The year 2020 continues to be full of uncertainties for investors. While some companies’ shares have seen a sharp recovery in recent months, most other stocks still seem to be on a roller-coaster ride.

The Canadian tech firm BlackBerry (TSX:BB)(NYSE:BB) lost about 31% in the first quarter (of the calendar year 2020). It saw a minor recovery of 15% in the second quarter but turned negative again in Q3 as it fell by about 8%. Let’s take a closer look and find out what we can expect from the stock in Q4.

BlackBerry’s key worries

In the quarter ended August 31, 2020, BlackBerry’s revenue rose by 2% on a year-over-year (YoY) basis to US$266 million. It was a big relief for investors, as the company reported a massive revenue decline of nearly 20% YoY in the previous quarter.

BlackBerry’s software solutions allow many companies to let their employees securely work from anywhere. The demand for such software solutions has risen sharply in the last couple of quarters. Its management expects a recovery in its QNX segment by the early next year. These expectations are based on some signs of recovery in auto production.

Nonetheless, BlackBerry might continue to face big challenges much longer than expected due to the prolonged pandemic — I believe. Many auto companies are currently running their production plants much below their full capacity. The overall global vehicle demand continues to remain weak. If we enter the phase of another recession — as predicted by many experts — the challenges might mount for the auto industry, and car companies would have no choice but to cut their production further. Lower auto production could prove to be terrible for BlackBerry’s QNX segment.

Recent developments

Earlier today, BlackBerry announced that it’s integrating “BlackBerry AdHoc” — its critical event management platform service — with Microsoft Teams. The company claims that its AdHoc service helps users minimize operational disruption when incidents like a natural disaster or industrial accident occur.

BlackBerry seems to be trying to benefit from recently increased demand for work-from-home culture with this latest move.

Could BlackBerry’s stock recover in Q4?

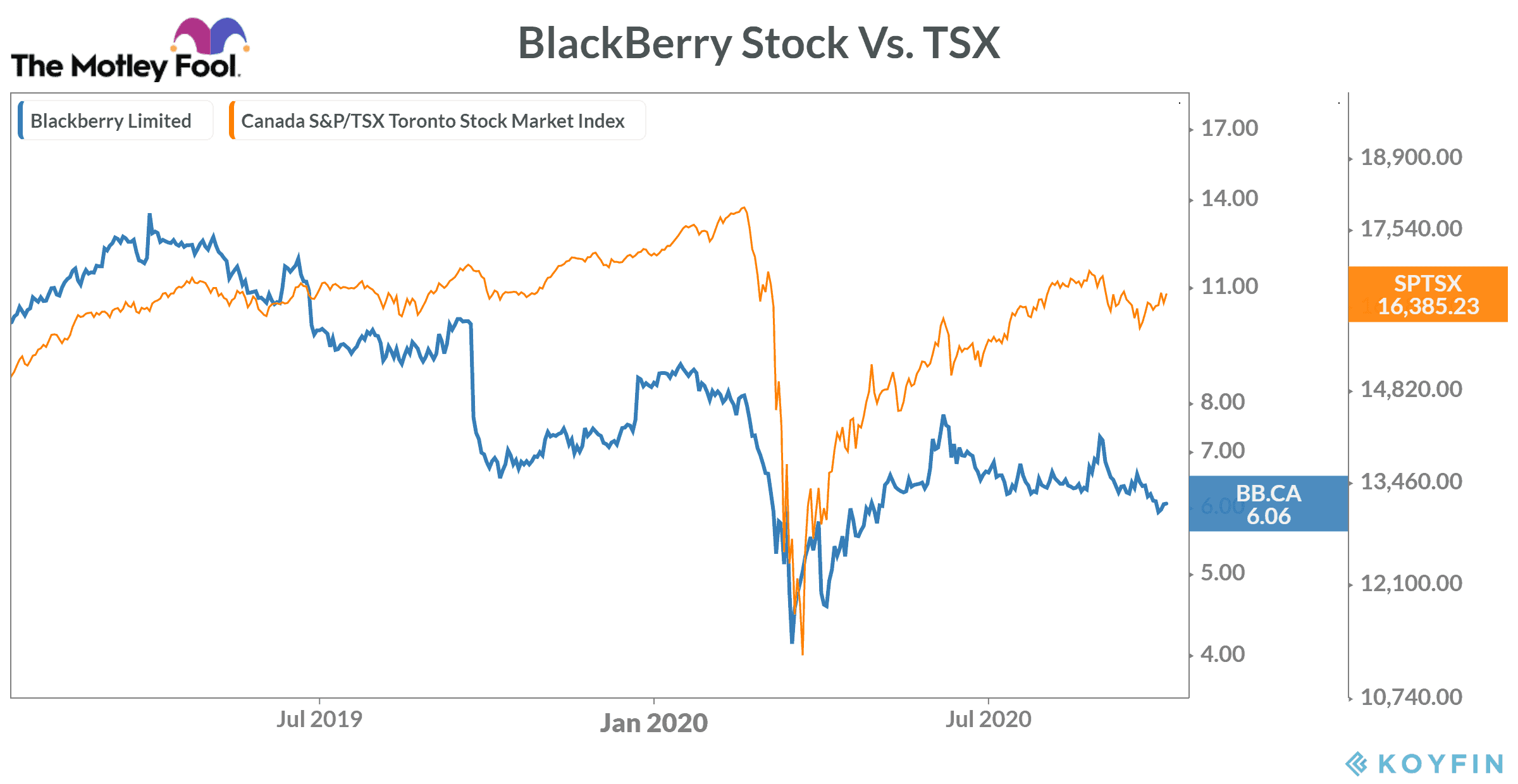

On a year-to-date basis, BlackBerry stock has underperformed the broader market by a wide margin. It’s currently trading with 27.5% losses in 2020 compared to a 4.8% drop in the S&P/TSX Composite Index.

Since July, the stock on TSX has largely remained range bound between $6.20 to $6.90 per share. It violated a key support level of $6.20 in the final week of September, and it’s continuing to sustain below it — showcasing weakness in the short-term trend.

On the fundamental side, I don’t find many reasons that support BlackBerry stock recovery in the near term. Unless its QNX segment growth is back on track, its stock might continue to struggle in the coming months.

This is the reason why you may not want to enter a long position in the stock here. But if you already own BlackBerry stock, you must try to minimize risks to your overall portfolio by adding some other good stocks in it — especially the ones that are on a path to a sharp recovery right now.