Fourth-quarter earnings report are due out in just about a month. There are plenty of industries that investors will be watching closely, but perhaps none as closely as cybersecurity. This industry has been on a tear with the work-from-home economy at its peak. Companies need to know employees can work from home safely, keeping company data secure.

But that doesn’t necessarily mean that every cybersecurity stock is created equal. So before you buy up every one you can find, I would first add these to your watch list.

Open Text

Open Text Corp. (TSX:OTEX)(NASDAQ:OTEX) is one of the few companies with decades of software experience behind it. The company connects and manages business data within organization, and protects it from cyber threats, with artificial intelligence and analytics for better business performance, all within the cloud. The company has been picked up by companies like Alphabet and Amazon AWS for its cybersecurity network.

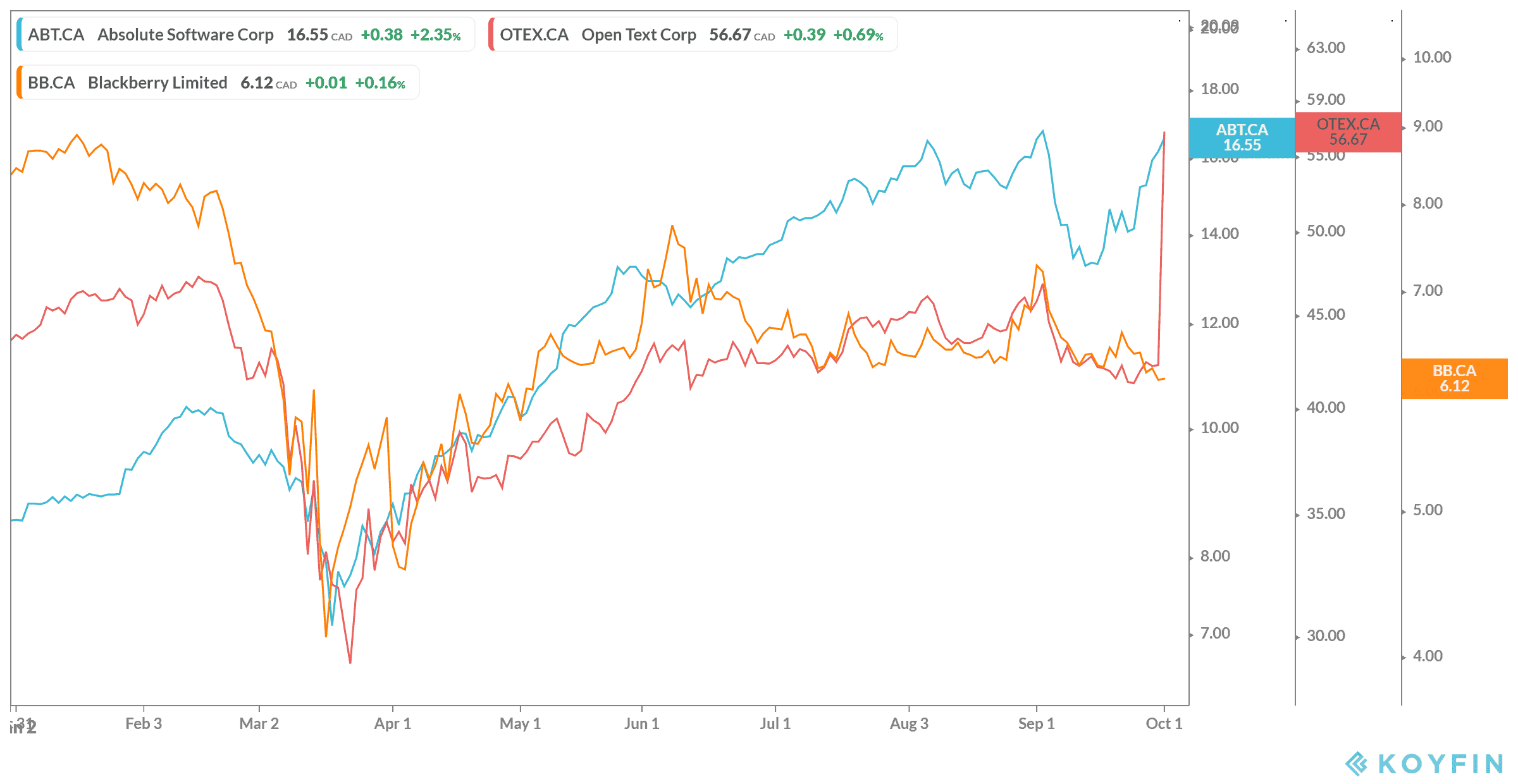

Shares are still down from February highs, offering a great opportunity to get in on this stock before earnings. The company reported a strong quarter in August with year-over-year revenue growth of 8.4%, with leveraged free cash flow growing to $948.2 million. Given that the company has recurring revenue through subscriptions, these numbers will likely only continue to increase when earnings come out Oct. 31, 2020.

BlackBerry

If you know anything about cybersecurity, you know that BlackBerry Ltd. (TSX:BB)(NYSE:BB) has stormed onto the cybersecurity stage. BlackBerry mainly offered businesses a way to protect the company from security threats. However, it has also bought its QNX software that keeps data in products like autonomous vehicles safe as well. Companies like Toyota have signed on to use the software as of late.

Again shares are still far lower than February highs, but have been climbing up. Blackberry has also gotten into the subscription recurring revenue game, but has a ways to go before turning a major profit. However, it’s seen year-over-year growth of 14% as of its last earnings report, which should continue. But it has much to prove during these next earnings reports, namely, that it can weather the economic downturn and take full advantage of today’s cybersecurity boom.

Absolute

Finally, we have Absolute Software Corp. (TSX:ABT), a company that provides cloud-based visibility and control platform to manage and secure devices, applications and data. These businesses tend to be enterprise level or public sector organizations. The company has been around since 1993, and has stretched around the world into almost every sector.

While the other stocks are down, Absolute is still up. The company has completely outpaced the market during this downturn, proving its worth in every way. Its year-over-year revenue growth stretched to 5.8% as of the last earnings report, and year-over-year earnings per share growing by 33% in that time. Sales should continue to rise, as should its stock as cybersecurity grows.