A showdown is currently underway at Artis Real Estate Investment Trust (TSX:AX.UN). A group of activist institutional investors is campaigning for the ouster of almost the entire board of trustees just weeks after it was voted in. Sandpiper Group and its affiliates believe Artis REIT’s units’ fair price is almost double today’s trading ranges — and their proposed action plan could immediately increase income distributions.

What’s happening?

Institutional investor Sandpiper Group and its associates, who own more than a 5% interest in the trust, demand that Artis REIT should urgently call for a special elective unitholders meeting in November. They intend to have five of the seven-member board of trustees, including the current CEO, fired. They have put forward a list of five preferred nominees to take the trust on a new growth path for investors.

In an investor presentation published on October 7, Sandpiper proposes a 25% reduction to board fees, the elimination of purported related-party transactions, and a strategic reset that reduces operating expenses.

The activists plan to increase Artis REIT’s annual distributions by at least 10% immediately “to put more money in the pockets of all unitholders.” This is a strong selling point for a typical income investor who endured the pain of a 50% distribution cut in November 2018.

Why are activist investors targeting the trust?

The activist investor group is strongly opposed to the trust’s proposed plan to spin-off its retail property portfolio.

Sandpiper strongly believes that a separately listed Artis Retail REIT will be an orphaned and unloved trust with properties located in Western Canada, a region likely to experience a worse recession due to significant exposures to commodities and oil.

The small retail property trust won’t be eligible for inclusion in top sector indices. Current, index following institutional investors may have to sell positions in the spun-off entity to align with portfolio mandates. Expectations are that about 10% of existing investors will dump their units. The activists fear that current investors may see value destruction as a result.

Sandpiper Group’s alternative plan involves an outright sale of retail portfolio assets. The activist believes properties may fetch better value that way. In an old press release in January 2019, Sandpiper Group’s CEO Mr. Samir Manji was quoted saying, “If a board and management of a retail pure-play REIT is committed to maximizing unit-holder value, the only way they are going to do it is by privatizing, because any other option that includes staying in public market today … is not going to produce full value.”

Most noteworthy, retail REITs aren’t exactly an income investor’s favorite asset right now. The COVID-19 pandemic dealt a huge blow to retail property rent collections. Although Artis’s retail portfolio collected a respectable 88.8% of second-quarter rentals, peers performed much worse. For example, Cominar REIT‘s comparable retail portfolio collected just 46% of rentals due for April, May, and June this year.

Could Artis REIT units double?

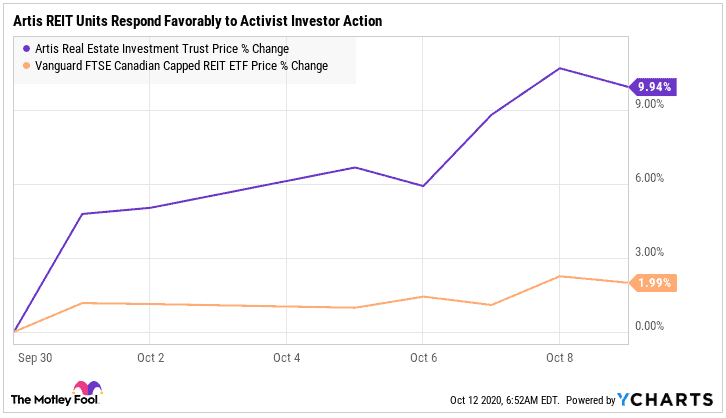

Artis REIT’s equity units trade at a significant 43% discount to their net asset value (NAV) of $15.40 on June 30 this year. The activists believe trust units should fetch a fair value of $16 apiece — nearly double their current trading price. Units have continued to rise since activist action. Investors are reacting positively to the news.

Sandpiper Group had successful activist campaigns in the past, including at Granite REIT and Agellan not so long ago. Perhaps Artis REIT‘s unit price could double if they are successful. However, there are significant risks to consider.

The trust recently held a special annual meeting on September 24. Unitholders resoundingly voted in favour of all seven nominees. Will the majority of investors suddenly change hearts? Activists have a tall order to win over key investor support. Currently, numbers aren’t in their favor. Their 5% voting interest isn’t enough to move the needle.

Further, the sudden call for an elective meeting is a huge threat to key personnel’s jobs. They won’t take it lightly.

Interestingly, trustees have accepted the requisition in principle, but the meeting will only be held in February 2021. Investors could have passed the current spin-off plan by then. It’s time to take out some popcorn and watch the action while enjoying the safe 6% yielding monthly distribution.