Making more income from passive investments like dividend stocks cannot be more relevant today. Many Canadians can use some extra cash that comes in regularly, as the pandemic has disrupted the economy and made things more expensive.

For example, restaurants I regularly go to have increased the prices on their menus to help compensate for the lost sales from lower traffic and social-distancing measures.

With Canada hitting 1,739 new cases of the novel coronavirus in a single day, and the four largest provinces experiencing a second wave, the situation could get worse before it gets better.

Canadians can prepare and make more income for themselves and their families starting in October 2020.

Here are some of the biggest dividend payers in my stock portfolio that should continue paying their dividends through 2020 and beyond. In fact, they have a good chance of growing their dividends in the future.

Make more income with BNS stock that yields 6.4%

Year to date, Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) stock lost about 24% of its value thanks largely to a negative macro environment. As a result, the international bank trades at a massive discount of more than 30% from its normal levels.

Its decade-low valuation makes it a super attractive entry point for income investors, as BNS stock’s yield is also the most compelling in 10 years.

At about $56 per share at writing, the dividend stock yields 6.4%. Its next quarterly dividend has an ex-dividend date of October 5 and is paid on October 28 to shareholders.

BNS Dividend Yield data by YCharts. BNS stock’s yield history over 10 years.

Investors should note that BNS tends to grow its book value per share in the long run, which should ultimately drive its stock price higher.

Data by YCharts. Huge discrepancy between BNS’s price to book value and share price.

Earn monthly income from H&R REIT

H&R REIT (TSX:HR.UN) stock declined approximately 54% year to date. Understandably, the diversified REIT has meaningful exposure to retail properties with enclosed malls doing the worst in the pandemic environment.

That said, management appropriately revised its cash distribution downward by 50% in May. H&R REIT’s August rent collection was 87% in its overall portfolio. It’s crucial to note that its rent collection was at this level if not higher since April.

In the first half of the year, the REIT’s payout ratio was 69% of its funds from operations. So, its monthly cash distribution is sustainable going forward.

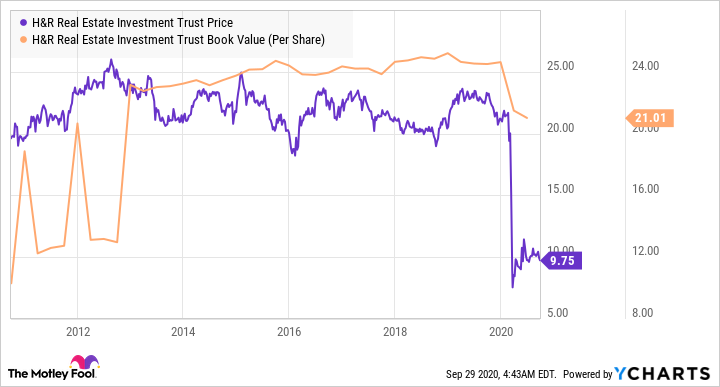

On top of the rich 7.1% dividend, H&R REIT stock can more than double investors’ money with 115% of price gains, assuming the stock eventually rises to its book value.

HR.UN data by YCharts. Huge disconnect between H&R’s price to book value and share price.

The Foolish takeaway

Bank of Nova Scotia and H&R REIT have been hit hard by the pandemic. Both stocks are likely to maintain their current dividends this year and potentially through 2021.

Longer term, BNS stock will likely resume dividend growth of about 5% per year. In contrast, H&R REIT will probably recover its cash distribution to close to the pre-pandemic levels when the pandemic is over and the rent collection from its retail portfolio normalizes.

In any case, both dividend stocks are trading at fantastic discounts that you can take advantage of right away and earn great income from starting in October.