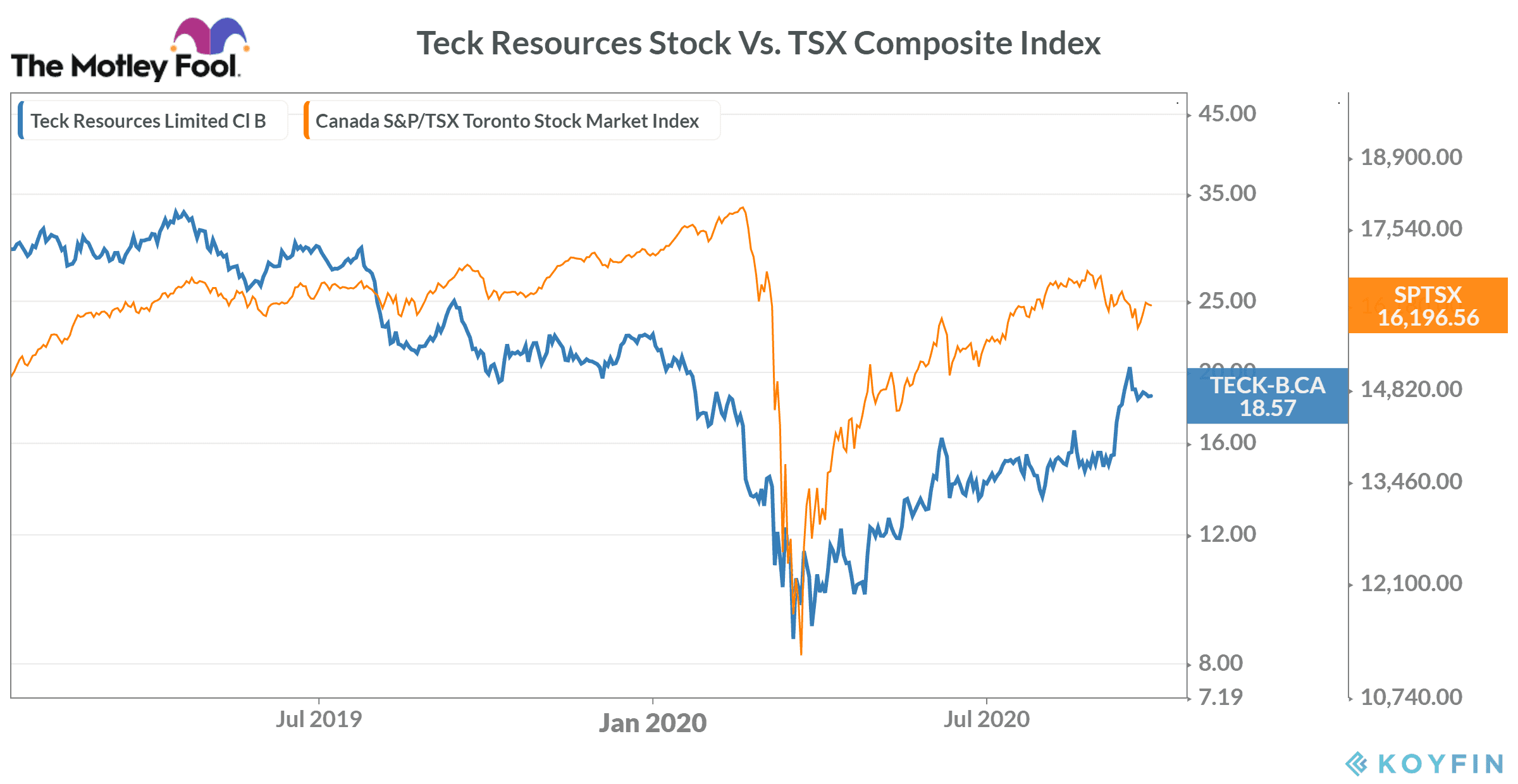

The shares of Teck Resources (TSX:TECK.B)(NYSE:TECK) rose sharply by over 23% in September against a 1.8% drop in the TSX Composite Index. It was the second consecutive month its stock surged. In August, the Canadian miner’s stock went up by 11%.

What triggered a rally in Teck Resources stock?

Like the most other metal mining companies, Teck Resources started 2020 on a negative note, as the fears of a sharp decline in metal demand — due to the COVID-19 pandemic — haunted investors. The company’s stock shed 53% in the first quarter.

Nonetheless, it has risen sharply in the last couple of quarters, as rallying base metal prices could help it boost profitability in the coming quarters. Copper prices skyrocketed in the last few months and reached their two-year high last week. As a result, Teck resources stock rose by 33% and 32% in the second and third quarters, respectively.

On a year-to-date basis, the stock is still down by 17.4% and has a $9.8 billion market cap.

It’s important to note that metal mining companies’ shares are highly linked with metal prices, as they directly impact miners’ profitability. This fact justifies a nearly 8% decline in Teck Resources stock last week after the copper prices retracted from their multi-year high.

Financials aren’t impressive

If you look closely at Teck Resources’s recent financials, you might not find them very impressive. The most recent quarter ended in June 2020, the revenue fell by 45% year over year (YoY) to $1.7 billion. While the company blamed COVID-19 for hurting the demand for its products and its overall business, it was the fourth quarter in a row when it reported YoY weakness in revenue. Clearly, its revenue started showcasing a negative trend well before the pandemic started.

On the profitability side, Teck Resources has been struggling for a long time now. In 2019, its adjusted EBITDA margin fell to 31.1% as compared to 42.9% in 2018. In the first half of 2020, its adjusted EBITDA margin shrunk further to a range of 25-29%.

I agree that a gradual rise in base metal demand with reopening economies and higher copper and zinc prices will likely help Teck Resources improve its profitability in the next couple of quarters. However, the profitability would still be much lower as compared to the previous year’s levels. Bay Street analysts expect the company to report 28.5% and 30.4% adjusted EBITDA margin in Q3 and Q4 2020, respectively.

Could Teck Resources stock continue to rally in October?

While Teck Resources’s profitability might improve in the next couple of quarters, I don’t consider its margins to be the only factor that could continue to drive its stock prices higher. The company is continuing to report lower revenue for the last four quarters, and the trend is not likely to change immediately.

A second wave of COVID-19 is likely to hurt global economic growth further, posing a risk to the base metals’ near-term demand. These are some of the key factors — I believe — that could reverse Teck Resources stock’s trend in the next couple of months.