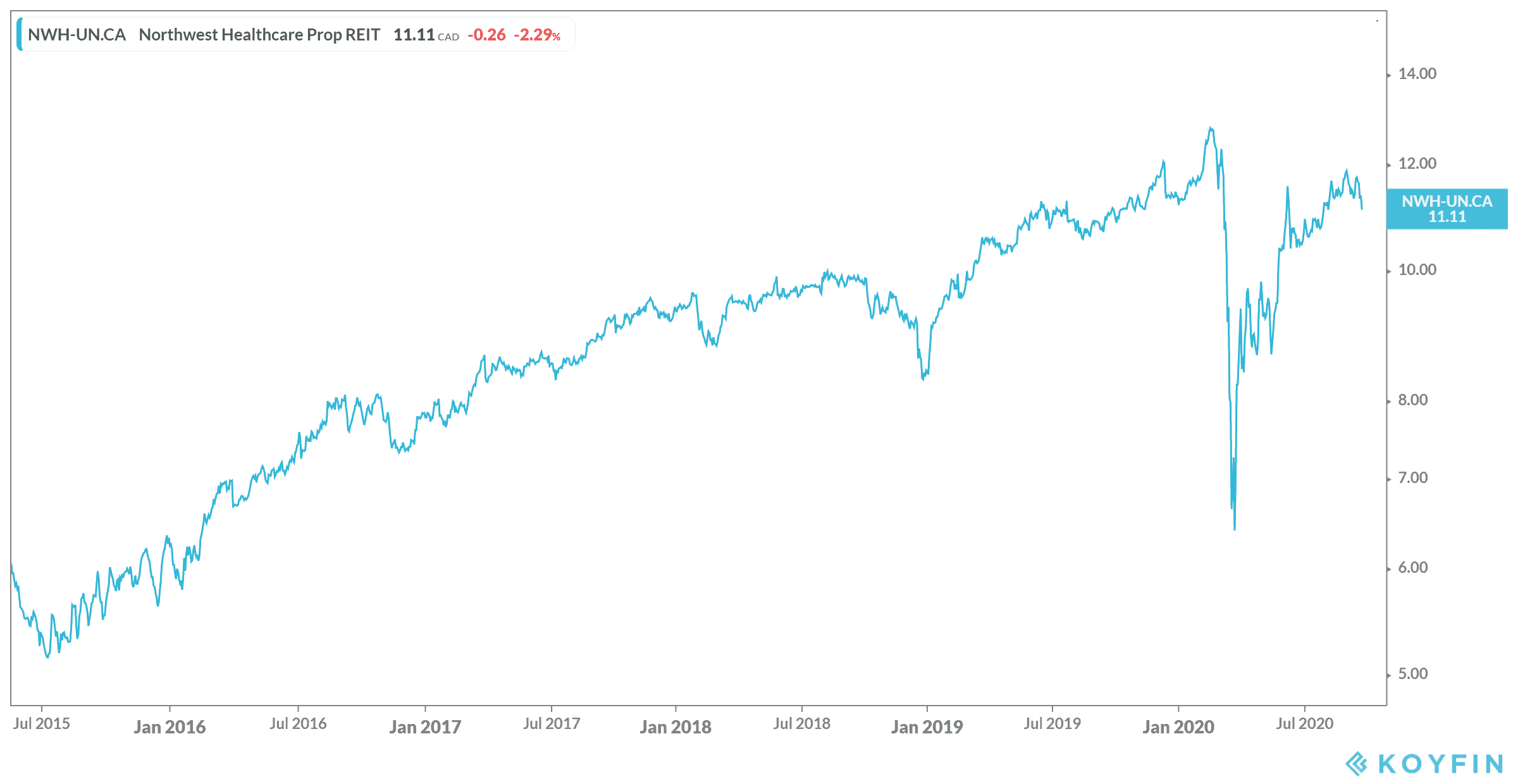

What this all means it that the share price is far below where it should be. As of writing, shares in Northwest trade at about $11. That’s almost to where shares were before the crash. However, in the next few years analysts expect sales to see solid growth. So, you can expect both shares and dividends to keep growing.

For now, those dividends have remained steady at $0.80 per share through the last five years. So, you can expect the solid cash flow to continue supporting this dividend. It might not sound like a lot, but with shares so low, you can turn that into huge cash flow.

Investing just half of your TFSA could bring in $2,527 per year in dividends. That income is given out monthly, turning that into a monthly payment of $210 at writing. Meanwhile, if shares continue to grow similarly to the last five years, you could see another five-year return of 88%, with a five-year CAGR of 13.52%!

Bottom line

We could all use the extra cash right now. If you need it, that $210 is there for you right this second. However, if you’re able to reinvest this cash you could be sitting on a gold mine a few years from now. In just five years, you could turn that original $34,750 investment into $66,982!