If you contribute to the Canada Pension Plan (CPP), you might be thinking you’ve set yourself up when it comes to retire. You may have maxed out payments and are looking forward to receiving Old Age Security (OAS) payments as well. But before you get ahead of yourself, the Canada Revenue Agency (CRA) has a harsh reality.

According to the CRA, CPP payments vary widely. It depends on both your work history and when you decide to take out benefits. For 2020, the maximum you can receive from CPP is $1,175.83. However, the average Canadians receive from CPP is almost half that at $672.87 for this year.

Even with OAS payments on top of that, you still have a long way to meet the necessities of life. For 2020, the maximum monthly OAS benefit comes to $613.53. However, if you’re a low-income senior, that’s bumped up to $916.53 per month through the OAS Guaranteed Income Supplement (GIS).

The contributions

You might be one of the lucky ones who have employee contributions made to CPP on your behalf. Those contributions take away on average 4.95% of earned income, up to a maximum of $58,700 for 2020. So, if you earned $58,700 in 2020, you’ll end up paying out $2,905.65 in CPP payments. That comes down to $242.14 per month, which is more than a third of your monthly CPP payments when you retire if you go by the average.

Now remember, most Canadians continue to work beyond the age of 65. What that means is you could actually end up paying more into CPP than you end up taking out. Say you retire at 70, but don’t live past 80, then all that money you contributed simply disappears.

Beyond that, CPP might turn into something else in the future. That could be good or bad, but it’s, of course, unknown. So, are these CPP payments even worth it in the first place?

Supplement payments

If you’ve got payments going in through your employer, it’s great to know you’ll receive some cash once you retire. However, you can certainly supplement those payments by investing in stocks that will pay you over the long term. If you’re looking to retire in the next decade, I would certainly recommend a stock like Enbridge (TSX:ENB)(NYSE:ENB).

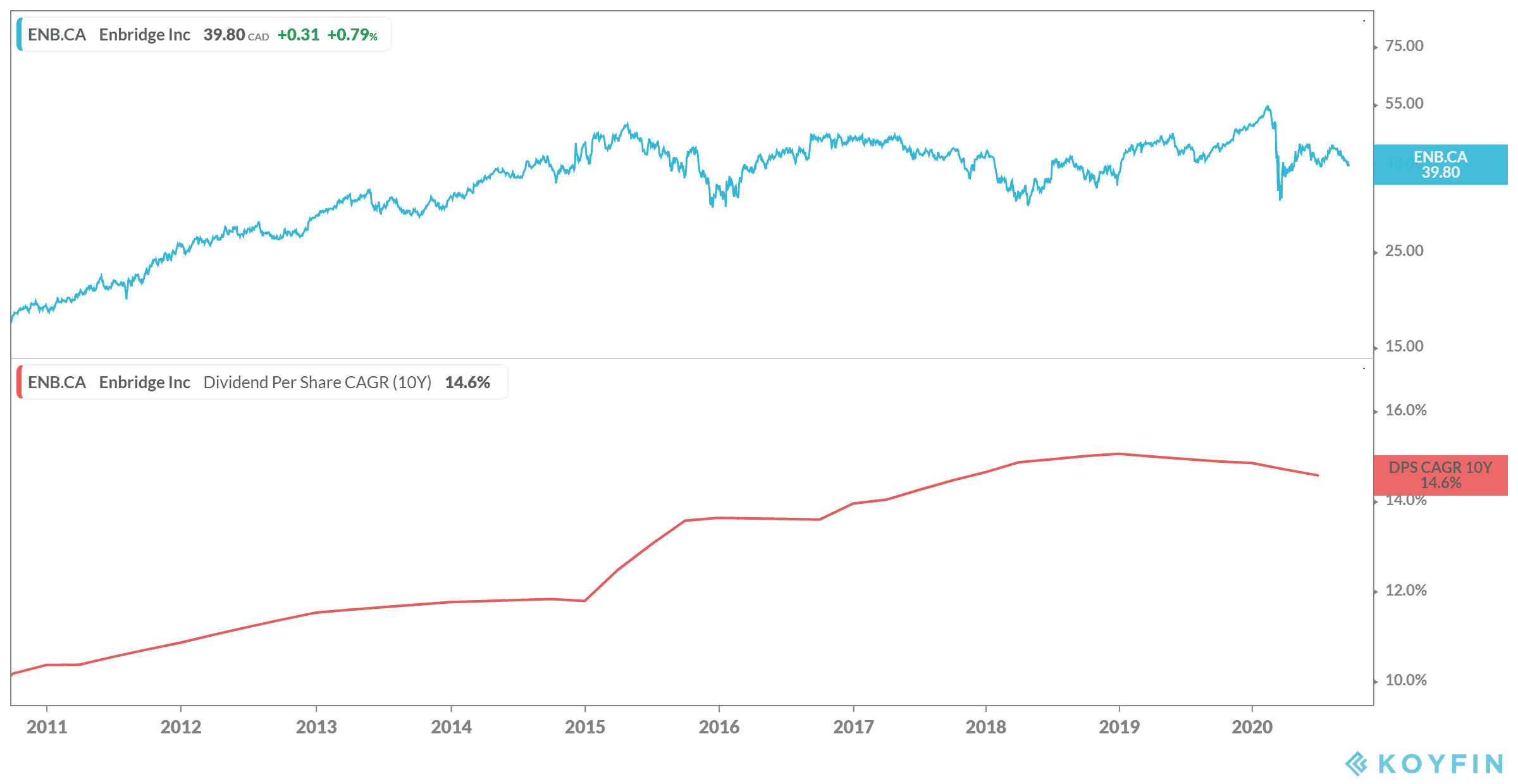

Enbridge is down right now but certainly not out. The company has been hit hard during the oil and gas crisis, with stocks sinking as the company continues to try and get pipelines built. Many economists believe oil and gas will go the way of the dodo bird in the next few decades. But until then, Enbridge has decades of long-term contracts to support its cash flow and dividends.

Economists predict a 32% potential upside for Enbridge in the next year or so as of writing. That comes from the creation of its pipelines, and the continued use of its pipelines for the necessary transportation of oil and gas. While sales and earnings are down this year, by next year sales should be up by 7%, with earnings per share rising the same amount.

Meanwhile, investors receive a bargain price for this dividend stock. Enbridge stock currently offers a 8% dividend yield, which has remained stable even during the financial crisis. The company sports a 10-year CAGR of 9% at writing, and an average dividend growth of 14% during the same period. If you were to put aside the same amount of annual OAS and CPP payments of $15,420 into Enbridge, in a decade you could be holding onto $103,978.32 with funds reinvested — or even higher if there is the predicted boost in a year’s time.

Bottom line

If you were to put that cash aside in a Tax-Free Savings Account, suddenly you have over $100,000 to help supplement your CPP and OAS payments. Investing in something like an Enbridge stock gives you a strong chance of keeping your retirement happy and healthy for as long as you can.