There are a number of ways to get defensive during a market downturn. One way is by turning to the banks, which will fall but also likely rebound quicker than other industries. There’s turning to emerging markets, such as the tech industry. This area has taken off, especially companies involved with e-commerce.

But there is one stock that I would recommend no matter what the stock market is doing. This stock will continue doing well even during a crash. It will do well during this market downturn, when the market rebounds, and decades from now. It has decades of historical growth, and is still a safe bet.

That stock is Canadian Pacific Ltd. (TSX:CP)(NYSE:CP).

Steady as a rail

CP Rail is the safest bet because it ships products by rail. That’s basically it, pure and simple. The company has over 12,700 miles of rail network stretching across North America. It’s been doing this since 1881 — a whopping 139 years! That’s about as much as some of the biggest banks in Canada.

So it has the years going for it, but it’s also the type of product it ships, which is pretty much everything. From bulk commodities like grain and fertilizer, to merchandise such as energy, forestry, and cars. When one area is down, another picks it up. Again, pure and simple.

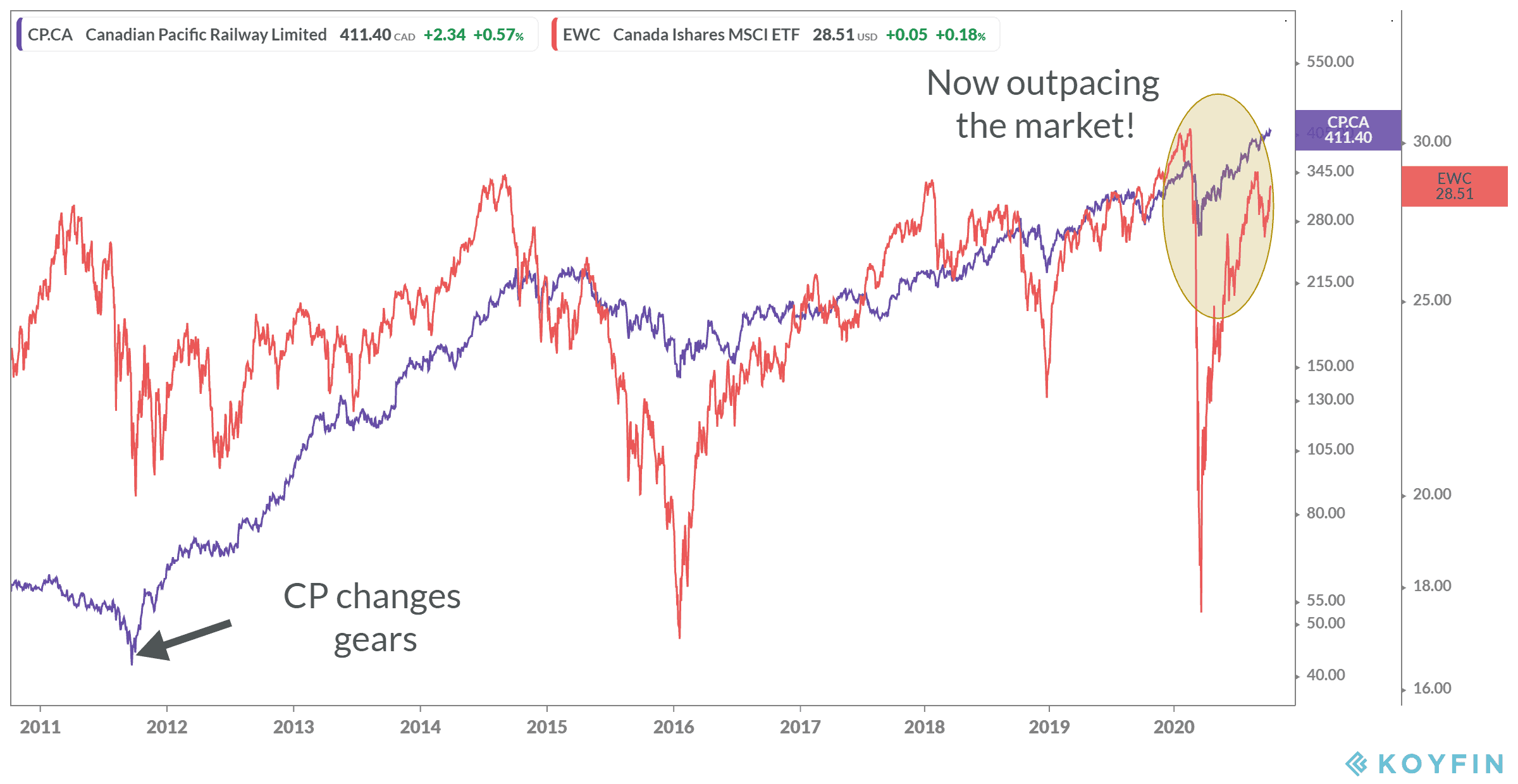

This can be seen in the company’s astounding historical growth. It all comes back to 2012, when the company did a complete overhaul. It reinvested in its infrastructure, cut unnecessary items, and overall brought costs far down. Now, revenue has been piling in. The company made a sharp incline since the change in 2012 and is now outpacing the market in today’s economic crash.

Numbers don’t lie

While it’s true that revenue growth has slowed with the pandemic, it still remains on the positive side. The company still saw revenue growth year over year of 3.1% during the last two consecutive quarters. It also still has leveraged free cash flow of $927.7 million as of writing, which has been growing for the last several quarters.

As for shares, the stock is at all-time highs. In the last five years, the company has seen returns of 113%. Its compound annual growth rate (CAGR) has been 21.61% for the last decade! Meanwhile it still has a strong dividend of 0.92% as of writing, that’s grown by a compound annual growth rate (CAGR) of 12.6% in the last decade.

Bottom line

The bottom line is this: if you had bought $10,000 in shares of CP Rail a decade ago, today that would be worth $85,996.61 today with dividends reinvested! If things keep going on this trajectory, a $10,000 investment today could be worth $70,582.94 with dividends reinvested. Not as high, for sure, but you can’t count on another huge turnaround.

What you can count on is this company staying steady as a rail for decades to come. This company has almost 150 years of growth behind it, and is likely to have another 150 more. So if there is one stock I’m going to recommend adding to your watch list, it has to be CP Rail.