BlackBerry (TSX:BB)(NYSE:BB) — the Canadian enterprise software company — reported its second-quarter fiscal 2021 results before the market opening bell on Thursday. For the quarter ended August 31, the company crushed Bay Street’s expectations by reporting earnings of US$0.11 per share — significantly higher as compared to analysts’ consensus estimate of US$0.02 per share.

Before we look at some key highlights from BlackBerry’s latest earnings, let’s find out how investors reacted to its earnings.

Investors’ mixed reaction

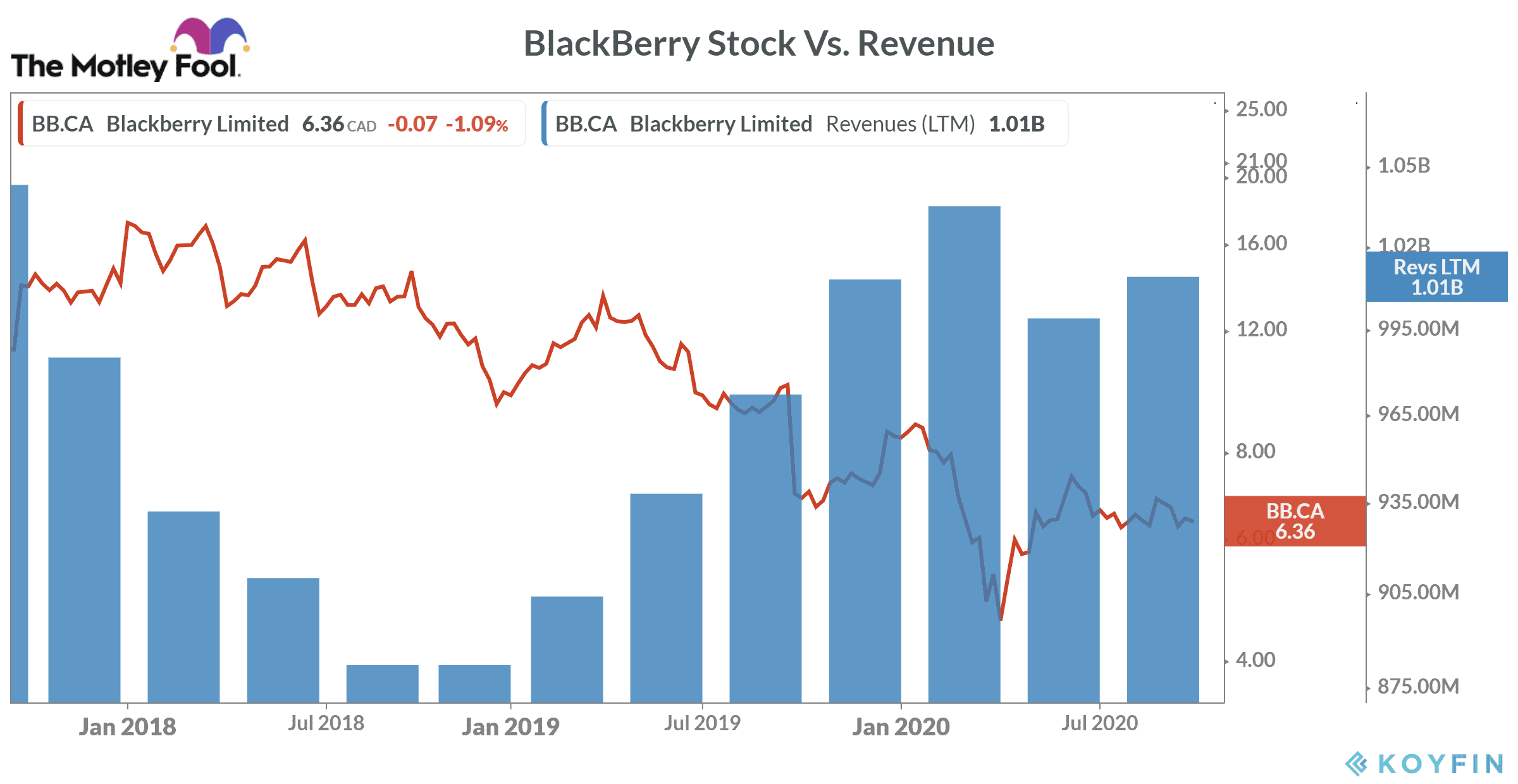

On September 24, BlackBerry stock opened at $6.89 (on TSX) on a strong note, with about 8% gains from the previous day’s closing price. However, the stock couldn’t maintain these gains for long. BlackBerry lost all these day gains later during the session and settled at $6.35 with about 1.2% loss for the day. By comparison, the TSX Composite Index rose by 0.3% yesterday.

Flat revenue

In the second quarter, BlackBerry reported a 0.8% year-over-year (YoY) decline in its adjusted revenue to US$259 million. Nonetheless, it was about 9% better than analysts’ expectations. In the previous quarter, the company reported US$214 million in revenue, with about 20% YoY drop. Overall, the short term in BlackBerry’s adjusted sales continues to be negative.

COVID-19 has forced many organizations to allow their employees to work from home. The remote-work culture has increased the need for companies to develop better enterprise software infrastructure. As a result, many enterprise software companies’ sales have risen sharply in the last couple of quarters.

What’s hurting BlackBerry’s revenue?

BlackBerry is now an enterprise software provider and not a smartphone company anymore. So, you might expect it to benefit from the rising demand for enterprise software amid the pandemic. However, its overall sales fell in the first half of fiscal 2021.

Here’s the reason why. A large number of BlackBerry’s customers include big automakers. The COVID-19 restrictions have badly hurt the auto industry and production — leading to reduced demand for BlackBerry’s software. This is one of the reasons why BlackBerry seems to be struggling to increase its revenue.

Fiscal 2021 outlook

During its second-quarter earnings conference call, BlackBerry’s management provided an update on its fiscal 2021 guidance. While there’s no change in the company’s revenue guidance of US$950 million, Blackberry now expects its fiscal 2021 licensing revenue to be slightly above its earlier expectation of US$250 million.

Is BlackBerry stock worth buying right now?

On a year-to-date basis, BlackBerry stock has lost 23% with no signs of an immediate recovery in sight. Currently, all of the five analysts covering the stock are recommending a “hold” with a price target of $5.96 — already lower than its market price.

While some fund managers may consider BlackBerry stock to be “extremely undervalued,” I would beg to differ. Despite many diversification efforts, BlackBerry’s business still heavily relies on the auto industry, which itself is facing a big crisis due to the pandemic. That’s why I don’t expect the company to report major YoY sales growth in the coming quarters, which could keep its stock on a subdued note.