Most of the market continues to spiral downward thanks to the pandemic. Even with businesses opening up yet again, revenue is still down almost across the board. A recession was likely to happen regardless of the pandemic. So there are many industries hurting badly when it comes to a recession coupled with a pandemic.

But if you look in the right places, there are still stocks that surpass expectations. In fact, there are some that should continue to have strong revenue growth right through to 2021 and beyond. If you then put those stocks in a Tax-Free Savings Account (TFSA), you could take full advantage of that growth, tax free.

goeasy

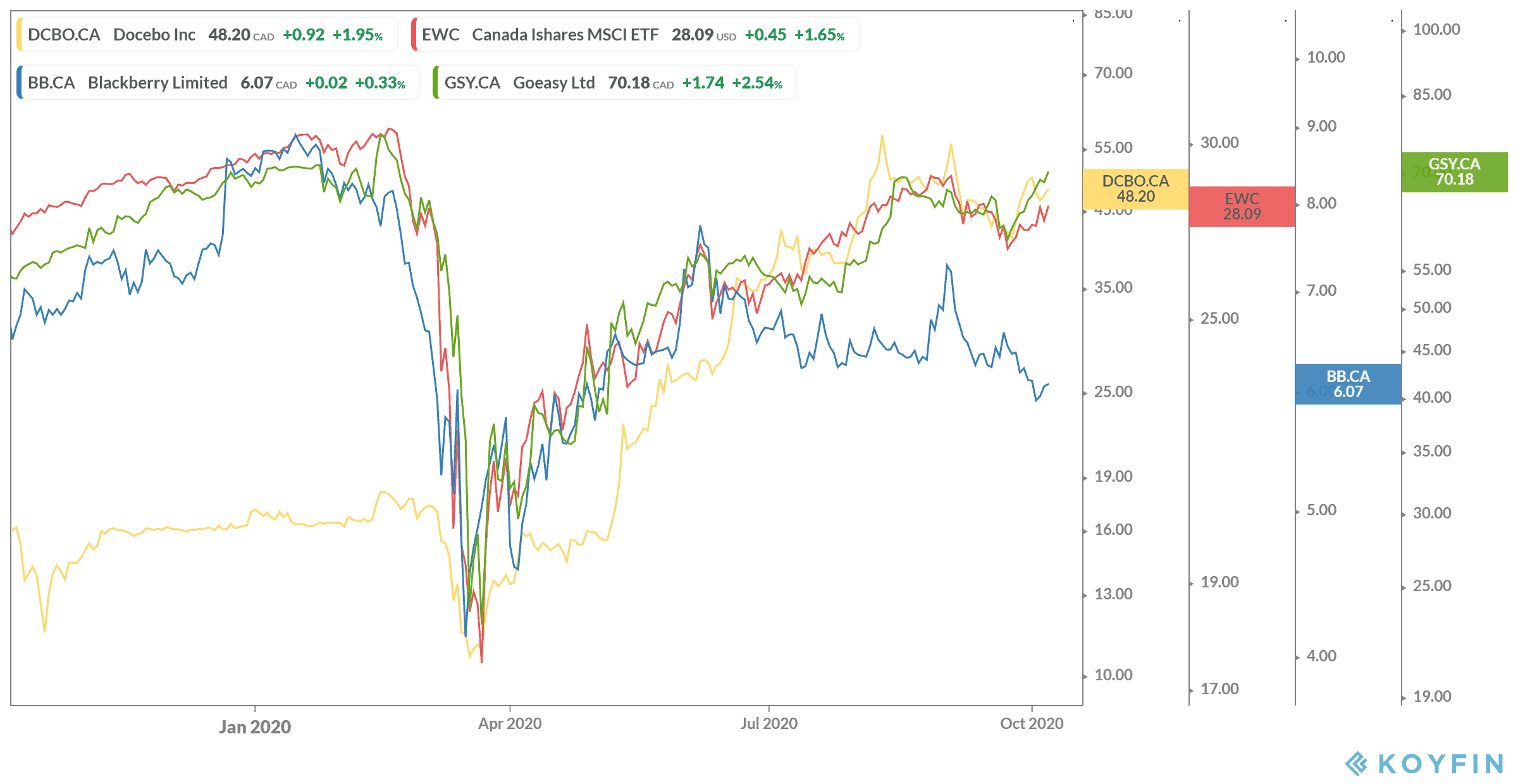

A top revenue producer of the last few years has been goeasy Ltd. (TSX:GSY). The company provides loan services and even household rentals to Canadians. Clearly, the company has found a niche industry, as the company continues to bring in steady revenue even during the downturn. Year-over-year revenue growth grew by 15.7% for another consecutive quarter during the latest round of earnings.

Revenue growth is one of the surest signs of strength, and of price performance for a company like goeasy. With a profit margin of 19.3%, that’s a huge driver of its current $70 share price. The company is likely to continue seeing this growth well through to 2021, and clearly continue to outpace the markets during the current wave of crashes.

BlackBerry

Now that BlackBerry Ltd. (TSX:BB)(NYSE:BB) has moved away from smartphones and towards cybersecurity software, it’s been a huge bolster. The company even owns QNX software, a software that can be used in devices with minimal changes, even for autonomous vehicles.

While the company is still working towards bringing in strong profits from the change, its subscription revenue is holding down the fort. Revenue has increased 4.3% year over year, reaching $1 billion in 2020. While the company has debt it needs to pay, as soon as it shows a profit this company should sky rocket in share price. Meanwhile, it continues to work toward pre-crash prices, making it a solid investment for 2021.

Docebo

If there’s one stock you should consider, it’s Docebo Inc. (TSX:DCBO). Docebo came to the right place at the right time. The company created a learning management system so that companies can train employees anywhere in the world. It launched on the TSX in 2019, but has surged as businesses demand the software with the emerging work-from-home economy.

So clearly, subscriptions have soared. Revenue increased 46.5% year over year during the last quarter. Meanwhile, subscription revenue increased 55%, which takes up 92% of gross revenue for the company. This company is really in its infancy, so investors should expect years of solid growth from a company like Docebo.

Foolish takeaway

As you can see above, the main factor to acknowledge is that these companies are outpacing the markets, with BlackBerry the only company needing to catch up. If you believe there will be further crashes, you need to get defensive. Holding on to stocks like these means you have the best chance of seeing your portfolio soar higher, rather than crash and burn.