The Tax Free Savings Account (TFSA) is a useful investing tool to help young Canadians build a substantial savings fund.

How to invest in a TFSA

Canada created the TFSA in 2009 to provide residents with a new savings alternative. Contribution limits increase each year and currently stand at a maximum of $59,500.

People use several approaches to put cash aside for the future, including taxable accounts, RRSPs, and TFSAs. Advisors often recommend using taxable accounts once RRSP and TFSA contributions limits are exhausted.

The RRSP remains very popular and is particularly useful when a person is in a higher marginal tax bracket than they expect to be in retirement. RRSP contributions reduce taxable income in the respective year. Inside the RRSP, the funds grow without being taxed. However, the CRA taxes the money when it is withdrawn.

Investors make TFSA contributions with after-tax income. Investments inside the TFSA grow tax-free and no tax is paid to the CRA when you remove the profits. Young investors who still have their highest-income years ahead of them might want to use the TFSA space first and save RRSP room for when they earn more money.

In addition, the TFSA benefits retirees. The CRA does not include TFSA earnings when determining OAS clawbacks.

Top TFSA stocks

The top stocks to owns over the long haul tend to be market leaders. They generate solid profits regardless of the economic environment and pay reliable dividends.

Savvy investors use the dividends to buy more shares, setting off a powerful compounding process that makes some people rich. Let’s take a look at two stocks that demonstrate how this works.

Canadian National Railway

Canadian National Railway (TSX:CNR)(NYSE:CNI) is the only rail operator in North America with access to ports on three coasts. The lines serve as the backbone of the Canadian and U.S. economies, carrying everything from coal and crude oil to grains, cars, forestry products, and finished consumer goods.

The stock tends to hold up well when the broader market crashes, making it a sleep-easy TFSA investment. For example, CN trades higher now than it did before the pandemic.

A $5,000 investment in CN just 20 years ago would be worth $135,000 today with the dividends reinvested.

Royal Bank of Canada

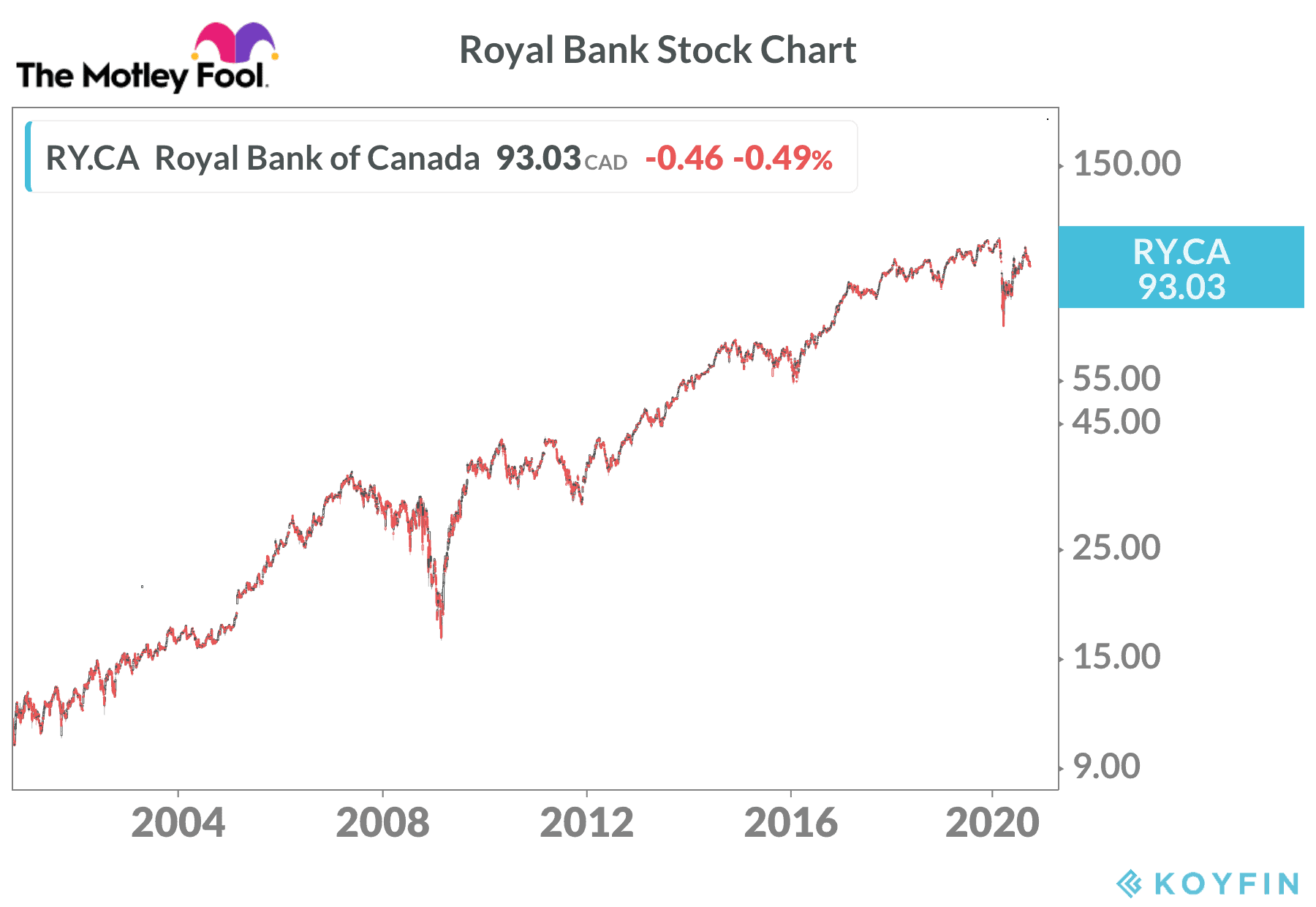

Royal Bank (TSX:RY)(NYSE:RY) is Canada’s largest financial institution. Earnings took a hit in the first half of 2020 due to the pandemic, but Royal Bank remains very profitable and has the capital to ride out the recession.

The bank gets revenue from several divisions, including personal banking, commercial banking, capital markets, and insurance. This helps balance the revenue stream in challenging times. Royal Bank has the firepower to make strategic acquisitions. The bank also invests heavily in digital platforms.

Buying Royal Bank stock on dips tends to be a smart move over the long term. A $5,000 investment in Royal Bank 25 years ago would be worth $150,000 today with the dividends reinvested.

Royal Bank survived every major financial and geopolitical crisis in the past 100 years. The stock now trades near $93 compared to $103 at the start of the year.

The bottom line for TFSA investing

Canadians can use their TFSA to turn small initial investments into significant savings for retirement. The strategy requires patience and discipline, but the payoff can be enormous.