It’s true. We now know exactly when the next crash is going to happen. It’s fairly easy, to be honest. All investors have to do today is look at what happened during the last crash to figure out when the next will happen.

Of course, it’s the prediction part that has many questioning when, or whether, another crash was going to happen at all. Economists predicted for a year before this crash that a recession was coming. But then the crash came, and it looked like we might be off the hook. A v-shaped recovery looked to be underway.

Unfortunately, there are a number of things at play that mean more crashes could, and are, coming. Let’s look at why.

The last crash

The last crash came from COVID-19, pure and simple. The pandemic created massive panic and uncertainty in an already volatile market. But that volatility came from something else. For years, governments around the world have been taking on enormous debt, and those debts are going to come due. Add onto that the oil and gas crisis, and you have a recipe for disaster.

So, why did a v-shaped recovery happen? Again, COVID-19. Governments around the world poured as much money as they could into the economy. This was in hopes of keeping the economy going so that there would be a quick recovery and we could get out the other side.

Unfortunately, the pandemic closed businesses, and millions of Canadians are still without work. Even with a $10 billion investment into the pandemic economy, Canada has a long way to go to pay down both pre-crash debts, and pandemic debts.

The next crash

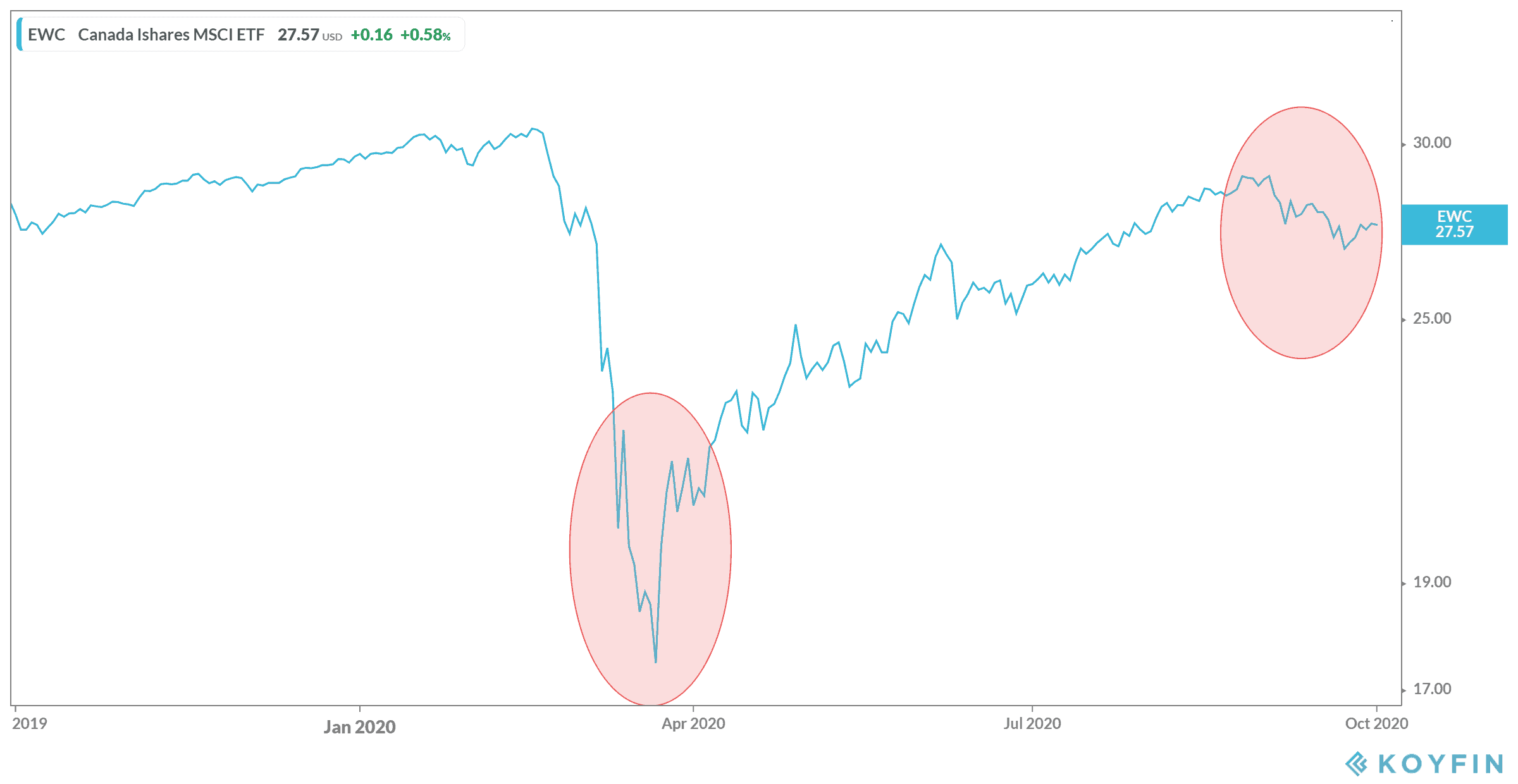

As I mentioned, the next crash is likely to be just like the first: pandemic related. COVID-19 cases are on the rise in Canada, and the federal health minister predicts a peak in mid-October. That’s only a week away. When that happens, it’s likely the markets will crash yet again. This is because businesses will be forced to close yet again. There could even be more lockdowns, as there have been in Quebec. At the least, it’s likely that we’ll roll back across the country to phase two of reopening.

This is also likely to occur around the world. Everyone is going through the same thing at the same time. That leads to further crashes in the markets for countries struggling with the pandemic. So, is there anything you can do mid-October?

Invest in defensive stocks

If you’re looking for long-term opportunities, then the next crash could be your opportunity to buy for the long haul. A stock to consider watching is Shopify (TSX:SHOP)(NYSE:SHOP). The company is overpriced but dropped during the last crash. It’s quite likely it will crash yet again, as those needing the cash will let go of the stock to take their returns.

What I would recommend is having a number in mind before just buying the stock during a drop. The company currently trades at $1,400 per share, so if it has another drop of around 20%, you could buy it for about $1,100 and be pretty happy. Then hold onto this stock for years, even decades. Don’t just hope for a quick turnaround. The company still needs to make a profit but is well on the way to doing so with subscriptions and revenue soaring.